What are Green Bonds?

What do we mean by Green Bonds? Is it related to environment protection? Does it have something to do with regular bonds which are fixed income instrument used by governments to raise funds for development projects? Or is it related to both? If you guess the latter, you guessed it right! Green Bonds are debt instruments which provide fixed incomes and are specifically designed to support and fund climate related and environment protection projects.

History of Green Bonds

The issuance of green bonds date backs to almost a decade and a half (2007) by European Investment Bank. Following this, the World Bank in 2008 began to issue green bonds to support its lending activities for climate related projects1. With the advent and rise of ESG (Environment, Social and Governance) and Sustainability Framework in investing reporting framework, the importance of green bonds became more visible. This led to the formulation of Green Bonds Principles2 (GBP) by the International Capital Market Association with a focus on transparency, disclosure and integrity in the development of green bonds market.

Green Bonds Market in India

In order to increase long-term resources for financing infrastructure projects in the renewable and clean energy industries, Yes Bank issued India's first green bond in 2015 to raise INR 5 billion. According to the Economic Survey 2019-203, 10.3 billion $ in climate bonds were issued in India during the first half of 2019. Despite being a phenomenal INR 6.11 billion, or 0.7% of the Indian bond market, the issue of green bonds in India in 2021 pales in contrast to the issuance of green bonds worldwide. Recently, the Securities and Exchange Board of India (SEBI) brought in a consultation paper4 on Green and Blue Bonds to amplify the definition of green bonds and to reduce the compliance costs for issuer of such bonds.

Project Financing Landscape in India

In order to finance a project, state governments can access funds from sources such as its own revenues, transfers from central government, raising funds from State Development loans through RBI monitored auction mechanism, concessional development assistance, financing under public/private partnerships and sector focused funds including support from multilateral agencies. These modes of financing are relevant to most of the Indian states including the hilly states of North Eastern region, which, however, lack generation of adequate returns for a project investor. The North Eastern region has abundance of bio-resources which can result in supporting a flourishing bio-economy and generating adequate returns for an investor as long as the cost of funds for financing such projects is kept under control.

Government of India’s fillip to Green Bonds

Before going into the specifics of the proposed framework for financing of these projects, let us visit two key developments which can provide a fillip to the green economy of the North-eastern region. Firstly, Government of India’s (GoI) announcement in budget for FY 2022-20235 that a portion of its market borrowings will be met through green bonds, which will be used towards financing of public sector green infrastructure projects. This will support in the development of a domestic sovereign green bond market providing relatively risk-free returns to a subscriber (as bonds will be raised by Government or its agency) and will reduce cost of funds for the issuer since proceeds will be utilized towards financing of “green” projects.

Secondly, GoI in August 2022 has brought Energy Conservation Amendment Bill 20226 to amend the Energy Conservation Act 2001 empowering central government to specify a carbon credit trading scheme, wherein carbon credit implies a tradeable permit to generate specified amount of carbon emissions. The central government or any authorised agency may issue carbon credit certificates to entities registered under and compliant with the scheme for trading of these certificates. In a developed market, it will increase transparency in trading of carbon emission certificates leading to better price discovery for the parties.

Framework for Issuance of State Sovereign Green Bonds

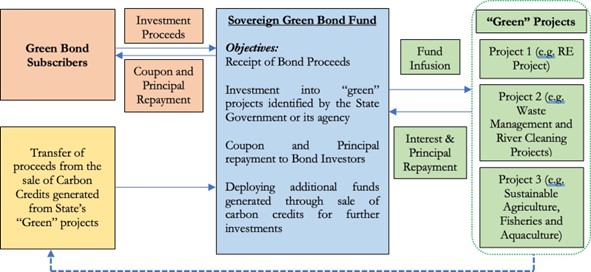

A framework for raising green bonds can include setting up of a fund wherein bond proceeds will be deposited, and these proceeds will be invested into a range of “green” projects identified by the respective government or its agency. The identification of “green” projects can be done with the help of GBP 2021 guidelines, which are voluntary in nature or state identified projects which can contribute to the sustainable development of the region. As per GBP 2021, suggestive list of projects can include projects from sectors such as Renewable Energy, Energy efficiency, Pollution prevention and control, Environmentally sustainable management of living natural resources and land use, Terrestrial and aquatic biodiversity conservation, Clean transportation, Sustainable water and wastewater management, Climate change adaptation, Circular economy adapted products, production technologies and processes and Green buildings.

The bond proceeds can further be supplemented through funds received from the sale of carbon certificates generated through the projects being financed by the fund. This alternate source of revenue to the fund will translate into further lower cost of funds for the fund manager and can also be leveraged for servicing of interests and/or funding of new projects being undertaken by the fund. This should be coupled with regular reporting and disclosures by fund manager or third party agency on the projects’ implementation status providing additional comfort to the investors. In the long run, it is expected to promote transparency in the sovereign green bond market (by preventing accusations of “Greenwashing”) and can translate into even lower cost of funds for future issuances. Given hereunder is a pictorial representation of the green bond framework being proposed along with objectives of the Fund to be set up for channelling of proceeds to respective projects.

Conclusion

As is evident from the experience in developed green bond markets abroad, green bonds trade at a premium in comparison to conventional bonds, popularly known as “greenium”. Further, in order to make it lucrative for investors, governments can provide tax benefits on interest earned on green bonds. The regular disclosures of utilization of green bonds proceeds including status of projects being funded, lower cost for bond issuer and benefits to the subscriber can go a long way in the development of a domestic green bond market. Needless to say, the projects financed through these bond proceeds will help in achieving India’s ambitious COP26 commitments for reducing projected carbon emissions by 1 billion tonnes by 2030 and net-zero carbon emissions by 2070.