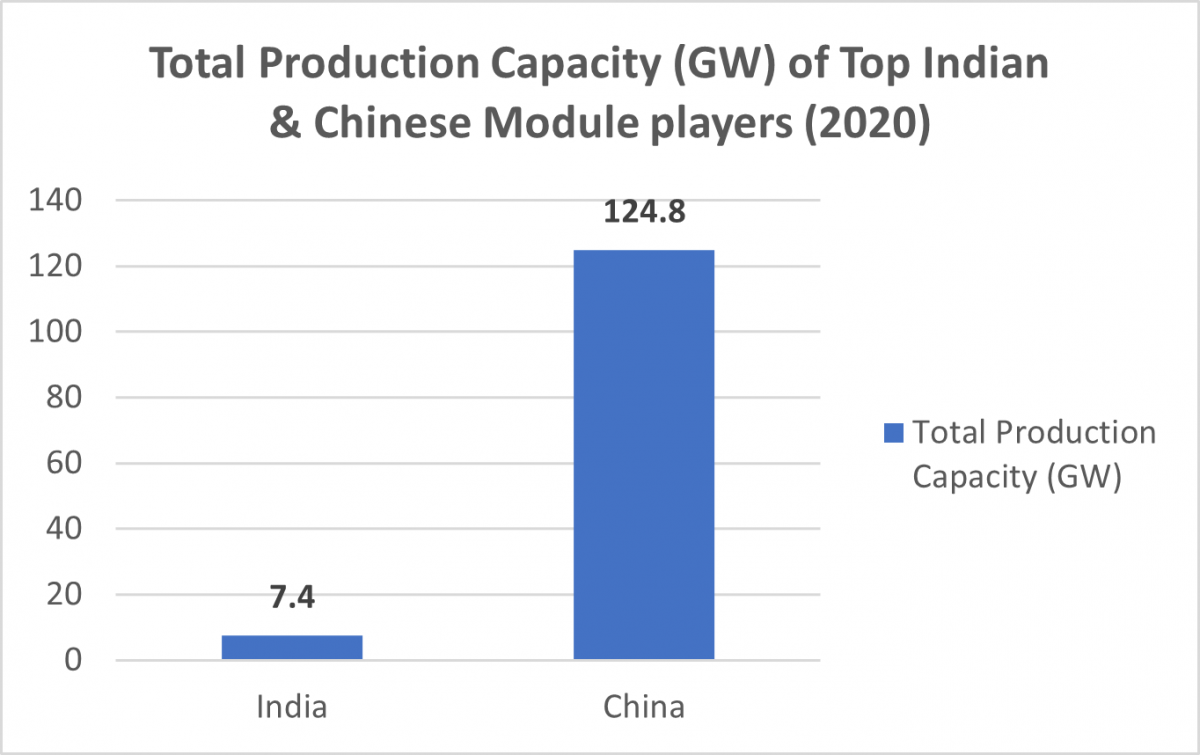

On 9th March, the Ministry of New & Renewable Energy (MNRE) declared the imposition of Basic Customs Duty (BCD) on Solar PV Cells and Modules/Panels, w.e.f. April 2022, following the 20 per cent BCD on solar inverters, announced earlier by the Hon’ble Finance Minister in the union budget 2021-22. If you read the Office Memorandum (OM) detailing the BCD on solar cells and modules, you can sense the urgency and need of this step, a long-standing demand by the industry. By all accounts, India’s solar industry is dependent on imports currently. China accounts for at least 80 per cent of all the modules imported into India and the rest comes from Malaysia, Thailand, and Vietnam. This import trend from China (and other countries) has been continuing for a while. Factors that underpin this massive imbalance (in favor of China) include the lower prices of these Chinese imports equipped with their superior quality, in terms of efficiency, wattage, etc., and backed by warranty from international insurers on high-performance modules. This, in turn, produced no incentive for the Indian developers/power producers to rely on domestic manufacturers, straining the government’s effort to indigenize the solar value chain further. If the price was one aspect, then the existing capacity of Indian manufacturers becomes the other face of this riddle. India’s capacity for module and cell stands at 15 GW and 3 GW, respectively. India roughly has 40 to 45 per cent of capacity utilization. India’s production capacity then becomes pale in comparison with China, as evident:

Now let us look at the Indian demand for cells and modules. India has a target to achieve an installed solar energy capacity of 280 GW i.e., around 25 GW every year till 2030. Compare this with the capacity that the domestic industry possesses, currently, it will become clear why developers/power producers are preferring imports, significantly.

It is here that the planned BCD of 25 per cent on Solar Cells and 40 per cent on Solar Module becomes a gamechanger. Once the new duty structures come into force the costs of imported cells and modules will increase, thereby removing the cost advantage attached to the imports and increasing the reliance on the domestic industry. Further up in a solar project chain, BCD will have a knock-on effect on solar tariffs as well. For imported modules, BCD will increase the capital cost of a solar project by 23-24 per cent, resulting in an increase of 25 per cent in solar tariffs . MNRE has also released the Approved List of Models and Manufacturers of PV Modules (ALMM), whose modules will be eligible for government-owned projects in India, further increasing the industry’s confidence in domestic suppliers. Additionally, the $ 606 Mn Production-Linked-Incentive (PLI) scheme for high-efficiency PV modules, launched last year, will further incentivize the capacity enhancement of the domestic module manufacturers.

India is on a relentless pursuit of achieving self-reliance in critical sectors of its economy. The challenges from COVID-19 further emboldened its resolve in becoming a manufacturing superpower and cutting dependencies. The newly announced BCD, ALMM, and PLI will accelerate the much-needed indigenization of the solar industry and help India become 'Atmanirbhar' in solar manufacturing.