Introduction

India’s strengths have already been defined in traditional textiles and natural fibres globally. It is the second largest producer of polyester in the world and is now emerging as a key player in technical textiles industry contributing to a market size of $ 19 Bn. Technical textiles is a fast-growing sub-segment that finds its usage in an array of sectors. The end use application of technical textiles is widespread and seen in industries such as agriculture, construction, sports apparel, healthcare etc. India’s leap towards modernisation and its manufacturing competitiveness are some of the key contributors to the growth of this segment.

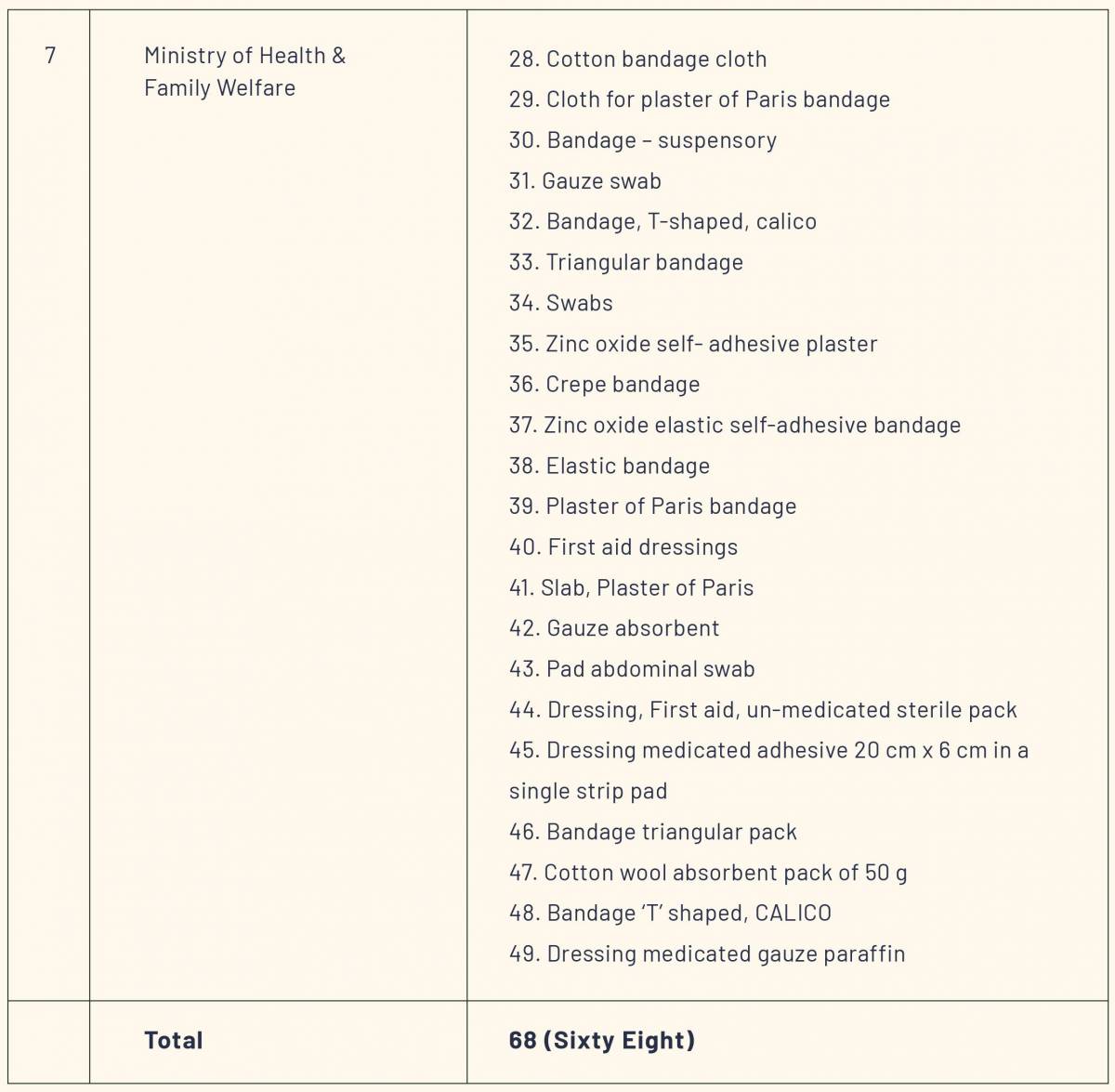

Technical textile accounts for approximately 13% of India’s total textile and apparel market and contributes to India’s GDP at 0.7%. There is a huge potential to fulfil a large demand gap as the consumption of technical textiles in India is still only at 5-10% against 30-70% in some of the advanced countries. Hence, garnering direct attention from prime minister Narendra Modi and his Cabinet Committee on Economic Affairs (CCEA), a National Technical Textiles Mission has been set up that aims at an average growth rate of 15-20% to increase the domestic market size of technical textiles to $ 40-50 Bn by the year 2024; through market development, market promotion, international technical collaborations, investment promotions and Make in India initiative.

Technical textiles, a sunrise sector, has become even more relevant during the Covid-19 crisis when the global manufacturing have come to a grinding halt and the ban on export of critical medical equipment including N95 face masks and protective gears, have made imports to India nearly impossible. India was entirely import dependent for PPE kits. From manufacturing 0 PPE kits in March, it soon rose to manufacturing 2.5 lakh a day in 60 days becoming the second largest manufacturer after China. Today, India stands to produce around 4.5 lakh PPEs and more than 1.5 crore masks a day.

Despite the economic slowdown and downturn in the overall demand for textiles due to Covid-19, the industry continues to be the second largest employer in India. By transforming a Covid-19 crisis to an opportunity, India has proven its ability to innovate and rise to the challenge with limited resources and time. Therefore, it is even more essential for the government and industry to collaborate to boost technical textiles, a high value segment of this sector.

This report elaborates the current scenario of technical textiles and highlights ways to tap into India’s growth potential in this sunrise sector.

Technical Textiles Sector: An Overview

Technical Textiles Ecosystem

Technical textiles are engineered products with a definite functionality. They are manufactured using natural as well as man-made fibres such as Nomex, Kevlar, Spandex, Twaron that exhibit enhanced functional properties such as higher tenacity, excellent insulation, improved thermal resistance etc. These products find end-use application across multiple non-conventional textile industries such as healthcare, construction, automobile, aerospace, sports, defence, agriculture. Taking cognisance of technological advancements, countries are aligning their industries to accommodate technical textiles. This shift is evident in India's textile sector as well, moving from traditional textiles to technical textiles.

The invention of speciality fibres and their incorporation in almost all areas suggest that the importance of technical textiles is only going to increase in the future.

Global Market Size

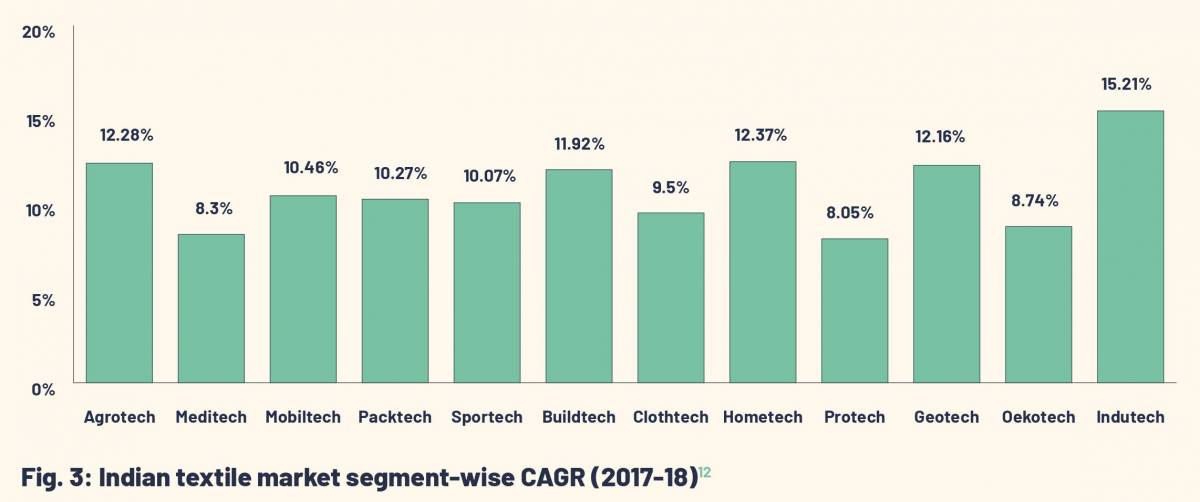

Technical textiles have seen an upward trend globally in the recent years due to improving economic conditions.Technological advancements, increase in end-use applications, cost-effectiveness, durability, user-friendliness and eco-friendliness of technical textiles has led to the upsurge of its demand in the global market. Indutech, Mobiltech, Packtech, Buildtech and Hometech together represent 2/3rd of the global market in value.

The demand for technical textiles was pegged at $ 165 Bn in the year 2018 and is expected to grow up to $ 220 Bn by 2025, at a CAGR of 4% from 2018-25. The Asia-Pacific has been leading the technical textiles sector by capturing 40% of the global market, while North America and Western Europe stand at 25% & 22% respectively.

Asia-Pacific has seen a tremendous growth in this sector and captures the largest market share due to rapid urbanisation and technological advancements in medical, automobile and construction industries. This is further catalysed by easy production, low cost labour and conducive government policy support.

European Union was leading in consumption from 2007-13, owing to Techtex producers proximity to large European car manufacturers. The product nomination process was unique to Europe and led to the presence of European Techtex products in different export markets worldwide. European Techtex manufacturers were able to establish a strong and unique position due to their R&D efforts and operational efficiency. However, production declined since 2013, particularly in France and Spain, due to weak demand in the automobile and construction sector.

India's Market Size

The current Indian technical textiles market is estimated at $ 19 Bn, growing at a CAGR of 12% since past five years. It contributes to about 0.7% to India’s GDP and accounts for approximately 13% of India’s total textile and apparel market.

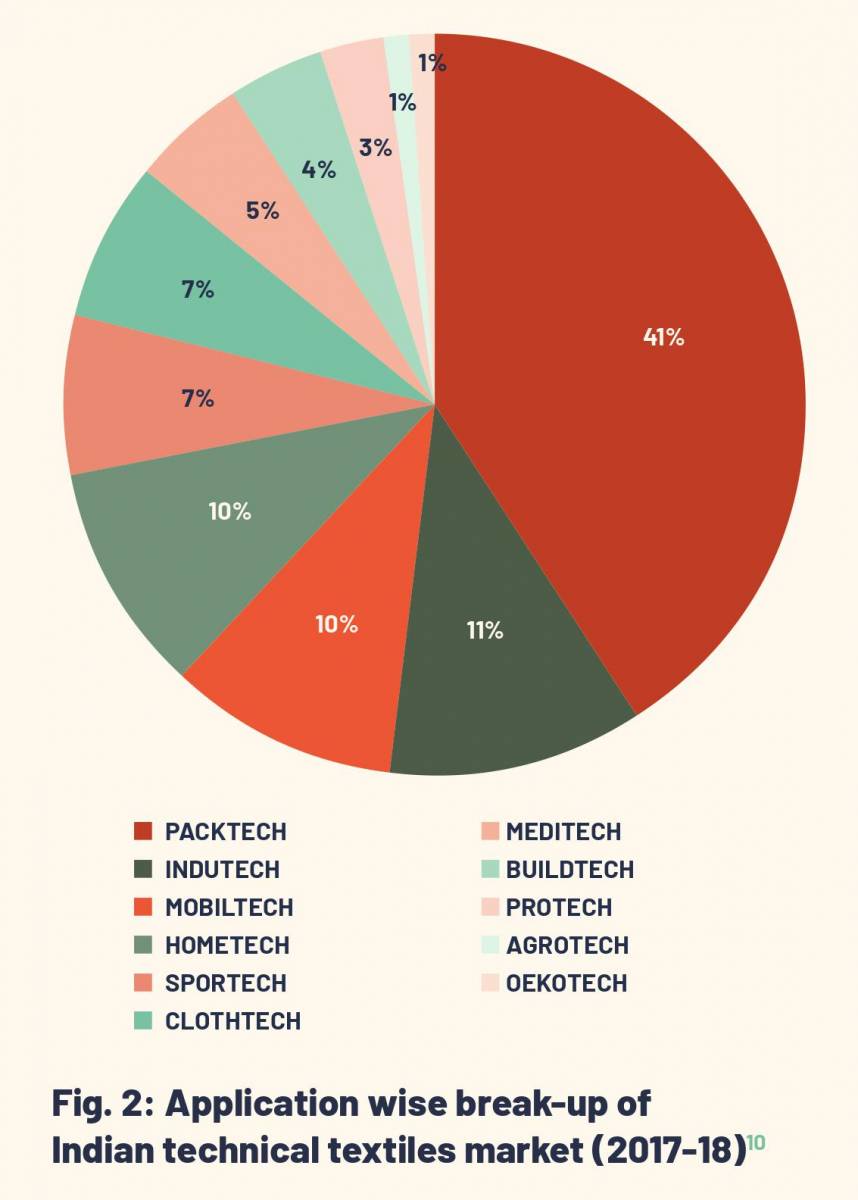

In 2017-18, Packtech segment had the highest share of 41%, followed by Indutech, Hometech, and Mobiltech with a share of 11%, 10% and 10%, respectively.

Although, Packtech accounts for 41% of the total market share, it is a low-value, low technology product.

Availability of raw materials such as cotton, wood, jute and silk along with a strong value chain, low cost labour, power and changing consumer trends are some of the contributing factors to India’s growth in this sector. India’s technical textiles market shows a promising growth of 20% from $ 16.6 Bn in 2017-18 to $ 28.7 Bn by 2020-21, as per the Baseline Survey of technical textile industry by Ministry of Textiles.

Overview of India's Technical Textiles Trade

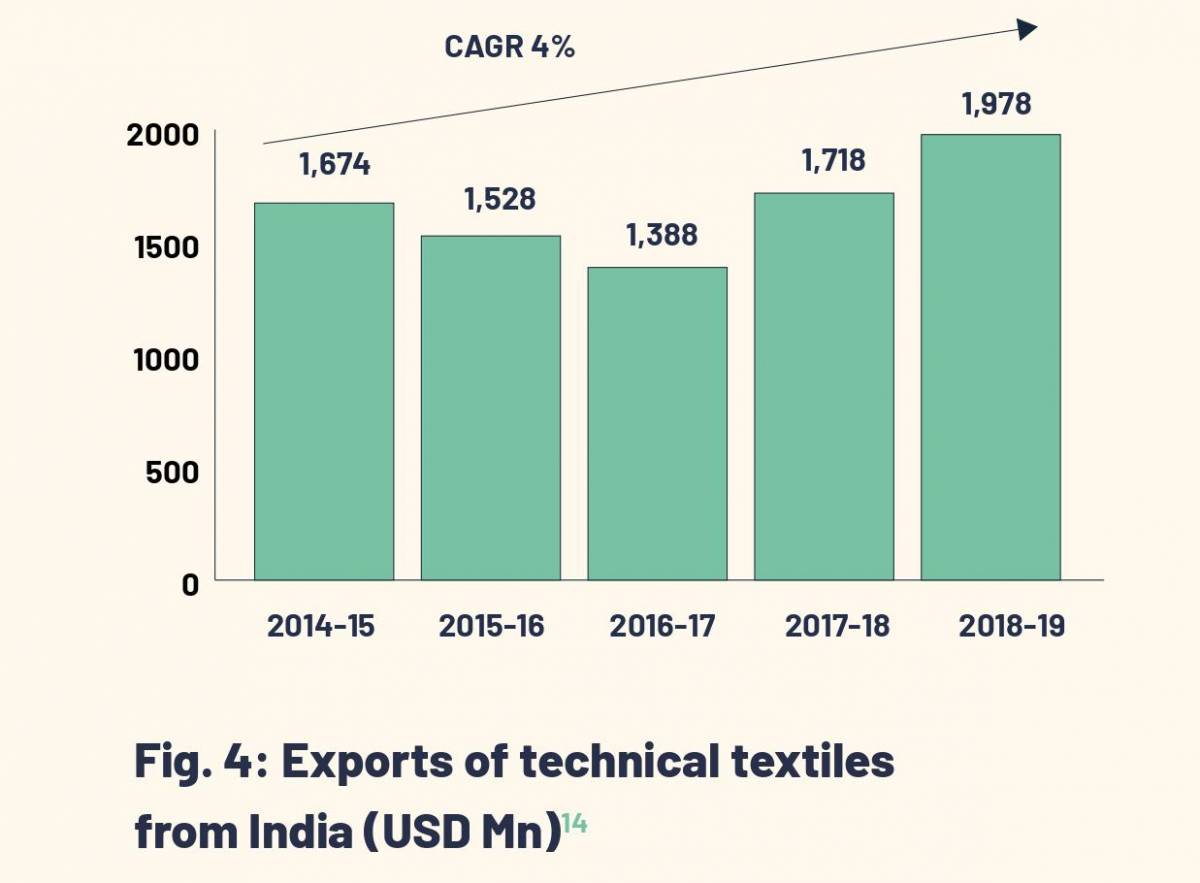

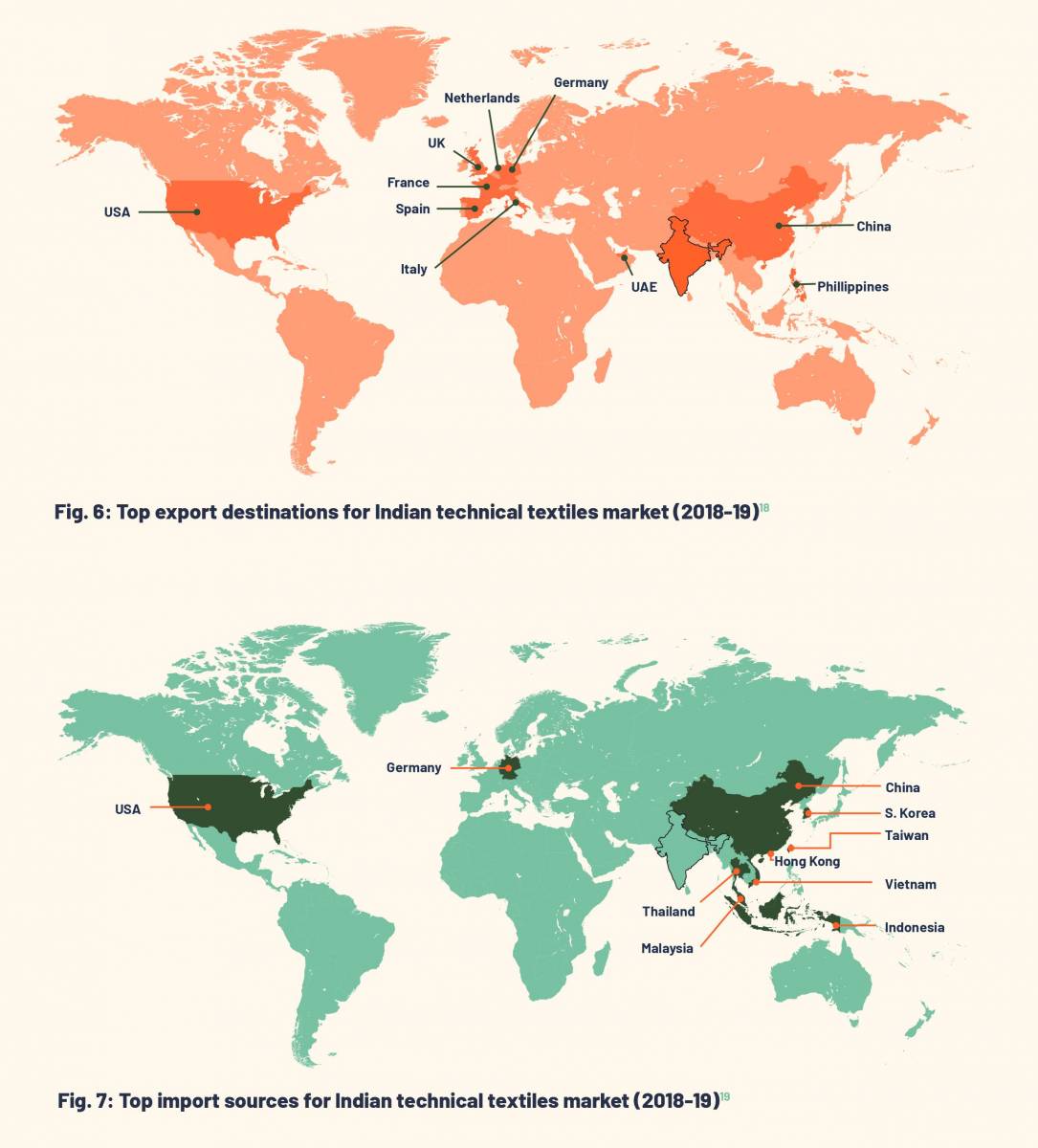

India’s exports of technical textiles in 2018-19 is estimated at $ 1.9 Bn, which has grown at a CAGR of 4% over the past four years.

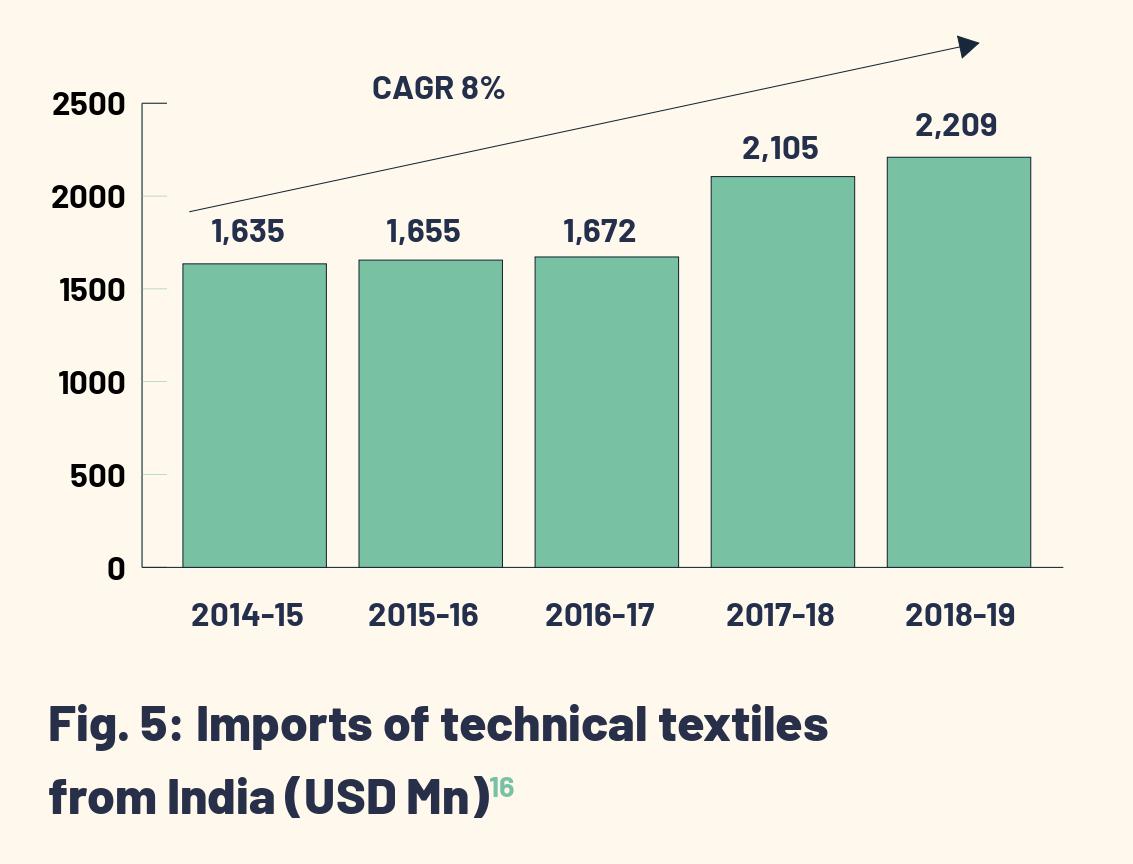

India’s imports of technical textiles have increased at a CAGR of 8% within the last four years, from $ 1,635 Mn to $ 2,209 Mn in 2018-19.

Packtech, Indutech and Hometech are the largest exported segments having a combined share of around 85% of the total exports of technical textiles.

Products such as flexible intermediate bulk containers, tarpaulins, jute carpet backing, hessian, fishnets, surgical dressings, crop covers, etc. that are not very R&D intensive have been able to capture a substantial share in the overall exports.

Unlike the conventional textile industry in India, which is highly export intensive, the technical textile industry is still import dependent. Products such as diapers, polypropylene spun-bond fabric for disposables, wipes, protective clothing, hoses, webbings for seat belts etc. form a substantial part of the country’s imports.

In India, production is largely concentrated in the small-scale segments such as canvas tarpaulin, carpet backing, woven sacks, shoelaces, soft luggage, zip fasteners, stuffed toys, fabrication of awnings, canopies and blinds etc.

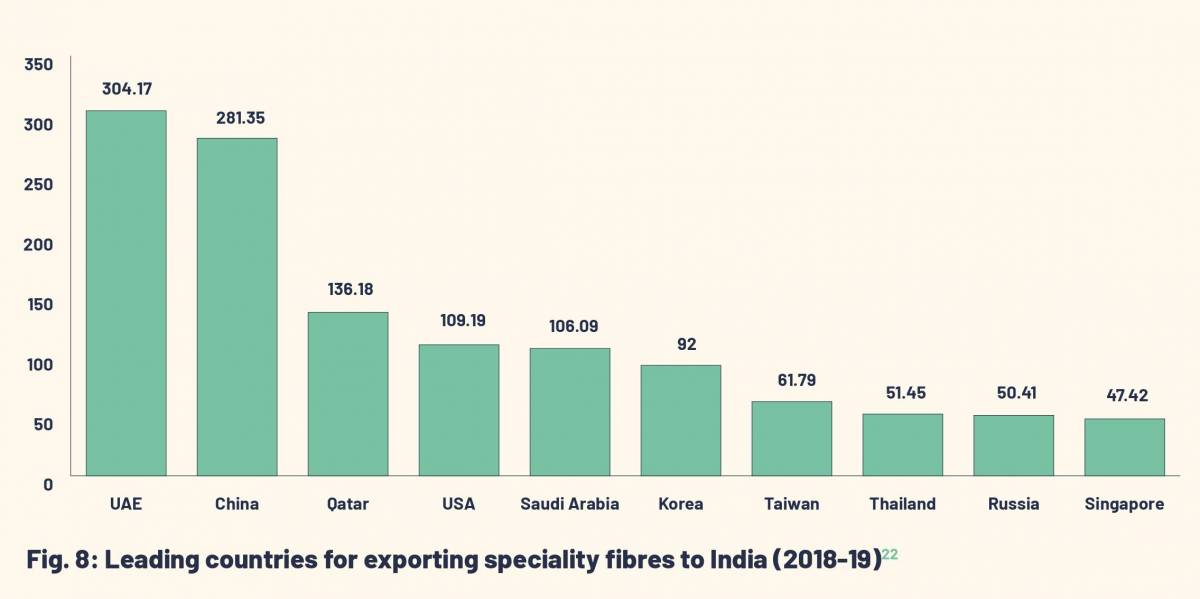

The technical textiles sector in India is heavily dependent on import of speciality fibres. The next segment highlights some of the speciality fibres and its strategic importance.

Speciality Fibres of Strategic Importance

While regular fibres like natural fibres and synthetic fibres (polyester, viscose, nylon, polypropylene) account for 70% of the total fibre used in technical textiles, speciality fibres constitute the remaining 30%. Their characteristics like light weight, durability and thermal stability have led to an increase in the overall demand for such composite materials. The Global Specialty Fibers market is expected to grow from $ 14.19 Bn in 2017 to reach $ 46.9 Bn by 2026 with a CAGR of 14.2%.

India relies heavily on importing speciality fibres owing to an increasing demand, but lack of requisite technology, absence of a robust R&D ecosystem has, however, been an impediment. Moreover, fiscal anomalies such as imposition of excise duties on raw material and no exemption on the finished product have escalated the overall costs and discouraged domestic production.

The baseline survey of technical textiles lists around 32 types of speciality fibres with application across different user industries like automotive, defence, construction etc.

The UAE is the leading exporter of specialty fibres to India of which 99.38% is constituted by Ultra-High-Molecular-Weight- Polyethylene (UHMWP). Saudi Arabia, Singapore and Iran are other countries that export UHMWP to India.

China has maintained top spots across the majority of 12 specialty fibres with an overall increase in value from 2017-18. South Korea has a varied presence across the speciality fibres with an increase in exports in Aramids, High-Tenacity Polypropylene, High-Tenacity Polyester, Carbon Fibres, Ceramic Fibres, UHMWP and Nylon - 6,6. Korea is a leader in Nylon - 6,6 exports, which comprises of 69.92% of the total Korean speciality fibre exports to India. Similarly, 99.52% of Russian speciality fibre exports to India comprise of Nylon - 6,6.

Taiwan exports multiple speciality fibres to India, with major exports in Nylon-6,6, High Tenacity Polypropylene and High Tenacity Polyester and also has a varied presence in Glass Fibre, High Tenacity Nylon Fibre and High Tenacity Viscose. Thailand too exports multiple speciality fibres to India like Aramids, High Tenacity Nylon, High Tenacity Polypropylene, High Tenacity Polyester, UHMWP and Nylon-6,6.

Government Initiatives to Boost Technical Textiles Market

1. Harmonized System of Nomenclature (HSN) Codes for Technical Textile

In 2019, the Ministry of Textiles, Government of India dedicated 207 HSN codes to technical textiles to help in monitoring the data of import and export, in providing financial support and other incentives to manufacturers. The purpose of this classification is to increase international trade, and enable the market size to grow up to $ 26 Bn by the year 2020-21.

2. 100% FDI under Automatic Route Government of India allows 100% FDI under automatic route. International technical textile manufacturers such as Ahlstrom, Johnson & Johnson, Du Pont Procter & Gamble, 3M, SKAPS, Kimberly Clark, Terram, Maccaferri, Strata Geosystems have already initiated operations in India.

3. Technotex India It is a flagship event organised by the Ministry of Textiles, in collaboration with Federation of Indian Chambers of Commerce & Industry (FICCI) and comprises of exhibitions, conferences and seminars with participation of stakeholders from across the global technical textile value chain.

4. National Technical Textiles Mission With a view to position the country as a global leader in technical textiles, the CCEA has given its approval to set up a National Technical Textiles Mission with a total outlay of $ 194 Mn in February 2020.

The Mission shall be set up for a four year implementation period from FY 2020-24 and will have the following four components:

- Component - I (Research, Innovation and Development)

- Component – II (Promotion and Market Development)

- Component - III (Export Promotion)

- Component- IV (Education, Training, Skill Development)

Schemes

1. Scheme for Integrated Textile Park (SITP) To boost entrepreneurship by providing financial support and state-of-the-art infrastructure, the scheme was launched in 2005 and has recently been extended for the period between 2017-20. The project cost will cover common infrastructure and buildings for production/support activities (including textile machinery, textiles engineering, accessories, packaging), depending on the needs of the ITP. Each project will normally be completed in 3 years from the date of release of the first installment of government grant.

SITPs dedicated to technical textiles, namely, Pallavada Technical Textiles Park (Tamil Nadu), Vraj Integrated Textile Park Ltd. (Gujarat), Mundra SEZ Integrated Textile and Apparel Park Pvt. Ltd (Gujarat), Gouthambudha Textile Park Pvt. Ltd (Andhra Pradesh) and Great Indian Linen & Textile Infra Structure Co. (P) Ltd (Tamil Nadu) are functional in the country.

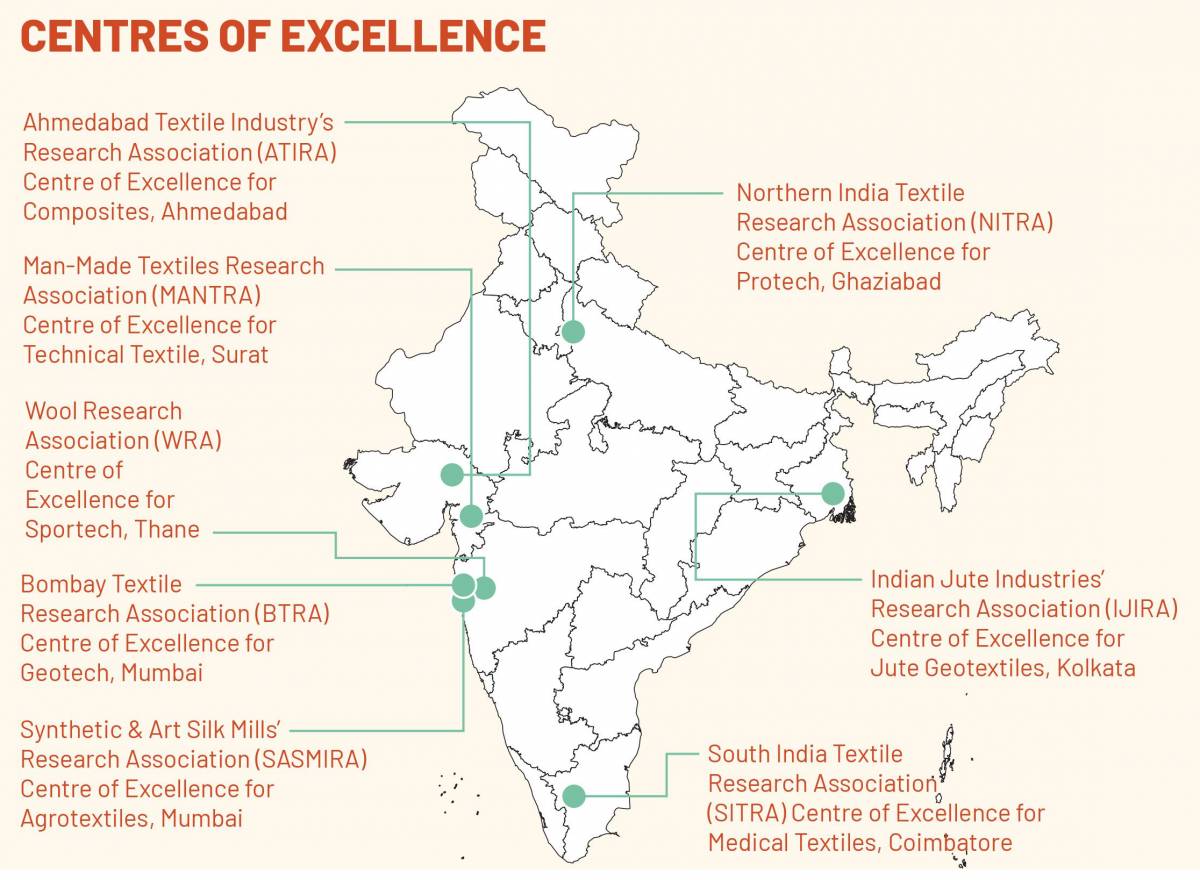

2. Centres of Excellence Ministry of Textiles had launched Technology Mission on Technical Textiles (TMTT) with two mini-missions for a period of five years from 2010-15 which entailed the creation of the following eight Centres of Excellence to provide infrastructure support, lead research and conduct tests of various technical textiles.

3. Amended Technology Upgradation Fund Scheme (ATUFS)

The Ministry of Textiles implemented ATUFS in January 2016, for a period of seven years. ATUFS’s larger objective is to improve exports and indirectly promote investments in the textile machinery. Under ATUFS, technology upgradation and CIS are offered to entities that are engaged in manufacturing textile and technical textile products under the guidance of TAMC (Technical Advisory Monitoring Committee).

- Entities or segments that engage in manufacturing of technical textiles are provided a CIS of 15% or an upper limit of $ 3 Mn.

- If the eligible capital investment is 50% of the project cost, then it is 10% or an upper limit of $ 2 Mn.

- The scheme is credit linked and shall be availed on the term loan from a notified lending agency with minimum 50% of the total eligible machinery cost under the project.

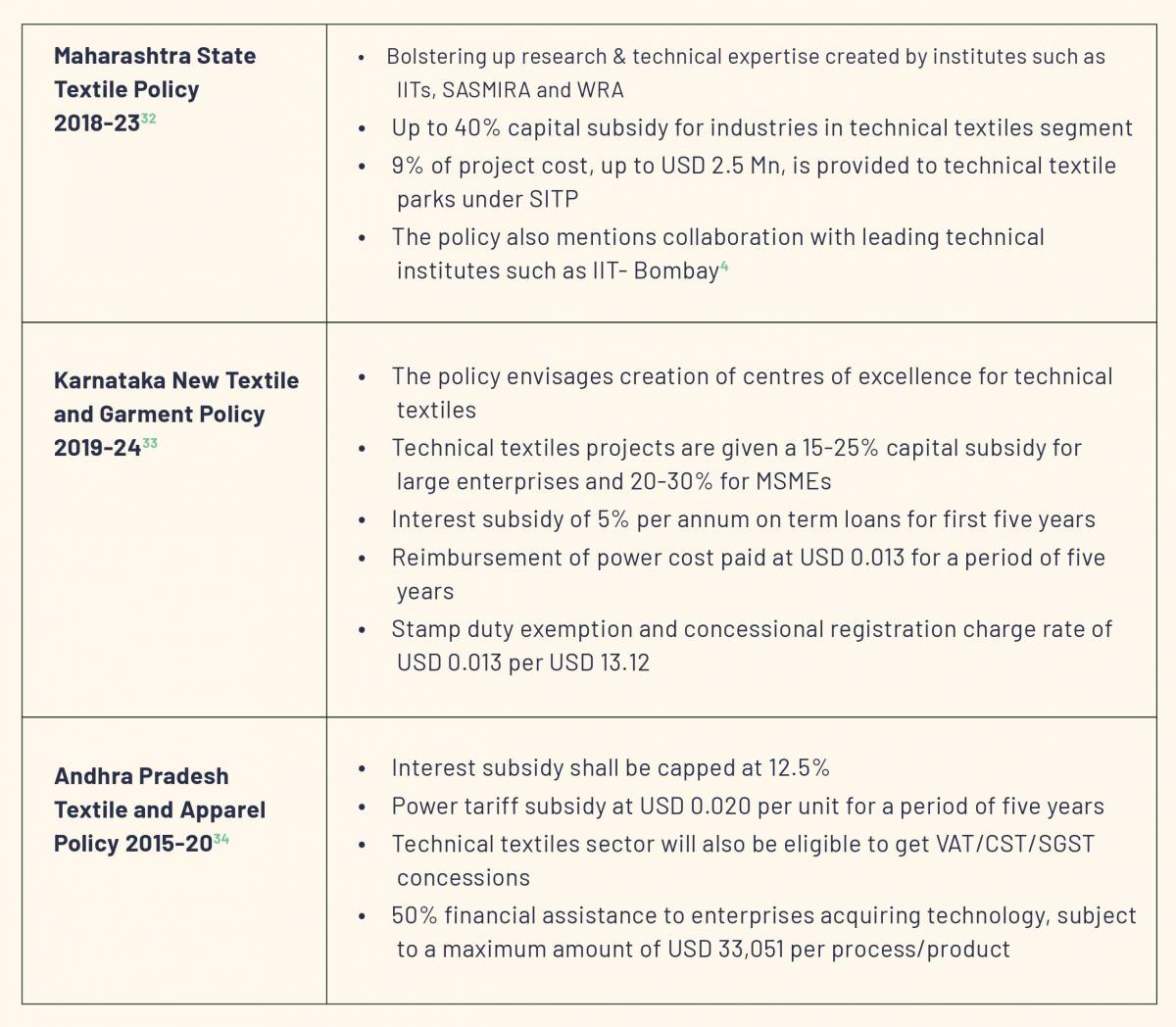

4. State Schemes

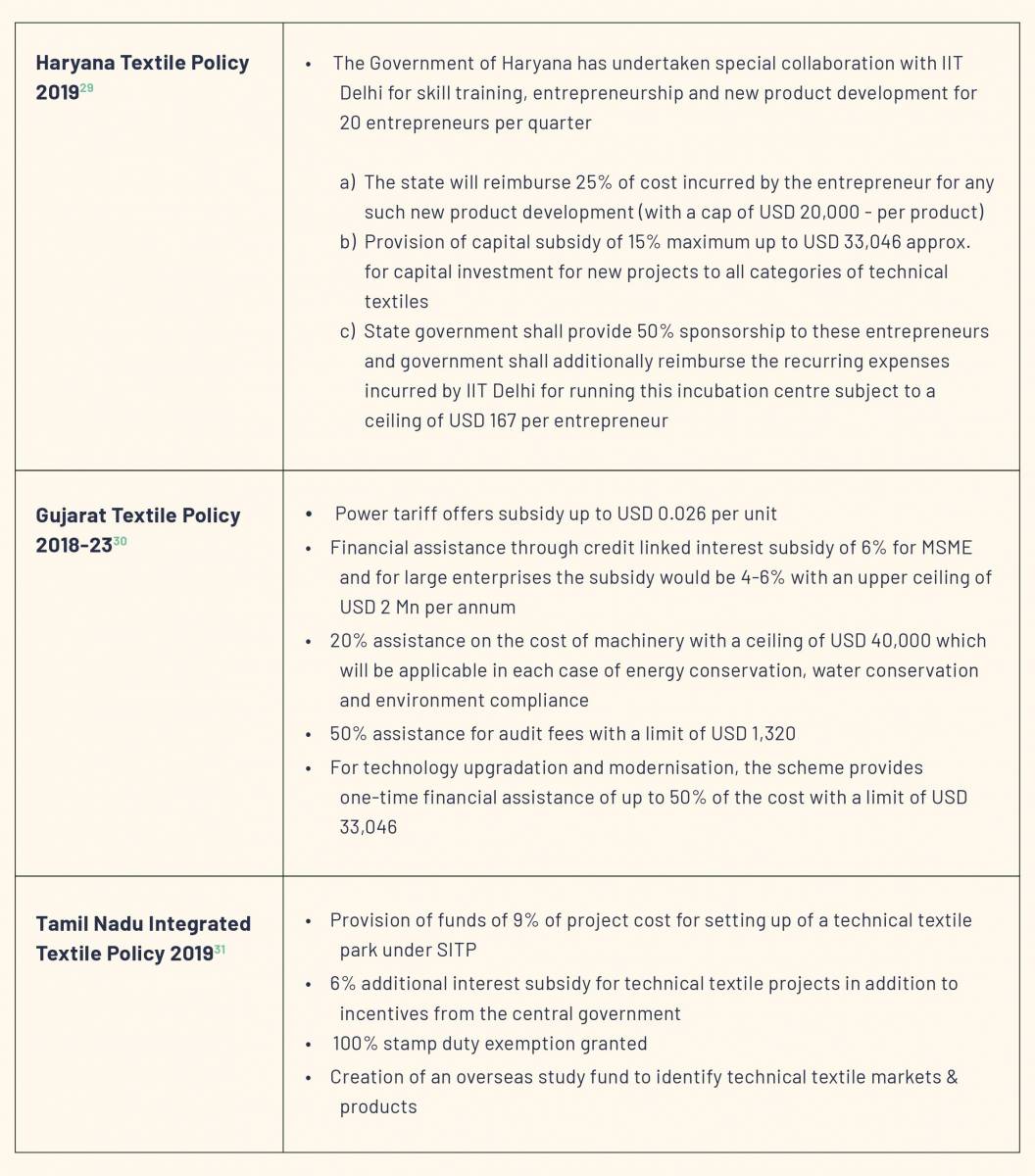

Following states have been actively promoting technical textiles through their textile policies

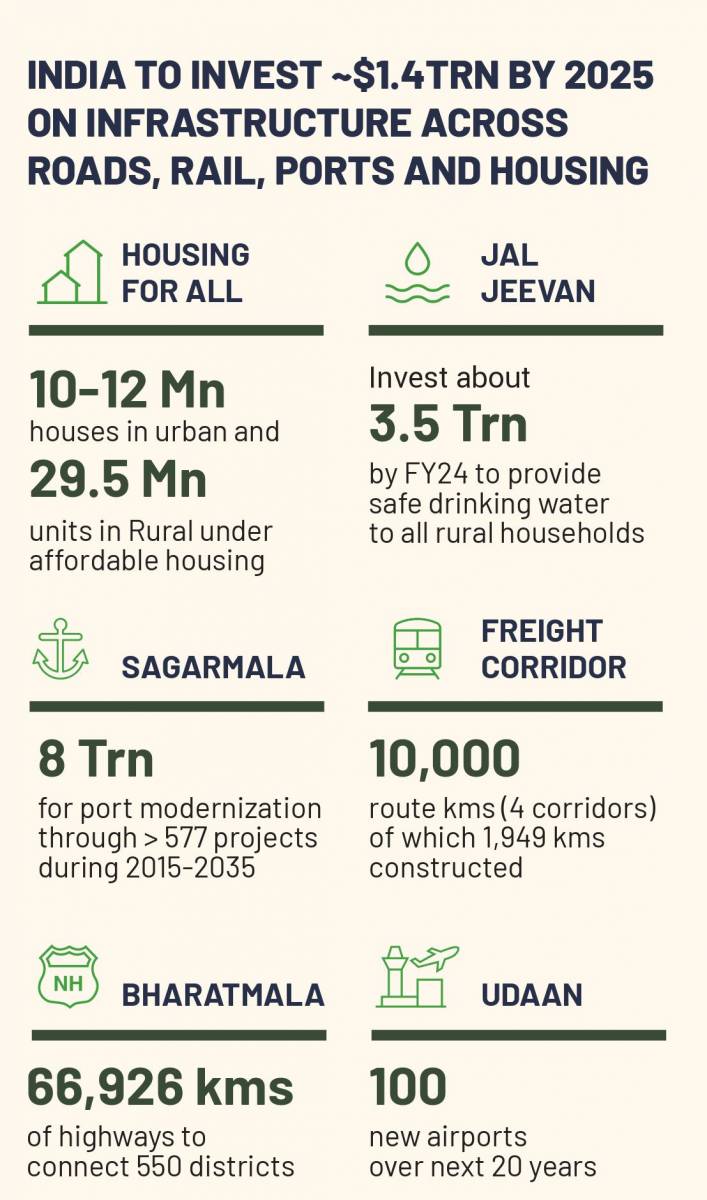

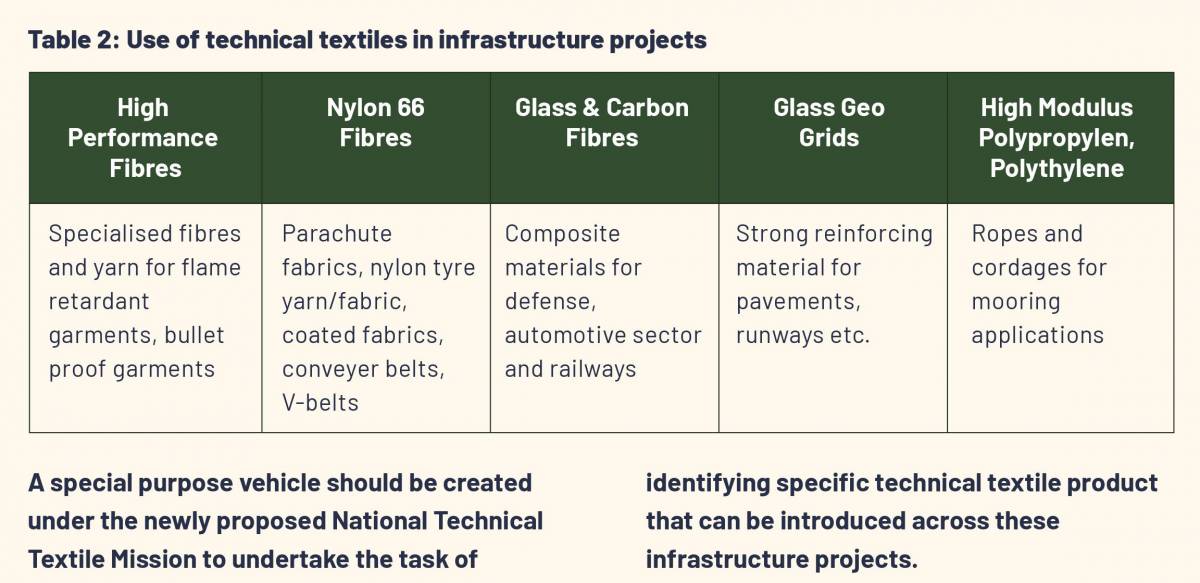

Capitalising the $ 1.4 Trn Infrastructure Fund

Aligning with the Prime Minister’s vision of achieving a $ 5 Trn economy, the Finance Minister unveiled a $ 1.4 Trn national infrastructure pipeline in December 2019 which will be implemented in the next five years. The projects identified include energy, road, railway, urban development, irrigation and health sectors, where technical textiles can be used extensively.

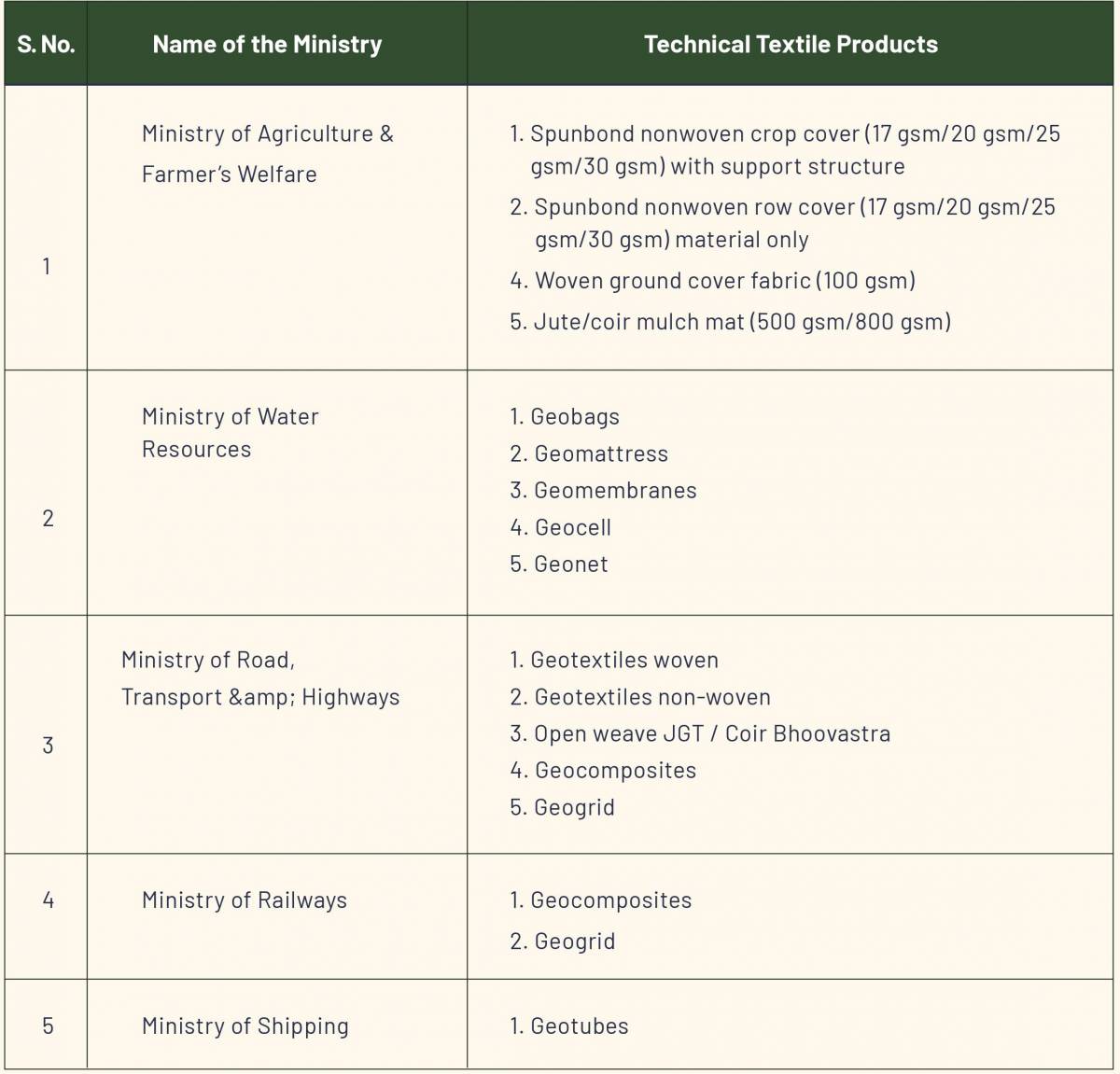

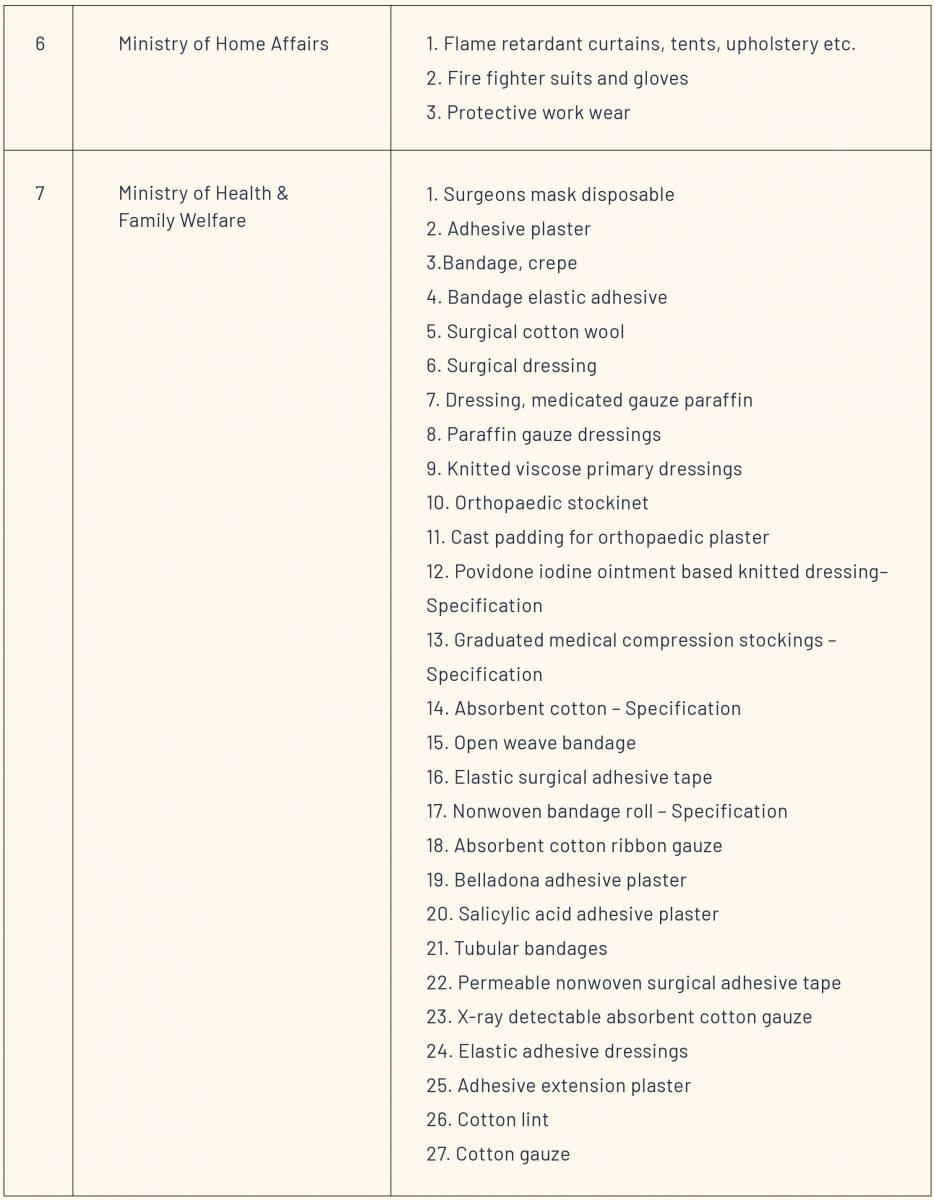

Below is a snapshot of institutionalisation of technical textiles across Ministries:

Ministry of Agriculture & Farmers’ Welfare

The regulatory and promotional mechanism and incentives have already improved the consumption of agro-based technical textile products such as shade net (material only), micro irrigation pipe, insect net (material only), vermi bed, water carrying pipe etc. The items already have a BIS standard in place and instructions/ notifications have been issued for the mandatory use by the Ministry. However, items such as spunbond nonwoven crop cover (17 gsm/20 gsm/25 gsm/30 gsm) with support structure, spunbond nonwoven row cover (17 gsm/20 gsm/25 gsm/30 gsm) material only, spunbond nonwoven fruit bag/bunch cover (17 gsm/20 gsm/25 gsm/30 gsm) with support structure, woven ground cover fabric (100 gsm), jute/coir mulch mat (500 gsm/800 gsm) already have a BIS standard in place but instructions/notifications have not yet been issued for the mandatory use by concerned Ministry.

Ministry of Water Resources

Items such as geotubes, geocell, geonet, geogrid used in slopes and embankments, woven & nonwoven geotextile used for filtration, drainage and protection against stone protrusion are important products that must be authorised for mandatory usage by Ministry of Water Resources.

Ministry of Railways

The Ministry of Railways is a major consumer of fire-retardant fabrics, used for seats and berth covers and geotextiles. The ministry has already conducted pilot tests for usage of technical textiles under its various sub-divisions. Application of geotextile in specific has already been done along the Udhampur- Jammu route, near the bridge on Tawi River. Geogrid was used for rehabilitation in a length of 6.4 Km in Kazipet-Ballarshah & Vijayawada-Visakhapatnam of South-Central Railway in 2006. Geogrid was also used in around 10 Km length on Moradabad-Bareilly section for rehabilitation during year 2010. Items such as geogrids and geo-composites have already been recommended by Indian Technical Textiles Association (ITTA) to the Ministry of Railways.

Ministry of Road Transport & Highways

Ministry of Road Transport & Highways is one of the largest institutional players and largest consumer of geotextiles in India. The use of synthetic and natural geo-textiles for increasing the longer life-span of the roads is already underway for construction of major roads – highways and expressways. Use of coir geotextiles which is cheaper and bio-degradable is being proposed for district level and village level roads.

Items such as geotextiles non-woven, geotextiles woven, open weave JGT / coir bhoovastra, geo-composites, geogrids are items for which BIS standards are available but instructions/notifications have not been issued for the mandatory use by the concerned ministry.

Ministry of Shipping

Items such as geotubes, geomembranes and geobags are often used at ports to prevent shoreline erosion by water. The key usage of geotextiles by the ministry is the construction of a geotube sea wall which has already been done at Uppada village in East Godavari District of Andhra Pradesh for prevention of erosion by sea. Geotubes have also been used at Kolkata port on an experimental basis. Hence, it is imperative that the concerned Ministry issues instructions/notifications for such products after mandatory use for which standards by BIS are already available as listed out by ITTA.

Ministry of Home Affairs

Ministry of Home Affairs is responsible for purchases for police and paramilitary which together are a major institutional buyer of protective textiles. Apart from the bullet proof jackets, it is necessary that the Ministry also brings flame retardant curtains, tents, upholstery, fire fighter suits and gloves, protective work wear under the ambit of mandatory usage.

Ministry of Health & Family Welfare

Nonwovens are extensively used in the medical field. Meditech products such as disposable surgical masks, adhesive plaster, bandage elastic adhesive and surgical cotton wool have a BIS standard in place but instructions/notifications have not yet issued for the mandatory use by the concerned Ministry. For more details, refer to the annexure.

However products such as bandage triangular pack and slab, plaster of paris are important products under this sub-segment for which there are no BIS standards available creating roadblocks in both demand and supply. Hence, standards are required for such products.

In order to capitalise the $ 1.4 Trn infrastructure fund, it is imperative to create a whole ecosystem for technical textiles to flourish in India. In this regard, creation of exclusive mega textile parks for technical textiles, laying due emphasis on this sub segment in the upcoming national textile policy, institutionalising R&D ecosystem in this domain, expediting standards for crucial products across its 12 sub-segments, providing technical skills to our workforce and making India a force to reckon with in production of textile machinery to reduce import dependence are some steps that could be taken to position India as a global leader in technical textiles.

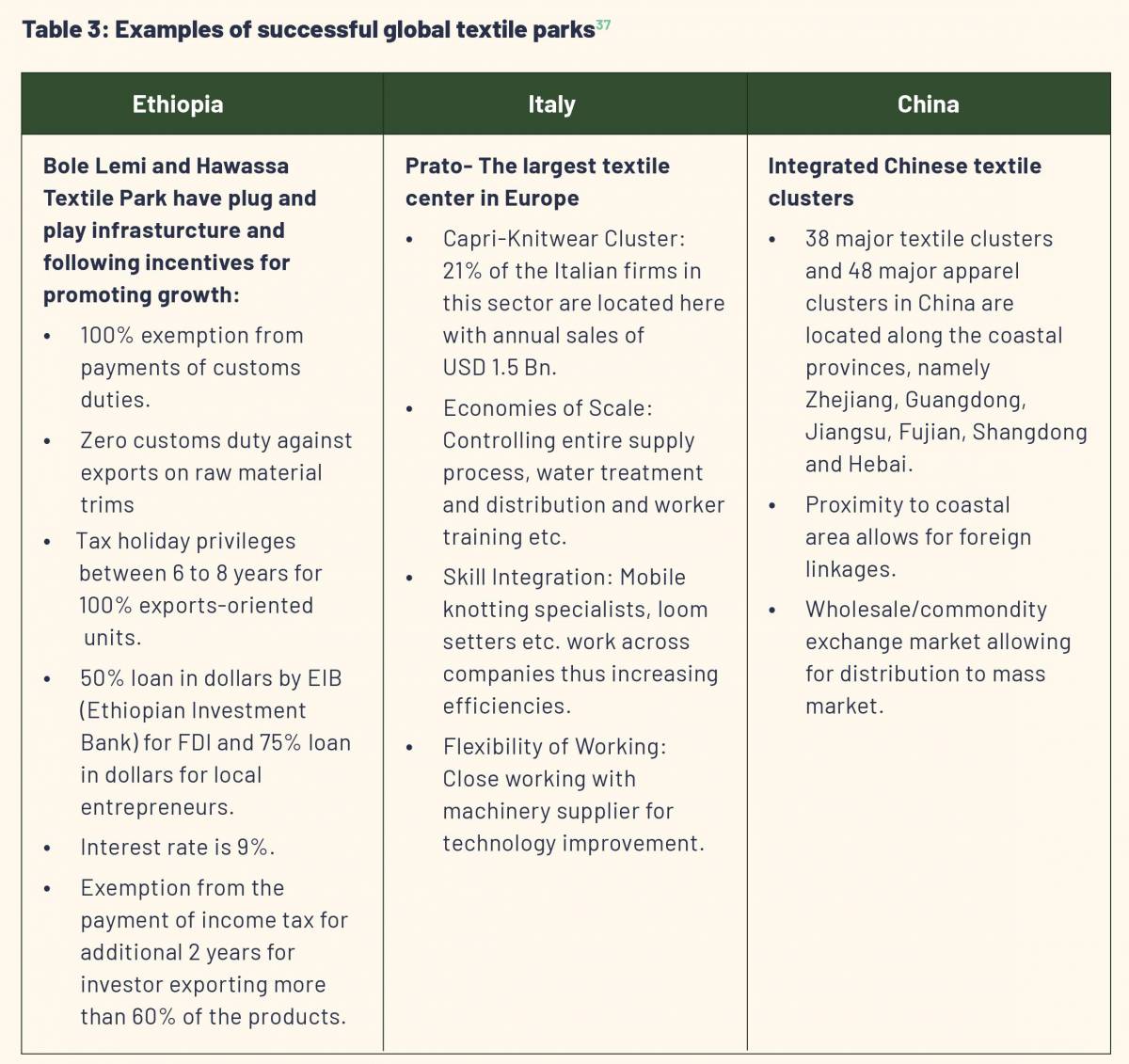

Setting Up Mega Textiles Park

Ministry of Textiles is already under the process to create an ecosystem model that would allow creation of new mega textile parks exclusively for technical textiles and upgradation of existing 19 functional textile parks supported by the government.

Characteristics of such a textile park could entail a comprehensive ‘technology-driven’ ecosystems with R&D, start-up incubation, forward linkages with logistics parks and market access systems and backward linkages with creation of textile standards under BIS. Creation of job quality certification systems through NSDA, harmonisation with international testing norms for, plug and play infrastructure for product realisation and machinery production are some of the additional features of the textile park.

Requirements for setting up a Mega Textile Park:

- High investment to the tune of $ ~52 Mn for development and 100 Crores for technology centres

- Area of ~1,000 acres

- Interdependencies on other ancillary industries for raw material and accessories

- Common state-of-the-art facilities for promotion of science & innovation

- Amenities for product testing, packaging and quality assurance

- Infrastructure for producing textile machinery

- Exemptions on duties on capital equipment imported

- Uninterrupted power and water supply

The shared services particularly those related with technology, testing, packaging, machinery production, research among others, can be operated on PPP mode by competitively selecting specialised service providers, simultaneously to multiple manufacturers located nearby. For instance, a PSU such as Warehousing Corporation of India can be invited to build their own warehouse at their own cost.

The proposed park must have technological and scientific infrastructure in terms of electricity, safety testing centre, 3D printing centre, packaging centre, warehouse, facility infrastructure in terms of sewage, water treatment pant (ETP, CETP), power station, dump yard, rainwater harvesting, recycling, solar infrastructure, training centre, testing centre and labs. In addition, social infrastructure such as food courts, convention centres, restaurants, banks, petrol pumps, first aid and fire station should be included.

NATIONAL LEVEL SPV MODEL

The governance model for mega textile park could have a national level SPV where Ministry of Textiles would have 51% ownership and 49% would be by the states represented by the various textile parks set up across the country. The SPV may be setup either as a Section 8 Company, as a trust/ society, or a Section 25 Company, or a For-Profit Section 2 Company.

The SPV would engage in management of corporate governance structure, acquiring land from the state(s), selection of states through a fair and competitive call for applications. Application and receipt of various grants for scientific facilities, technology centres, and common facilities, undertaking contracting with specialised service providers for integrated ecosystem, knowledge management by developing and channelising sector specific technical knowledge are some of the additional functions of the SPV.

The SPV would hire a Chief Executive Officer for a period of five years on a contract basis. Each proposed park would also have a Chief Operating Officer who may be taken on contract basis as well. The SPV would run the campuses through contracts with service providers on an outsource model. This will keep the recurring expenses of SPV to a bare minimum with negligible administrative burden. The SPV shall also charge a service fee (say 5% or as may be permitted by the board of the SPV) from the revenues of the technology centres and service centres operated by specialised private service providers. This would allow SPV to be self-sustainable within six months of operation.

Example of a Successful Mega Textile Park in India

Brandix India Apparel City (BIAC), Visakhapatnam

BIAC is promoted by Brandix Apparel Co. as a 1000-acre textile park with world class infrastructure developed and managed by apparel industry veterans. BIAC has contributed to cumulative exports of $ 1.85 Bn and has also attracted FDI of $ 144 Mn, as of 2019.36 It exports approximately $ 360 Mn worth of merchandise annually. With 22,000 persons working in a single SEZ/textile park, this is the single largest integrated employment enclave in textile sector in India. Moreover, it is 100% self-sufficient in knits. Among the 17 units proposed- 10 for apparel, 2 for fabric mills, 1 for spinning, 2 for processing and 2 for embroidery, a total of 14 are operational. A vertically integrated cluster starting from spinning to apparel manufacturing, finishing and embroidery, BIAC is a self-sufficient unit.

Essential facilities available at BIAC:

- Pre-built manufacturing units: 26.9 lac sq m of land has been earmarked for construction of factory sheds for production purpose. 17 factory units in different plot sizes have also been planned in the park.

- Common facilities: Exhibition hall & product display centre, training centre, testing centre and laboratory, administration building, canteen, first-aid and fire station, worker’s hostel & creche, customs office and security.

- Common Infrastructure: Main roads (2.70kms of 30m width), arterial roads- (5.7kms of 24 m width), sub arterial roads (3.1 kms of 18 m width and 2.9kms of 9m width), water supply (storage and distribution network of supplying 60 MLD of water), 25.7 kms of storm water drainage, electrical distribution system with a power demand of 200 MW, 54 MLD common effluent treatment plant with 7.5 kms of effluent collection system.

Developing a National Textile Policy

In order to develop the textile industry into a strong and vibrant one, meet the growing needs of the people and contribute to sustainable growth of employment and economic growth, it is imperative that we have a sound and dynamic National Textile Policy. The National Textile Policy was released in 2000. With the textiles industry growing by leaps and bounds, there is a need for revising and updating the national textiles policy. Although states have released their own set of goals and objectives, it is equally important that the Centre recognises the industry’s uniqueness as a self-reliant one in generating employment opportunities especially in rural areas and particularly for women.

The revised policy should take stock of the changing domestic and global needs, acknowledge the potential of “the fourth industrial revolution”, improve the overall supply chain, including structural reforms to improve present trade practices. The policy should constitute an elaborate strategy on how to build the technical textiles industry, focusing on institutionalisation, standardisation, measures to deal with sustainability, R&D efforts to procure the fibres within India. The focus should be to create new values, realise our strengths and capabilities and truly understand the potential to achieve a higher growth in this sector.

The guidelines are to develop a comprehensive policy that integrates the needs of the stakeholders, covers multiple skill clusters and disseminates information at various levels. This strategy must focus on the value addition that it creates in economic terms and the difference it will make in the lives of the future society. The policy should be forward looking and should seek to create a much needed roadmap for enabling the growth of technical textiles, promote trade expansion and remove roadblocks.

Inclusions

- Time bound programmes should be initiated for building strong capacities with R&D facilities and to encourage their growth and development in the private sector while strategically, strengthening the public sector to complement the private initiatives where it is essential.

- Adoption of a PPP model by the government will build trust and encourage the industry to work towards the common goal resulting in positive outcomes.

- Subsidies and incentives should be offered to set up export focussed technical textile manufacturing hubs.

- Policy should initiate steps taken to identify potential organisations and in promoting international standardisation to meet the demands of global market. To bolster the existing BIS, a new department dedicated to fast-tracking standardisation of technical textiles must be formed. The department must work towards streamlining the otherwise cumbersome process of creating standards and handing out licenses.

- The policy must address the need for ease in licensing and regulatory requirements which will boost foreign investments and facilitate the development of next generation technologies in this sector. Custom duties on vital inputs for technical textiles are very high leading to an exponential rise in the final costing of the product. Hence, customs duty on raw materials should be further reduced to remove the existing anomaly.

- In order to encourage the spirit of innovation and a new breed of young textile innovators, the government should frame a scheme to provide various fiscal and non-fiscal incentives to develop and promote incubation centres, provide seed money for startups, scale up funding and other support required by the startup units.

- To promote consumer awareness, it is important to instil confidence to encourage adoption of technical textiles in the market. Therefore, the government should encourage user education and various benefits that the products can bring to the lives in terms of convenience and lowering of costs. For example, setting up of demonstration centres which were set up across the eight north eastern states and provision of 1126 agro kits to the farmers to increase the usage of agro-textiles and creating awareness.

- To explore the potential of the technical textiles and facilitate their public procurement, mandatory use of technical textiles in priority sectors such as defence, agriculture, medical and construction that are already low hanging fruits should be included in the draft.

- Growth of this sector has to be made sustainable and in particular, ensure environmental sustainability through green technologies, energy efficiency, and optimal utilisation of natural resources and restoration of damaged / degraded ecosystems. Small, medium, large scale and mega industries should be provided incentives and subsidies for investments in setting up of waste management systems, pollution control, health and safety standards and water conservation etc.

- Market development assistance should include branding, design development, product diversification, assistance in standards and compliances especially for the backward areas.

- The National Skill Development Initiative launched by the Government of India has provided a renewed thrust to build productive capacities. This must integrate skill building programs and capacity building workshops and, provide incentives and subsidies for the establishment of such centres.

- One of the key instruments that must be included in the policy to catalyse the growth of technical textiles is the establishment of textile parks and cluster development. These should be developed and benchmarked with the best textile manufacturing hubs in the world. This will also help us to meet the increasing demand for creating world-class facilities and providing gainful employment opportunities.

- The entire process of clearances by Central and State authorities for the establishment of technical textile parks and clusters should be progressively made web enabled. Efforts should be placed in reducing the burden of compliance. Single window clearances and fast track approvals should part of the issue resolving process.

- Policies and measures should include access for Indian companies to foreign technologies as well as development of advanced indigenous technologies. These would include incentives, in the form of:

- tax concessions and government subsidies,

- partnerships between industries and government laboratories,

- judicious development of an intellectual property regime to enable more collaborative innovation,

- joint ventures between foreign companies and Indian partners.

Research and Development

The technical textile sector in India is at a nascent stage and therefore R&D play a critical role to gain a lead in this sector. In order to catalyse this and to test basic and applied research, 8 Centres of Excellence (CoE) and 11 Focus Incubation Centres (FIC) have been set up by the government in the past years, each having different areas of expertise. Recently, the government has also suggested creating a special fund for R&D worth $ 13 Mn in technical textiles.39 Along with these, more efforts will have to be made in the direction of fostering a well-developed R&D ecosystem.

- The importance of R&D in technical textiles should be driven through academia wherein students of textile engineering in various universities, institutions, polytechnics and applied sciences are provided learning and advanced experimental knowledge in specialised scientific subjects.

- An incentive package should be charted out between startups engaged in R&D and recognised by DPIIT and CoEs for the former to optimally utilise the latter’s testing facilities.

- For an international exposure and to comprehend the international market, joint PhD degrees between Indian institutions and foreign universities should be encouraged to jointly confer degrees to students.

- Companies in the textiles sector that are liable to spend at least 2% of their average net profit for Corporate Social Responsibility (CSR) activities may be encouraged to channelise these funds towards the research and promotion of technical textiles like protech (under Schedule VII of the Companies Act, 2013).

- A grand transition to generate value from waste requires a combination of different measures which includes reuse and recycling. For example, the textile industry generates a lot of fibrous waste and fibre being a plastic may then be recycled and reused.

- There is a dire need of research facilities and mentorship in institutions at Tier 2 and Tier 3 cities. An existing program such as ‘Summer -Teacher Research Award’ between IIT-D and Delhi University, where a faculty interested in working under the mentorship of an IIT professor undertakes a project, is one such example.

During the course of the study, a number of attempts to initiate collaborative research with the help of industry in adapting newer technologies and developing functional textiles should be explored. While industry realises the need for research to develop new technologies and products, it is reluctant to invest in research and development. In the process of waiting for technologies to mature and become commercially available, it loses the first mover advantage. Consortium approach is new to the textile industry and there are apprehensions about the same technology being available to competitors for free. No major investment from industry is likely to materialise on technology development till successful examples of R&D investments in the country emerge. Government will have to take initiative and start a few major R&D projects which can act as catalysts and encourage industry to invest heavily in developing technologies and newer products.

Creation of a National Centre for Research in Technical Textiles

The formation of a ‘National Centre of Research in Technical Textiles’ may be proposed as a first step towards creating a formal institutional structure. This may be established within an existing institution or as a separate entity.

Constitution of the Apex Body

- Core Committee: The Core Committee should comprise of experts from technical backgrounds, industries and ministries.

- Networking Wing: Primary responsibilities should include mapping of research facilities across industries /universities and facilitate exchange of knowledge.

- It must connect research with larger market and drive innovation on a regular basis.

Tenure

The tenure of the committee should be for a minimum of five years, keeping in line with the life cycle of a prototype taking the shape of a final product (the minimum timeline for which is five to seven years). This shall ensure continual mentorship throughout the project.

Responsibilities

In addition to monitoring long and short-term research, the centre should be encouraged to create international collaborations with the leading institutes around the world.

Funding

The different levels of funding will be as follows:

- TRL* 1 – R&D funding for a large number of projects

- Duration – Short term (3-5 years)

- Fund – Upto $ 39,38540

- Eligibility – Any student can apply

- TRL 2 – Shortlisted candidates from level 1 who have shown tangible progress like publishing research papers or filing patents. At this stage an industry partner should be introduced to provide direction to the candidate.

- Duration – 1-2 years

- Possible outcome: Prototype

- Fund – 5% to 10% increase in the TRL 1 funding

- TRL 3 – Industry can participate at this stage by acquiring stakes in a specific project by providing 30% funding. They can further assess its market viability by running a pilot program at the end of the term.

- Duration: 2-3 years

- TRL 4 – Industry may fund 51%. This is the final leg of the research where all efforts will be made towards the commercialisation of the product.

If an industry partner cannot be identified on any project that project may be put on hold until a potential partner is identified.

Standards

Standards form a critical part in the regulatory framework by helping the industry deliver high quality products, build trust and improve our export ability. Product specification leads to consumer empowerment, enhance product awareness and create a level playing field for industry players across the domain.

Establishing standards will also help technical textiles move towards the regime of mandatory usage and institutionalisation of the products. Standardisation of technical textile testing is key in gauging product quality, ensuring regulatory compliance and assessing the performance of textile materials.

BIS is the National standards body of India established under the BIS Act 2016 for the development of the activities of standardisation, marking and quality certification of goods. Through standardisation, certification and testing BIS has been able to provide safe and reliable quality products. To further support the upcoming range of technical textiles, to boost exports and to assist the industry in tackling with the jungle of standards and norms, we recommend that the following listed measures be considered.

Standard formulation process

At present, proposals are submitted to the Bureau for establishing a standard or for revising, amending, or cancelling an established standard. Once the necessity of standardisation is established by the Division Council of Textile, the task of formulating the standard is assigned to an appropriate technical committee. A draft standard prepared and duly approved by the committee is issued and widely circulated for a period of not less than a month amongst the stakeholders concerned for review and suggestions.

The appropriate technical committee, thereafter, finalises the draft standards giving due consideration to the comments that may be received. The draft standard, after approval by the Sectional Committee is then submitted to the Chairman of the Division Council for adoption. Established standards are then reviewed periodically, at least once in five years, to determine the need for revision or withdrawal.

The committee structure is designed to bring together all those with substantial interest, so that standards are developed keeping in view the balance of interests among the relevant stakeholders and after taking into account all significant view-points through a process of wide consultation. The consensus process to arrive at a decision can be cumbersome and usually takes an average time of six months to complete the process. Such process can be expeditiously accomplished if a fast track mechanism is initiated for the products or methods depending on the urgency.

Standards to work towards eliminating trade barriers

Along with reduction in tariff barrier, standards should become more prominent growth drivers rather than becoming market barriers. The government should work with its counterparts in other countries and through intergovernmental organisations to ensure that standards facilitate global trade and minimise potential trade barriers and requirements for duplicative tests.

The government should work with other WTO members to seek full implementation of the Technical Barriers to Trade (TBT) Agreement and annexes as well as decisions taken in the WTO TBT committee.

International cooperation

Since inception of ISO, BIS has been an active member and contributes in policy as well as in technical matters related to international standardisation.

BIS has already signed several MoUs in the field ofstandardisation and conformity assessment and is in the process of having such arrangements with several other countries. In addition, BIS has also signed Bilateral Cooperation Agreements (BCA)/Mutual Recognition Agreements (MRA) with the National standard bodies of several countries. But there is a dire need to leverage the existing partnerships in full measure. Government should encourage BIS to utilise knowledge sharing programs to influence the selection of standards by these developing economies leading to creation of favourable trade alliances.

Forming a technical task force Creating a subcommittee focused on long-range and succession planning which should be at the forefront of many innovations and should be responsive to the marketplace. The committee should be proactive in exploring where the gaps are and seek to identify opportunities where new standards and test methods are needed. We can already imagine a future where fibres that are created out of goat milk, fabrics manufactured via 3D printing and maybe even textile applications incorporating nanotechnology and apparels that can monitor an individual's health or incorporate electronic gear.

With products now being produced with scents, antiseptic and antibiotic healing properties, and medical repair and replacement capability - such as artificial veins created from textiles- there is an urgent need to speed up the process of formulating testing methods to meet the demands of the global marketplace.

Skilling

India has the advantage of productive workforce owing to a promising demographic dividend where over 65% population is below 35 years of age. The Indian workforce is expected to increase to approximately 600 Mn by the year 2022 from the current estimate of 473 Mn.

Since lesser than 5% individuals attend any kind of formal training in India as compared to other nations (UK-68%, Germany-75%, USA-52%, Japan-80% and South Korea-96%), it becomes important to focus on skill advancement and have an industrious pool of ‘work-ready’ skill based individuals for textiles.

Under Skill India Mission, an effective and elaborate training framework has been implemented in India. For textile and apparel sector specifically, two Sector Skill Councils i.e. Textile Sector Skill Council (TSC) and Apparel, Made-ups & Home Furnishing Sector Skill Council (AMHSSC) have been formed under the aegis of National Skill Development Corporation (NSDC). The Ministry of Textiles also introduced Integrated Skill Development Scheme (ISDS) for textiles and apparel sector. Under this scheme, a total of 11.04 lakh people have been provided skilling, out of which 10.45 lakhs have been assessed and 8.43 lakhs have been placed. Ministry of Textiles also introduced the Scheme for Capacity Building in Textile Sector (SCBTS) named ‘Samarth’ to train 10 lakh (9 lakhs in organised and 1 lakh in traditional sector) persons over a period of three years (2017 – 2020), excluding weaving & spinning sector with an estimated budget of $ 170 Mn and additional $ 787 Mn has been earmarked for the future.

Apart from these initiatives, it is imperative that the Ministry of Textiles formulates and adopts a two-pronged strategy in creating a pool of workers with technical skills.

Bolstering the existing curriculum of colleges offering courses on textile engineering in the country is the first step that could be taken in this direction. Institutions such as IIT-Delhi, IIT-Bombay, Institute of Chemical Technology, Mumbai are already running successful courses in the field of textile technology and can leverage their existing MoUs with foreign institutions to provide for on ground training internships for final year students. This will not only strengthen their existing knowledge base but will also expose them to best practices from countries leading the way in technical textiles.

The second line of strategy could align with the National Skill Development Corporation (NSDC) wherein vocational training is provided to candidates for running the basic operations of a technical textile manufacturing unit. Initiatives in this direction could be led by state skilling universities such as Shri Vishwakarma Skilling University, Haryana, Nagpur Skills University, Maharashtra and Rajasthan ILD Skills University. It is in this space that the government could leverage partnerships between employers and technology innovators to increase access to high-quality personalised learning.

The Ministry of Textiles and Ministry of Skill Development and Entrepreneurship’s (MSDE) could collaborate on creation of skilling universities across the country to focus on technical textiles. This could be in cognisance with the Industry Revolution 4.0 which shall demand a completely different skill set from the upcoming workforce. As a result, it is essential for a skill university to conduct and/or outsource regular demand-assessment studies (preferably every five years) within its jurisdiction as well as refer to similar studies carried out in other parts of the world. These efforts must be supplemented by state as well as central governments with periodic studies on skill-gaps in different sectors, future projections etc, and a lead in this direction could be taken by the Centres of Excellence. The institution thus created could be following the National Skills Qualification Framework (NSQF), in which it has been stated that there must be multiple entry and exit between vocational education, skills training, general education, technical education and job markets. For example, a student completing the first year of a three-year degree course must be awarded a diploma at the end of the first year and be allowed to enrol in the second year after a gap.

Thus, with many government initiatives for upskilling the Indian workforce, the textile industry can be hopeful to address the highly skewed demand-supply manpower challenges.

Procurement of Machinery

The Textile Engineering Industry (TEI) in India is one of the five key capital goods industries. The industry has more than 80% of the units as SMEs with a total investment of $ 1.2 Bn and capacity of $ 1.4 Bn.44 The mapping of the textile engineering industry in the country has been done by Textile Machine manufacturing Association of India (TMMA) under the following three heads:

Group I (At par with International Standards)

Under this category comes ginning, spinning, weaving preparatory, synthetic machinery, testing equipment and jute machinery segments wherein a substantial number of machines are being produced and supplied to the domestic as well as export markets. Key industry players in this segment are Lakshmi Machine Works Ltd., Aalidhra Group, Weavetech Group, Palod Himson, Meera Industries and Premier Evolvics.

Group II (Marginal Technological Gap Exists)

This category contains weaving, processing, embroidery, and knitting machines, and parts, components and accessories having a technological gap of 10-15 years. Key players include Lifebond, Arun Industries, Yamuna Machines, Inspiron Engineering, Nantex Machineries, Hi-tech International, and Perfect Engineering.

Group III (Huge Technological Gaps Exists)

Under this category falls technology for technical textiles & non-wovens, garment making machinery and processing machinery which at current status is obsolete. This is the category that demands for immediate action to fill in a gap of 20-30 years that exists between India and the global market.

The following measures can be proposed for the same:

Structural changes

Currently, the administrative ministry for the Indian textile machinery industry is the Department of Heavy Industries under the Ministry of Heavy Industries and Public Enterprises. The Textile Machinery Branch of the Office of the Textile Commissioner, Mumbai is the sponsoring authority for the textile machinery industry. With the Department of Heavy Industries having an array of responsibilities to serve a cross section of user industry segments ranging from defence, oil and gas, refinery, nuclear, chemical and petrochemicals, machine tools, consumer durables, fertilizers, automobiles, textiles, steel, cement, paper, construction, mining, etc, it is highly recommended that the department be relieved of its responsibilities towards textile machinery industry. This industry is at a nascent stage in India and requires much more attention. By making the Ministry of Textiles the administrative ministry for the Indian textile machinery industry, it is more likely that the industry will grow in sync with the overall textile value chain and also reap direct benefits of policies.

FDI and formation of JVs

One of the effective ways to bridge this technological gap is to bring in Foreign Direct Investments (FDI) from leading countries such as Germany, Spain, Switzerland, Japan, Korea and Italy. Some global companies may consider bringing their technologies to India for supplying into domestic and overseas markets. This could lead to the formation of JVs between a global company and a domestic entity. A successful example in this direction is the JV between the German company Karl Mayer with Rabatex Industries and A.T.E. signed in March 2019 to strengthen manufacturing capabilities in the sector of warp preparation machines.

Import substitution & boosting domestic production

As per the 2017-18 data, the domestic production (export-import) figures in textile machinery stood $ 905 Mn, $ 393 Mn and $ 1.4 Bn respectively.46 The huge cost of importing machinery in the country is only going to pose immense burden. Hence, there is a clear need to substitute imports through indigenous technology development, JVs and FDIs which will further propel the Make in India campaign to greater heights. It is under this section of incentivising domestic production of textile machines, that TMMA proposed to the Ministry of Textiles to consider a one-time ‘Commercialisation Grant’ (30% of the technology cost), and a ‘Technology Adoption Incentive’ (18% or 30% of each machine cost) for the first 1000 machines sold in the Indian and/or the overseas markets, exclusively for the technology owners. This will enable them to develop their manufacturing capabilities, enhance their marketing and branding efforts, and most importantly reduce the cost of their machines to a level that matches with that of their closest competitors.

Creation of machine manufacturing clusters

The need to bolster the existing SITP scheme has been realised by the Ministry of Textiles. Having a dedicated park to manufacturing of textile machines in the country will prove beneficial to turn around the entire value chain and fill the existing gaps. The park should have state-of-the-art support infrastructure, developed land, uninterrupted power supply and other utilities for manufacturing and training centres for skilled manpower.

Road Ahead

Technical textiles industry is at a nascent stage in India and hence, holds a vast potential for growth. With the government’s aim to create world class infrastructure in the country, in addition to the implementation of several policies and schemes to boost the textile sector, technical textiles is poised for growth.

Useful physical properties such as durability, elasticity and versatility make technical textiles even more useful in times of changing climate, global warming, and complex industrial processes. Presence of large and global and domestic players has influenced the growth in technical textiles and has helped build sector prominence.

The overall development of the infrastructure, coupled with the availability of skilled and low-cost labour, focus of research and development activities and strong manufacturing capabilities make India increasingly preferable as an attractive investment destination.

India is redefining its position in the world as a formidable destination for FDI in textiles and apparel industry attracting $ 3.1 Bn worth FDI during 2018-19, hence, there is an enormous potential for technical textiles too, to achieve a fast paced growth and capture the rising markets.47 Garnering direct attention from Prime Minister Narendra Modi and with a favourable policy ecosystem in place, India is already on its way to capitalise the fullest potential of this sector.