BFSI Backdrop

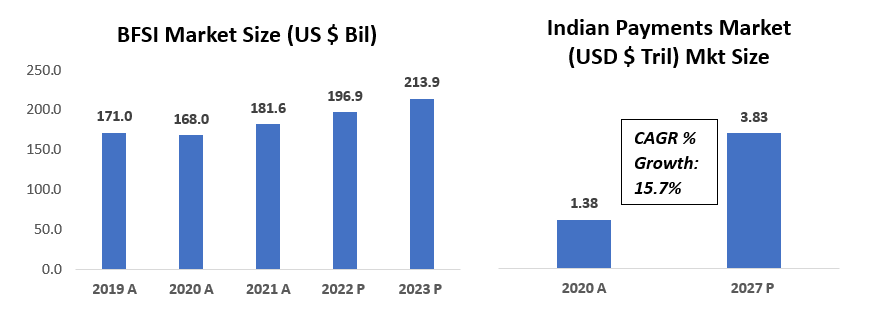

The BFSI sector has frequently been referred to as the lifeblood of the real economy and continues to be of vital importance in the modern credit-driven economic growth model. Among its major functions are intermediation between savers and borrowers, ensuring funds are allocated efficiently; support of payment and settlement systems that facilitate trade and international economic relations; and provision of various products that mitigate risk and uncertainty. The accelerating pace of technological change, stricter regulation and shifting consumer habits are reshaping the traditional banking model and pushing the sector towards innovation-led growth. Amidst this backdrop Banking Assets are estimated at ~ $ 28.5 Tn by 2025 and digital payments and alternative payments which have dominated the Indian Fintech landscape are estimated at $ 1 Trn by 2023 and are 14.8% of the GDP as of Dec 2021. As such there is a multitude of public market investment opportunities.

Key Market Snapshots

Public Market Opportunities in BFSI – Quality Financials & Housing Finance a Bright Spot

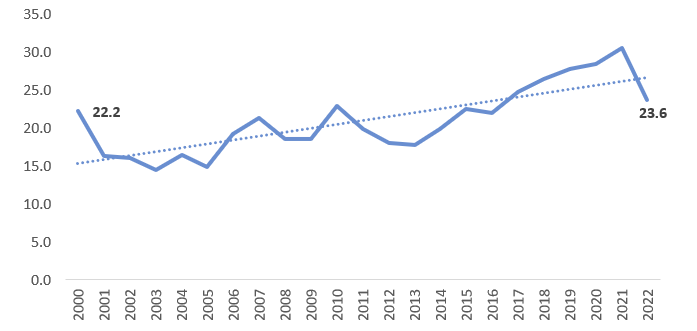

The current run up in markets has created certain pockets of the market where valuations might seem a bit stretched certainly on a trailing P/E basis particularly in tech which therefore on a relative basis presents opportunities in BFSI. Currently the NIFTY trades at 23.6x which puts it at roughly a ~ 13% premium to its average trailing P/E of 21x dating back to the dot com bubble of 2000 when the market traded at 22.2x.

Trailing NIFTY Price/Earnings Ratio (2000- Present)

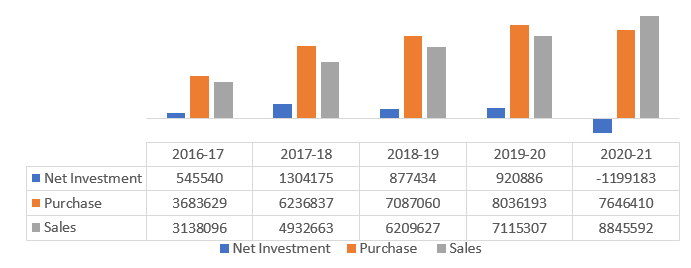

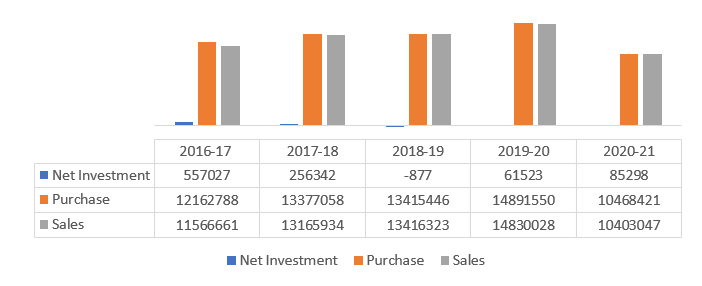

How have Domestic and Foreign Institutional Investors been positioned in the Public Market?

Net Investments in Indian Equities by MFs (INR Mil)

Net Investments in Indian Equities by FIIs (INR Mil)

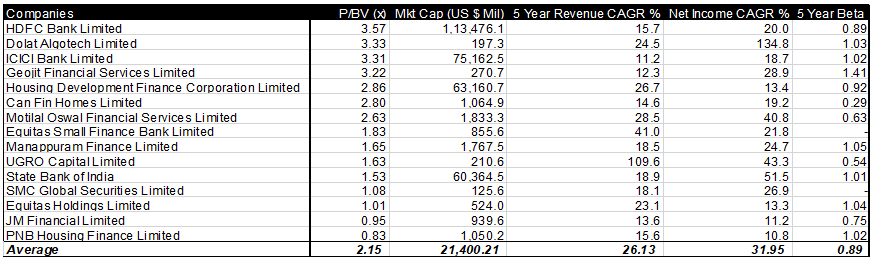

When screening for quality financials trading relatively inexpensively on a P/BV basis below 4, with a market capitalization of at least $US 100 million and compounding 5 Year CAGR revenues and PAT at 10% bettering real GDP growth rate adjusted for inflation we witness particularly interesting investment opportunities in banks as well as housing finance companies. While investors could potentially look to pay-up for quality for leading private banks such as HDFC Bank and ICICI bank trading at 3.6x and 3.3x, cheaper valuation opportunities are in HDFC Ltd, Canara Finance Homes Ltd, Equitas Small Finance bank, SBI and PNB Housing.

Investment Thesis: Strong financials aside, from a thematic perspective, the Indian banking industry is witnessing increasing penetration of digital banking in tier 2-3 cities with Fintech companies. Banks are increasingly collaborating with fintech companies to explore these new growth areas in neo-banking. Using these platforms and solutions by fintech startups, banks and FSIs are modernizing their core and replacing legacy systems with modern and agile systems to improve banking processes and customer engagement. Given this underlying trend supported by millennial banking habits, traditional banks are navigating this fintech revolution to build innovative products that can provide a superior customer experience to function in the new normal.

• ICICI Bank: ICICI bank has been partnering with a few SME-focused neo banks to capitalize on the digitization opportunity. Additionally, in Dec 2020 ICICI introduced iMobilePay an expansion of the former iMobile Banking App. ICICI’s digital platforms, including internet and mobile banking, are significant to its operations as it accounted for more than 90% of savings account transactions in FY2021. ICICI Bank has also announced it has on-boarded 70 leading corporates on ‘Corp-Connect’ a digital platform for banking and supply chain finance. The digital platform that it launched last year shall enable corporates to undertake instant payments and collections to/from their channel partners

• HDFC Bank: Is also expected to announce partnerships once the RBI – imposed embargo on digital initiatives is lifted.

• Equitas Small Finance Bank: Recognizing collaboration opportunities with neo banks to onboard new bank customers and is leading this initiative among mid-sized banks to forge partnerships and cross-sell products.

• State Bank of India: SBI is a market leader among the public sector banks and has been looking to capitalize on the digitization theme. SBI’s flagship, all-encompassing digital platform, YONO, reflects the company’s prowess delivering cutting edge digital services to millions of retail customers. SBI’s robust digital channels reflects this driver of personal and domestic loans growth. In fact, since 2017, SBI has collaborated with 11 fintechs including Singzy to create value for themselves, the bank and the larger ecosystem.

Government Initiatives: The Indian banking industry has recently witnessed the roll out of innovative banking models like payments and small finance banks. RBI’s new measures may go a long way in helping the restructuring of the domestic banking industry. The digital payments system in India has evolved the most among 25 countries with India’s Immediate Payment Service (IMPS) being the only system at level five in the Faster Payments Innovation Index (FPII). From the Union Budget 2022, 75 digital banking units in 75 districts of country by scheduled commercial banks, and digital payments infrastructure as well as 100% of 1.5 lakh post offices going on core banking system which would support financial inclusion and access to accounts through net banking and mobile banking will further provide a boost to the banking sector. Further the extension of the ECLGS scheme till March 2023, is expected to benefit business growth for MSME focused banks.

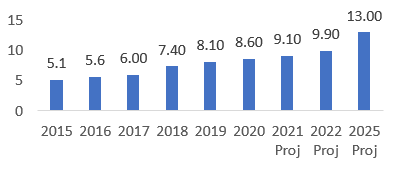

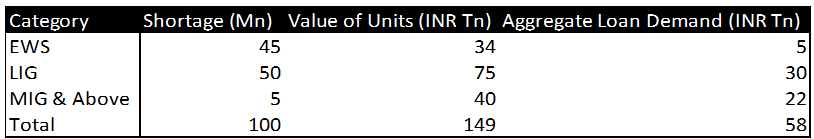

So, what’s the investment play in Housing Financing? The Mid and Affordable Housing Finance Sector is estimated to have a financing opportunity at INR 50 – 60 Tril which creates a big space for major players such as HDFC Ltd, Canara Finance Homes Ltd and PNB Housing. With rapid rise in urbanization, 34% of Indian population reside in urban locations which is set to reach 37% by 2025, spurring demand for affordable housing.

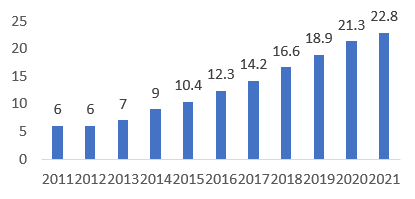

India Housing Finance (INR Tril)

Affordable Housing Finance Market (INR Tril)

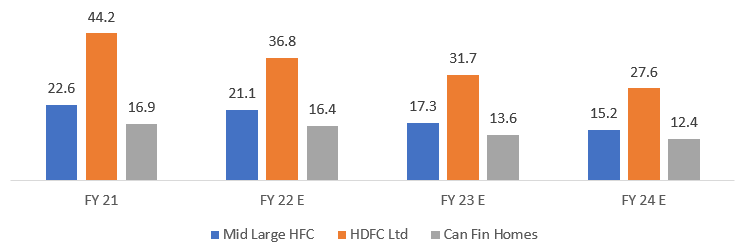

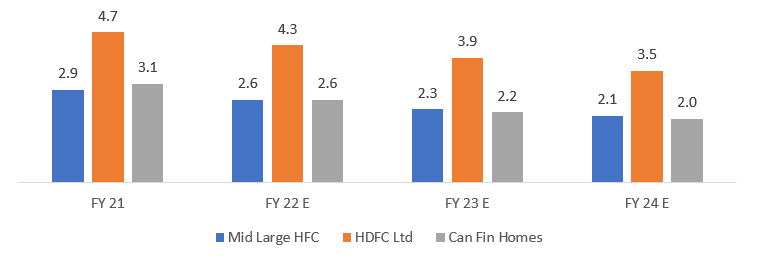

P/E Comparison across Mid Large Housing Fin

P/BV Comparison across Mid Large Housing Fin

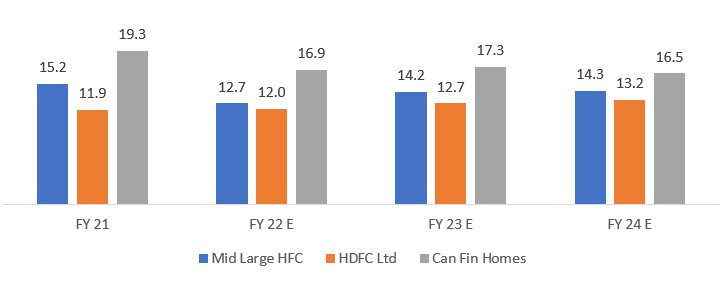

ROE Profile across Mid Large Housing Fin

Investment Thesis: Housing Financiers particularly in the mid and affordable housing segment have reported very strong growth rates and utilizing technology are able to cater to a less served clientele and underpenetrated credit market which provides tailwinds for the sector. The success of the housing finance model is dependent on an ability to manage cost of capital, operating costs and credit costs. This robust ROE profile is augmented by strong tailwinds and favorable sector dynamics. The structural and secular nature of the lending model, tech-backed technology platform (that ensures adequate credit underwriting, disbursements, and collections), and contained asset quality (even as the economy navigates through the challenging phase of COVID) have also attributed to the increased interest amongst investors. According to the rating agencies, the overall housing finance market stood at ~Rs23tn (FY21) and has witnessed a stellar 14.3% CAGR over FY11-21. The growth rates are higher at 15.4% CAGR (over FY15-20) following the launch of PMAY scheme that aimed at credit to economically weaker section (EWS) and low-middle income (LIG).

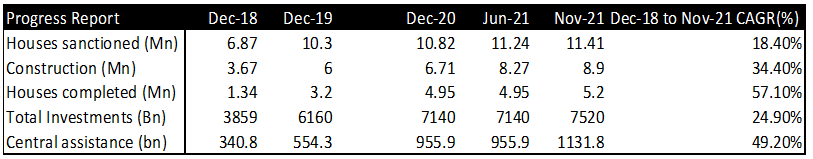

Government Initiatives: The Government of India’s, Housing for All by 2022 scheme under the Pradhan Mantri Awas Yojana (PMAY) had introduced the Credit Linked Subsidy Scheme (CLSS), which aims at expanding institutional credit flow to the housing needs of the urban poor by providing credit-linked subsidy on home loans taken by eligible urban poor for acquisition or construction of houses. This scheme is designed to cater to the housing demand in the EWS and LIG segments and is aimed at the construction of 50mn new housing units by 2022; 30mn units are proposed to be constructed in rural areas (through PMAY-Rural or PMAY-G) and 20mn in urban areas (through PMAY-Urban or PMAY-U).

Houses completed since PMAY (U)

Union Budget 2022 Support: The government has announced INR 48,000 Cr for PM Awas Yojana and 60,000 houses which will be identified as beneficiaries in rural and urban areas which is a positive development for housing financing. Additionally in 2022-23, 80 lakh households will be identified for the affordable housing scheme which would further unlock investment demand particularly in the EWS and LIG housing segments.

National Housing Bank collaborating with housing financiers: An additional facet that could also be looked at to unlock and further support this burgeoning housing finance market is the increased support from the National Housing Bank in conjunction with the housing financiers towards the origination of these housing loans and long-term housing financing needs particularly for the EWS and LIG segments.