Inflation is the largest macro force at play coming out of the pandemic for India as well as the world, but it is still not understood well. This article is a small effort in understanding this phenomenon in India.

First, the data

The Consumer Price Index (CPI) for April was released on 12th May and the key numbers were:

The year-on-year growth in inflation for the month came in at 4.29 per cent. The April figure showed a decline from March’s 5.52 per cent which was in the vicinity of the Reserve Bank of India’s (RBI) tolerance band of 2-6 per cent. The easing of the inflation last month can be attributed to the softening of food prices. The Consumer Food Price Index (CFPI) eased to 2.02 per cent in the month of April, down from 4.87 per cent in March.

Food inflation has been an important driver of inflation for the past several years. A reduction in food inflation from 5.24 per cent in March 2021 to 2.66 per cent in April 2021 point to structural issues at a ground level. Vegetables, cereals, sugar, and confectionery have shown negative trends, while meat and fish, eggs, pulses, fruits, and non-alcoholic beverages have all shown very high positive upward trends. The food inflation data points towards higher protein demand by the population and thus making protein food more expensive.

What causes inflation?

Inflation results when demand exceeds supply in an economy. Economists use the “output gap” to capture this phenomenon. When the economy grows faster than its ability to provide goods and services demanded by consumers, prices rise. When the economy grows more slowly than its potential growth rate, prices tend to fall.

Due to the pandemic, there was a huge widening of the output gap last year, but the economy’s rapid rebound in Q4 2020 had caused the gap to narrow but not yet fully close. With more fiscal stimulus on the way, it is likely that the gap will close later this year, signaling higher inflation in Q2 2021.

RBI’s inflation tolerance band

Macroeconomic management in any economy usually proceeds by setting targets of crucial aggregates to be achieved over specified time horizon of five to ten years. In most of the countries, these aggregates are growth rates of real Gross Domestic Product (GDP), retail inflation rate, fiscal deficit (FD) to GDP ratio and current account deficit (CAD). In the latter half of the last century, these four targets were usually set by a single central authority in a country in consultation with different constituents. They were largely aspirational and therefore, the question about their internal consistency never arose. However, the principles and approach to macroeconomic management changed substantially after the crude oil shocks of the 1970s and the end of cold war in the late 1980s. Assigning different goals to different organs of the government to increase accountability became a more popular practice. Since fiscal and monetary policy are more precisely defined macroeconomic policies, the targets of FD/GDP and inflation rate were assigned respectively to the Ministry of Finance and the central bank of the country. Inflation targeting was formally adopted with the amendments to the Reserve Bank of India (RBI) Act, effective June 27, 2016. Under both these legislations, formal targets were set for FD/GDP ratio and inflation rate. The government asked the central bank to maintain retail inflation at 4 per cent with a margin of 2 per cent on either side for a five-year period ending March 2026. This is called as 'Inflation Tolerance Band.' Now, let us understand this from the point of GDP growth in a country.

Threshold Inflation

RBI serves the economy and the cause of growth best by keeping inflation low and stable around the target it is given by the government. So, if tomorrow RBI cuts the interest rate by 100 basis points, and banks pass it on, then demand will pick up and we could get stronger growth temporarily. This increase in demand will raise inflation. Now, again RBI will have to intervene and raise interest rates substantially to offset that temporary growth. This cycle of growth and de-growth is not good for the economy in the long run. That is why, RBI maintains a sustainable growth and helps to keep demand close to potential supply so that inflation remains moderate and remains in the tolerance band. Hence an inflation-focused framework means better coordination between the government and the RBI as they go towards the common goal of macro stability. India adopted a formal 'Inflation Targeting Regime' in 2016 under the new monetary policy framework which mandated keeping inflation at 4 per cent (+/-2%).

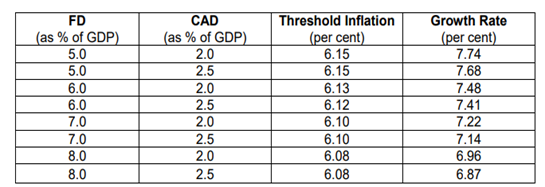

The concept of threshold inflation is linked to the level of inflation beyond which it becomes detrimental to economic growth. For years, India has debated what the right level of inflation for the economy is. Is it 2-6 per cent, the range set for India’s flexible inflation? Or is it 4 per cent, the mid-point of that range? A research paper by RBI’s Development Research Group puts the following scenarios for India.

Per Table 1 data, fiscal deficit at 6 per cent and current account deficit at 2 per cent of GDP suggest a threshold inflation level of 6.1 per cent and optimal growth rate of 7.5 per cent for India.

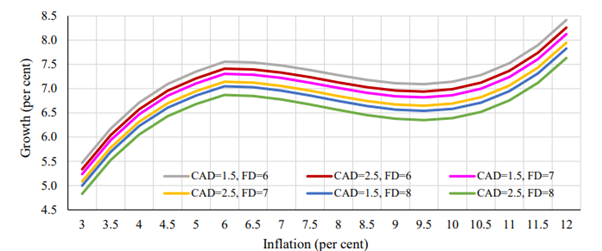

Per Table 2 data, in the threshold inflation band of 2 per cent-6 per cent, we see that there is a positive co-relation between growth and inflation.

Way Ahead

Globally, we are witnessing supply constraints being pitted against surging demand as the economy reopens and gives way to higher inflation. In my opinion, inflation in advanced economies could be structural in nature as it is due to the impact of the joint fiscal monetary policy and higher production costs from the expected realignment of global supply chains, rather than simply a large, external supply shock that has historically been a driver of inflation. Global supply chains have come under pressure during the pandemic, as companies are faced with challenges including raw material shortages, rising raw material prices and longer delivery times. This unusual dynamic could lead to higher inflation for next 2-3 years and will only reduce when the manufacturing costs come down or there is a gain in productivity.

In India, there are expectations of higher inflation in the coming months which will be transitory in nature as the temporary increase in inflation is due to supply side constraints amid localised lockdowns and curfews imposed to control second wave surge in COVID-19 cases, while the government is expected to take measures to support demand to keep the economy afloat.

Going forward, the outlook for India will continue to be determined by pandemic’s impact on demand and supply side dynamics. Over the next quarter we are also expecting a good monsoon and subsequent good agricultural harvest which will help in reducing the inflation as it will ease the supply side dynamics especially the food inflation. This will help us in many ways. Lower inflation has favourable redistribution effects particularly on the poor and is beneficial for financial stability of the nation. On the other hand, the addition to the foreign exchange reserves, which reached a historic high of $ 590.3 billion at end-January 2021 and were at $ 577.0 billion at end-March 2021, was driven by robust foreign portfolio and direct investments. This will instill confidence in foreign investors who will see India as a country with stable monetary policy goals, and this stability will only improve as we meet our inflation goals.

Overall, monetary policy in India would be guided by evolving macroeconomic conditions and will support growth while ensuring inflation remains within the target. The government has retained this guidance reflecting not just the credibility of the current framework, but also its role in preserving macro-economic stability. RBI will continue with the accommodative stance as long as necessary to sustain growth on a durable basis, while ensuring that inflation remains within the threshold band going forward.

- https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/DRG459A5150A6496D4702A082AED8ADF8D7C0.PDF

- http://www.mospi.nic.in/sites/default/files/press_release/CPI_Press_Release_April2021.pdf

- https://eaindustry.nic.in/pdf_files/cmonthly.pdf

- https://www.bloombergquint.com/economy-finance/wholesale-inflation-surges-to-eight-year-high-in-march