Section 1: Introduction

Corporate Social Responsibility (CSR) does not have a universally accepted defnition, the core of the concept however, is structured around the belief that businesses have a sense of responsibility towards society and the people from whom they derive their success. In countries such as India, where economic integration and social inclusion are imperative forces that drive the masses towards growth and development CSR has become an integral and impactful part of corporate landscape.

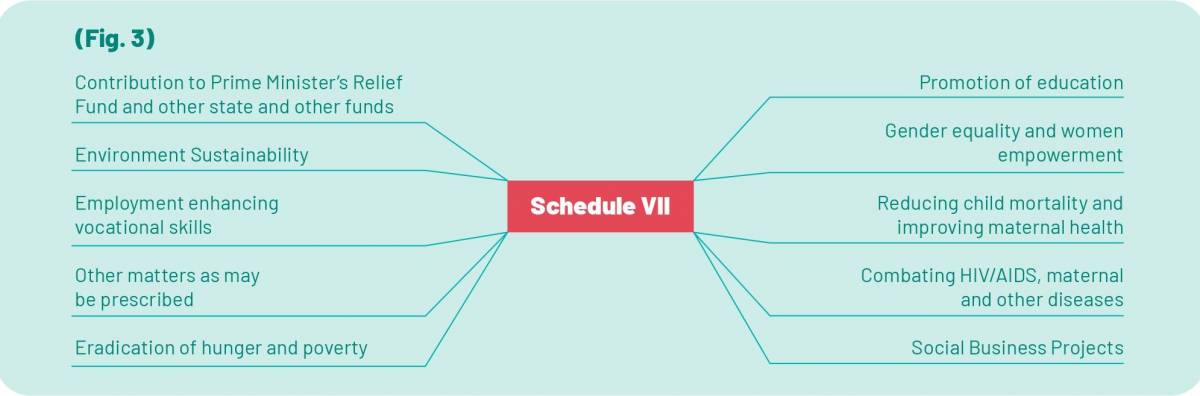

India was the frst country in the world to impose a statutory obligation of CSR for corporations meeting certain criteria. As per Section 135 of the Companies Act, companies with a net worth of INR 5 Bn ($ 70 Mn) or more, or an annual turnover of INR 10 Bn ($ 140 Mn) or more, or net proft of INR 50 Mn ($ 699,125) or more, to spend two per cent of their average net profts of three years on CSR. This provision makes India the only country in the world that makes both the spending and reporting of CSR obligations mandatory. Furthermore, the Companies Act and subsequent amendments have expanded and clarifed activities for which the two per cent funding can be used. The Government of India has made it clear that CSR spending is not charity or mere donations without any strategic benefts. In fact, there has been a concerted effort to defne broad areas (Schedule VII of the Companies Act 2013) under which the funding can be channelled, thereby visibly and positively impacting society. Moreover, there has been a conscious attempt to keep the CSR legislation aligned with India’s commitment to the United Nations Sustainable Development Goals (UN-SDGs). Schedule VII of the Companies Act 2013 defnes broad areas of intervention that are intended to be interpreted liberally with the eventual focus being on ensuring sustainable development of the country.

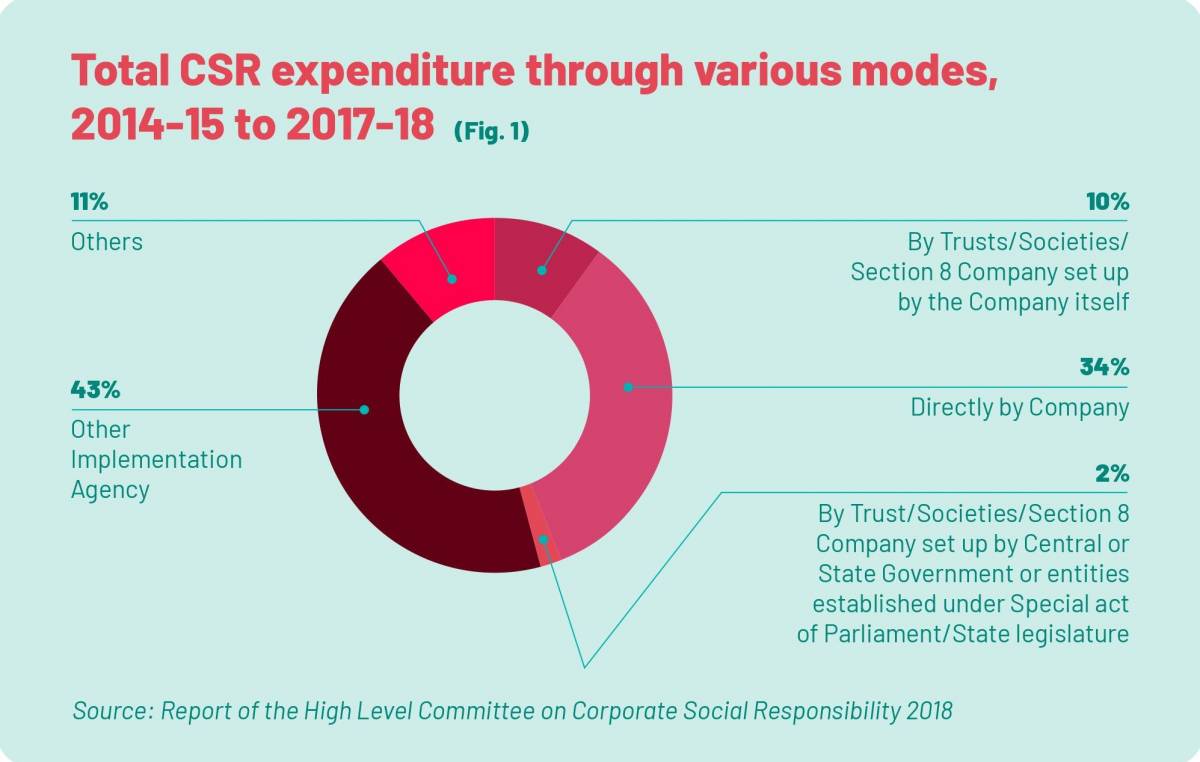

A total of INR 71, 277 Cr have been spent on 1,05,358 CSR projects till FY2019. The top three domains receiving maximum funding are education, health and rural development. Another area receiving signifcant funding is environmental sustainability. Another interesting trend is that signifcant amounts of funding go to higher industrialised states. Since FY 2015, Maharashtra, Karnataka, Gujarat and Tamil Nadu have received more than 30 per cent of the total CSR spend. This could be for multiple reasons like the company is looking to have a positive social impact in their areas of operation, as well as deeper connects with social impact organisations operating in the same area. This can also be seen in data on CSR expenditure modes where almost 44 per cent of all spending is done by the companies themselves or via trusts/societies/ Section 8 companies set-up by them. Another 43 per cent is done through various implementation partners. However, the concentration of spending in these states, means that states such as Jharkhand, Bihar, Chattisgarh, Madhya Pradesh and Uttar Pradesh which account for more than 55 per cent of the aspirational districts (states with poor socio-economic indicators), receive only 9 percent of the total expenditure towards CSR. In fact, no state, apart from Uttar Pradesh (#9), from the list above feature in the top 10 state benefciaries. For CSR to be truly effective, this imbalance would have to be corrected. Invest India’s ‘Corporate Social Responsibility Projects Repository’ on the India Investment Grid (IIG) is an effort in this direction. It is hoped that by giving a platform to all states to list potential CSR projects at a central level, companies and their implementation partners would be able to assess where their CSR funds would be most impactful across India. Currently, the portal has over 650+ projects across eight diverse domains.

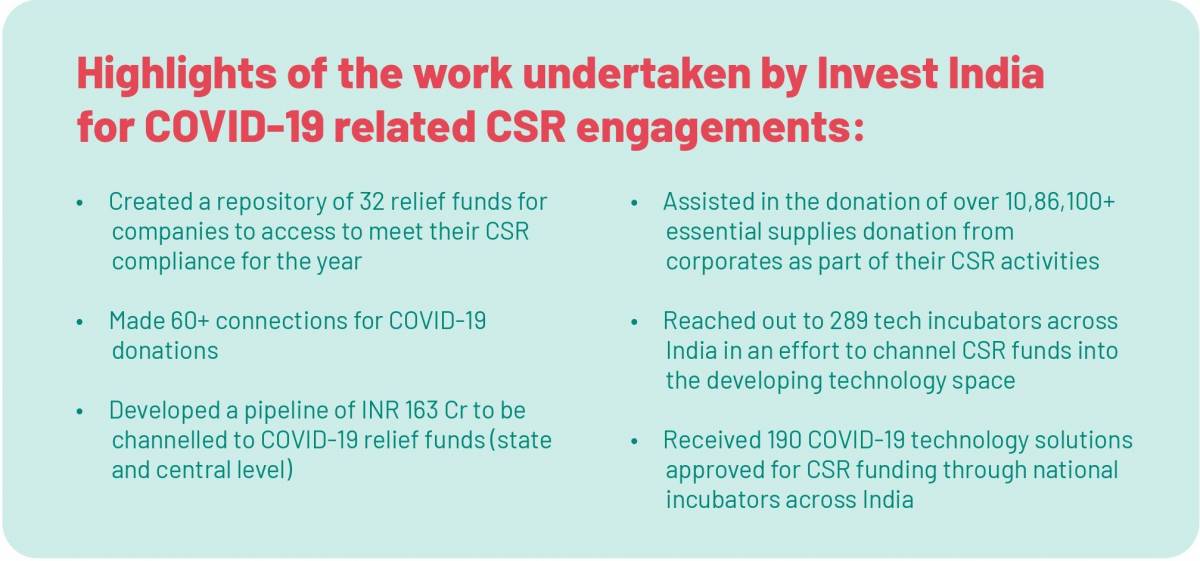

Government of India declared the novel coronavirus outbreak in the country a “notifed disaster” to enable state governments to mobilise resources from the State Disaster Response Funds (SDRF). Following the notifcation, the Ministry of Corporate Affairs (MCA) clarifed that spending of funds for COVID-19 relief would be a permissible activity under CSR. Again, the MCA advised that the activities should be interpreted liberally so as to capture the essence of the activities permitted under the Schedule. The government has also set up the ‘Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund’ (PM CARES) to respond to the COVID-19 crisis and provide relief to those affected. Further, Schedule VII was amended to include contributions to PM CARES as CSR along with the existing Prime Minister’s National Relief Fund. Tapping into its vast network and relationships, Invest India set up a CSR specifc assistance cell to assist corporates to channel their CSR funding into various governmental and non-governmental organisations as well as central and state-level funds set up for the specifc task of COVID-19 relief. To support contributions to relief funds across both the centre and states, Invest India created an online repository of 30+ relief funds as well as developed a pipeline of INR 163 Cr in donations and CSR contributions from corporates. This enabled corporates and volunteers to locate and connect with organisations needing monetary or other support in their activities. Another key enablement function for Invest India’s COVID-19 response was the facilitation of donations of essential supplies, over 10,86,100 pieces of PPEs, critical care equipment and other commodities to frontline organisations.

To shed light on an aspect of corporate India that is often overlooked Invest India has written this report. It presents a broad overview of the changing landscape of CSR in India especially during COVID-19 along with learning from our engagements and insights into key trends. It also features the role of CSR for technological incubators as an instrumental stride in the battle against COVID-19. This report is based on our analysis from primary research, through a survey of companies and government incubators. The secondary data was collected through company annual reports, MCA notifcations, and reports on CSR in India.

Section 2: Past CSR Trends in India

Contribution by the corporate sector:

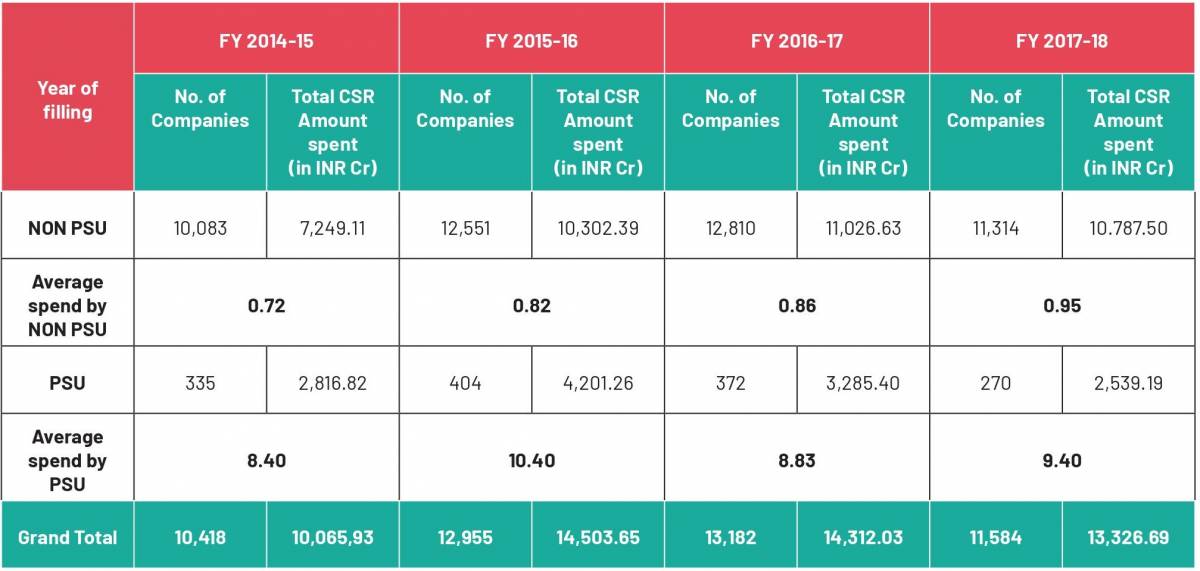

According to the Report of the High-Level Committee on Corporate Social Responsibility 2018, the number of reporting companies that carry CSR obligation has steadily increased in 2014-15 to 2016-17 and then declined in the year 2017-18. The total CSR expenditure by these companies increased substantially by 44 per cent from 2014-16 and thereafter marginally declined in 2016-17. This has been highlighted in the table below.

It has also been observed that the average spend by a government enterprise on CSR varied between INR 8-10 Cr per company between 2014-15 to 2017-18 whereas the average spend by a private company steadily increased from INR 72 Lakh per company in 2014-15 to INR 95 Lakh per company in the year 2017-18.

CSR EXPENDITURE BY COMPANIES REPORTING ON CSR

Figures as per the fllings received as on 31st March, 2019

Note: Number of the companies in the above table include companies which are liable and reporting on CSR

PSU: Public Sector Undertaking

Source: Report of the High-Level Committee on Corporate Social Responsibility 2018

MODE OF IMPLEMENTATION

According to the Report of the High-Level Committee on Corporate Social Responsibility 2018, it may be observed that most of the CSR expenditure has been done through an implementing agency. Even though the percentage of projects implemented through trust/society/Section 8 companies set up by the company has been quite low, the CSR expenditure made via this mode has been high.

While a substantial proportion of companies spend their CSR funds directly, NGOs are becoming the most popular channel for others. This upward trend can be attributed to implementing agencies being a more suitable model for the companies to execute CSR projects, due to their presence in the target areas, local connections and knowledge based experience in executing social projects which a company may typically lack in.

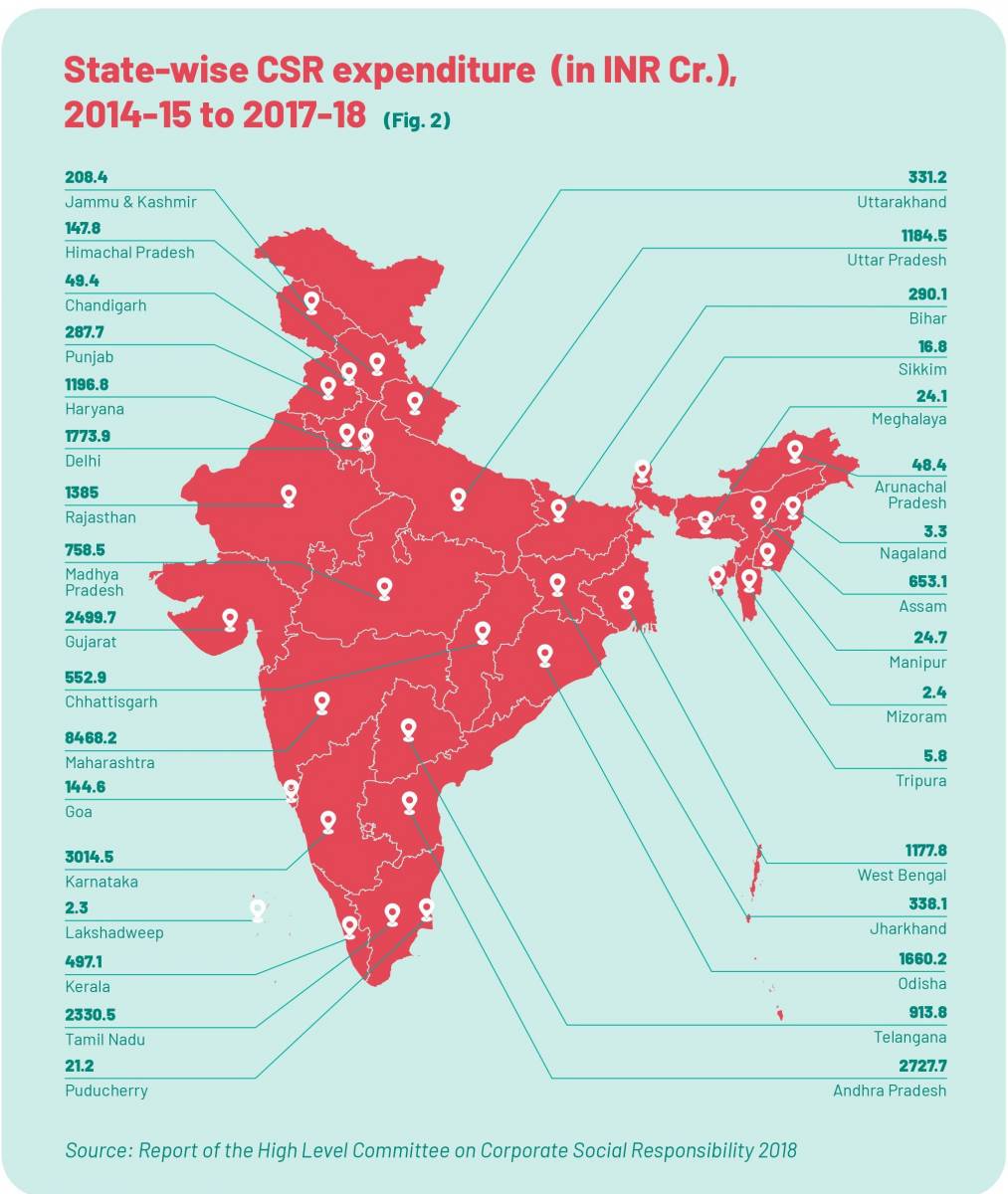

STATE-WISE DISTRIBUTION OF CSR FUNDS

In 2018, as per the Ministry of Rural Development, India had a total of 718 districts, of which, approx. 16 per cent (115 districts) were aspirational districts as per NITI Aayog. Jharkhand, Bihar, Chattisgarh, Madhya Pradesh and Uttar Pradesh account for more than 55 per cent of the aspirational districts’ concentration across India, yet received only nine per cent of the total expenditure towards CSR. States with a relatively higher level of development are where the concentration of CSR-led activities is the highest and is seen to be increasing over the years. Maharashtra, Karnataka, Andhra Pradesh, Gujarat, Tamil Nadu and Delhi received 40 per cent of the total CSR expenditure from 2014-15 to 2017-18, even though they account for 11 per cent of the total number of aspirational districts.

This bias exists not only towards relatively well developed states but also within a state itself. An analysis of data for FY 2016-17 shows that even in Maharashtra, which received the largest volume of funding, certain districts such as Pune and Mumbai (suburban) received the highest amount in CSR funding (more than INR 200 Cr each), while those which were farther away from industrialised areas such as Hingoli, Buldhana and Parbhani received less than INR 1 Cr of funding.

KEY AREAS OF CSR

Activities that are specifed in Schedule VII as the activities which may be included by companies in their CSR policies are:

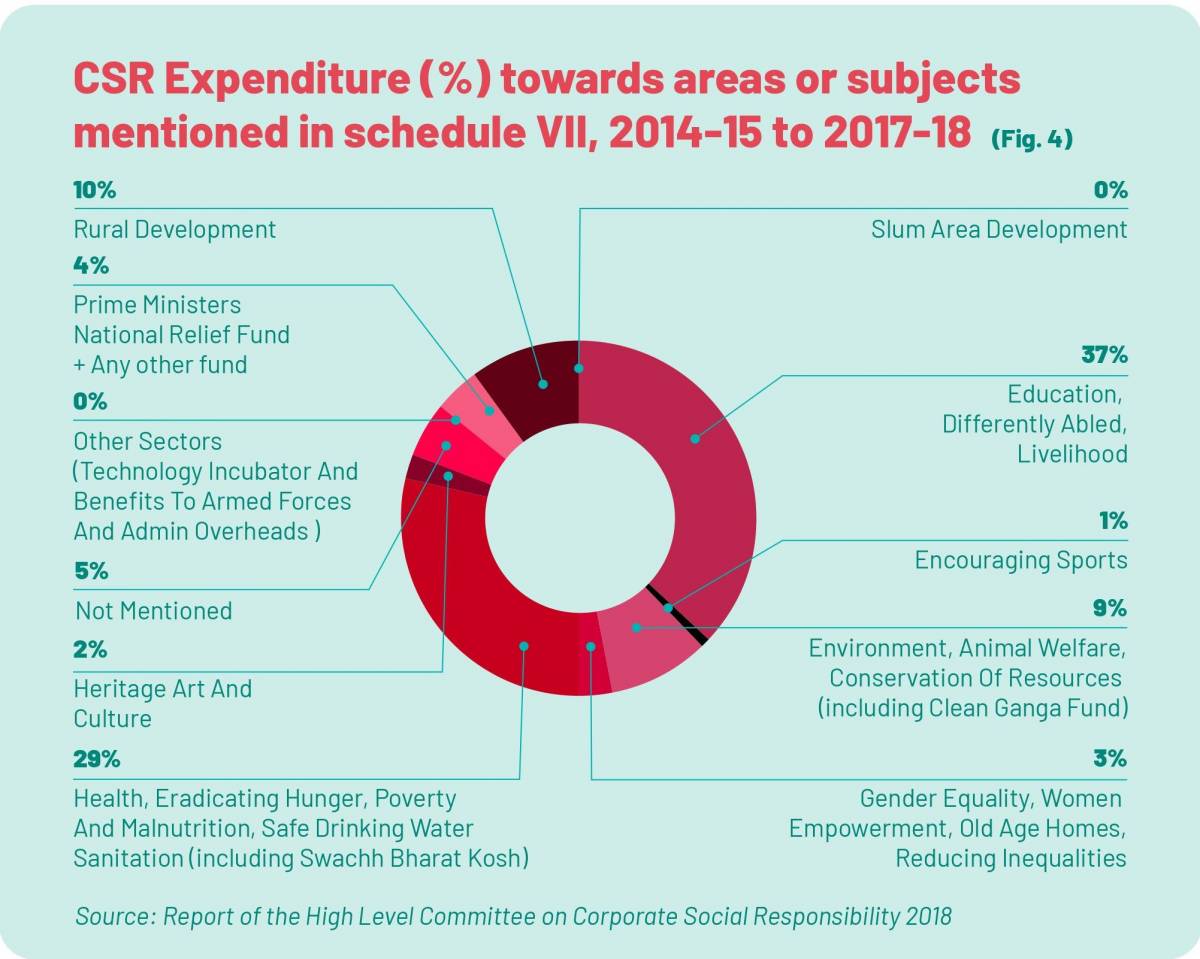

Out of the total expenditure incurred on Schedule VII areas, the projects related to education and health have received maximum CSR funds. The cumulative fgure from 2014- 15 to 2017-18 for total expenditure incurred on projects related to education is INR 15,612.20 Cr, followed by INR 9,020.47 Cr spent on projects related to healthcare.

Besides Schedule VII activities, CSR funds can be also contributed to PM National Relief Fund, Swachh Bharat Kosh, Clean Ganga Fund and any other fund set up by the Government of India for socio-economic development. The contributions to these funds have been in a small proportion (approx. 5.6 percent) of the total CSR expenditures for the years 2014-15 to 2017-18.

SUSTAINABLE DEVELOPMENT GOALS (SDGS) AND CSR

SDGs are a collection of 17 global goals designed to be a blueprint to achieve a better and more sustainable future for all. These 17 goals consist of 169 targets which must be achieved by 2030.

India played a prominent role in the formulation of the United Nations Sustainable Development Agenda 2030 and much of the country’s National Development Agenda is linked to achieving Sustainable Development Goals (SDGs). India ranks 115 out of 162 on the SDG Index. This slow progress calls for immediate action through a collaboration between the corporate sector, civil society organisations and the government. Corporates are seen as the key drivers of SDGs as they can apply their creativity and innovation to achieve sustainable development and facilitate the implementation of these goals.

CSR and SDGs together have tremendous potential to develop an interconnected model for sustainable growth. Many companies are aligning their CSR focus areas according to SDGs to meet their CSR mandate. For example, when an organisation defnes its CSR focus area on enhancing livelihoods through skill development training of women and youth, it is contributing to various SDGs such as creating means to end poverty, zero hunger, provide quality education, promote gender equality and economic growth.

FDI AND CSR

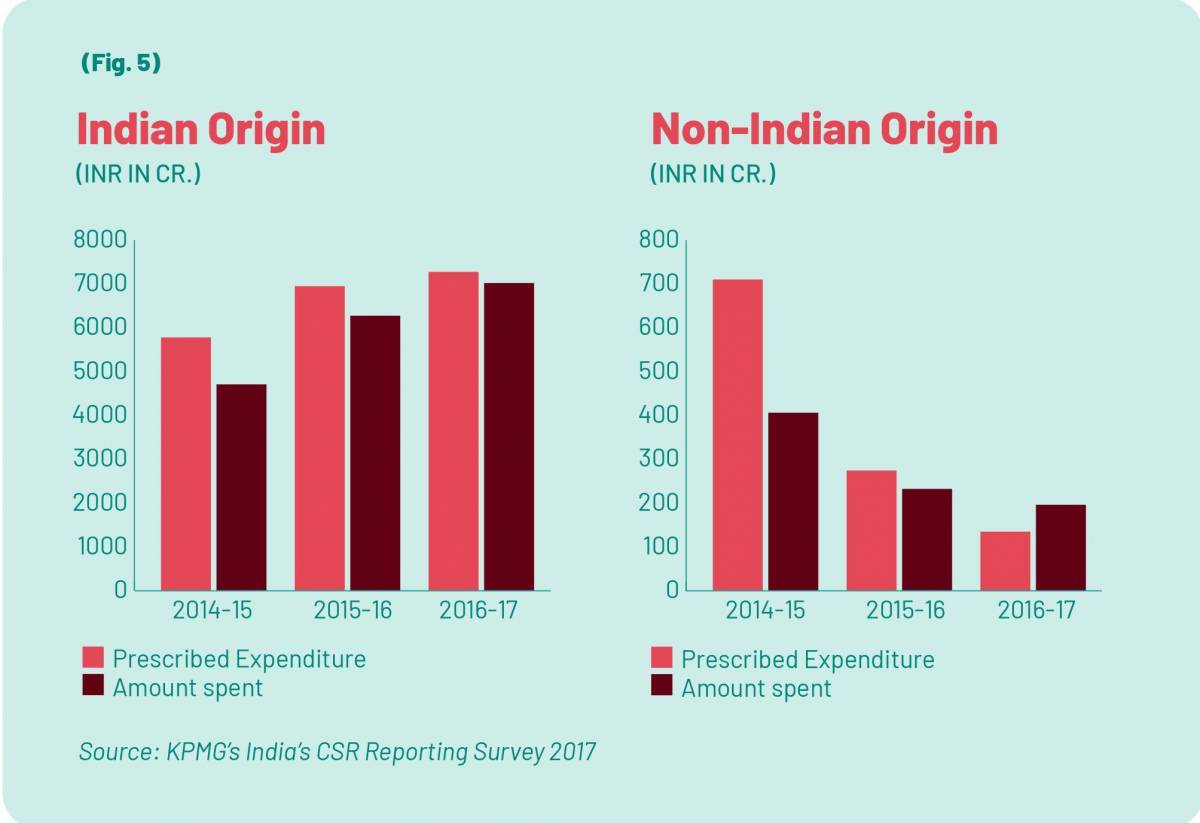

Foreign companies comprise a signifcant part of the CSR expenditure in India. According to KPMG’s, India’s CSR Reporting Survey 2017, which analyses and brings together fndings from CSR reporting of the top hundred listed companies as per market capital as on 31 March 2017, companies have spent INR 7215.9 Cr which is 41 per cent higher as compared to 2014-15. This is a signifcant rise, clearly demonstrating higher expenditure towards CSR activities from the mandated year. Additionally, the average spending per company has also gone up by 25 per cent. Comparing CSR activities by Indian origin and non-Indian origin companies, it is observed that 35 per cent of Indian origin and 22 per cent of non-Indian origin companies are executing CSR projects exclusively through implementing agencies. In case of non-India origin companies, only 95 projects (fve per cent) were executed with an expenditure to the tune of only three per cent.

As shown in the graphs below, in 2016-17, against the prescribed CSR expenditure, Indian origin companies have spent 96 per cent while nonIndian origin companies have spent 145 per cent.

Section 3: Key Government Announcements Regarding CSR for COVID-19

DECLARATION OF THE CORONAVIRUS OUTBREAK AS A “NOTIFIED DISASTER”

In a move termed as a “special one-time dispensation”, the Government of India declared the novel coronavirus outbreak in the country as a “notifed disaster” on 14 March 2020. This was done to enable the state governments to provide assistance and utilise funds from the State’s Disaster Response Fund (SDRF) towards avenues like temporary accommodation, food supplies, and medical care for patients and people in quarantine facilities. The notifcation allowed for states to not only deploy these funds as part of their containment measures, but also channel funds towards efforts geared towards screening such as setting up procurement of essential equipment/testing laboratories within the government.

CLASSIFICATION OF FUNDS SPENT ON COVID-19 AS ELIGIBLE CSR ACTIVITY

On 23 March 2020, the MCA declared that the funds spent on COVID-19 management would be treated as eligible CSR activity2. “Keeping in view the spread of COVID-19 in India, its declaration as a pandemic by the World Health Organization (WHO), and the decision of the Government of India to treat this as a notifed disaster. It is hereby clarifed that spending of CSR funds for COVID-19 is eligible under CSR activity”, the MCA order said. Companies’ CSR funds can now be used towards promoting preventive care healthcare infrastructure and disaster management. The order was treated as a welcoming step by many who believed this would help the government and industry to join forces and alleviate the distressing impact of the virus outbreak.

The MCA circular also stated that the CSR funds can be spent by companies for various activities related to COVID-19 as enlisted under item nos. (i)- eradicating extreme hunger and poverty and (xii)- disaster management, including relief, rehabilitation and reconstruction activities of Schedule VII appended to the Companies Act, 2013 and relating to the promotion of health care, including preventive healthcare and sanitation and disaster management. MCA also notifed that items under Schedule VII are broad-based and shall be interpreted liberally in the wake of the crisis.

SETTING UP OF PM CARES FUND

Keeping in mind the need for having a dedicated national fund with the primary objective of dealing with any kind of emergency or distress situation, such as the COVID-19 pandemic, and to provide relief to the affected, a public charitable trust under the name of ‘Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund’ (PM CARES Fund)’ was set up on 28 March 2020. The Prime Minister is the Chairman of this trust and its members include Defence Minister, Home Minister and the Finance Minister. In a tweet, PM Modi said, “People from all walks of life expressed their desire to donate to India’s war against COVID-19. Respecting that spirit, the Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund has been constituted. This will go a long way in creating a healthier India.”

The MCA, in a subsequent notifcation issued on 28 March 2020, clarifed that all donations and contributions to the PM-CARES Fund will be counted towards a company’s mandatory corporate social responsibility spend. This was done by amending Schedule VII of the Companies Act, 2013 by including PM-CARES Fund as a permissible CSR activity along with the Prime Minister’s National Relief Fund.

AMENDMENT OF CSR NORMS TO INCLUDE R&D SPENDS ON VACCINE, DRUGS AND MEDICAL DEVICES RELATED TO COVID-19

On 26 August’20, the Government amended the CSR norms to include research and development (R&D) spending on new vaccines, drugs, medical devices related to COVID-19. “Any company engaged in research and development activity of new vaccine, drugs and medical devices in their normal course of business may undertake research and development activity of new vaccine, drugs and medical devices related to COVID-19 for fnancial years 2020-21, 2021-22 and 2022-23 subject to the conditions,” said the gazette notifcation.

These conditions are “such research and development activities shall be carried out in collaboration with any of the institutes or organisations mentioned in item (ix) of Schedule VII to the Act. And, details of such activity shall be disclosed separately in the Annual Report on CSR included in the Board’s Report”, according to the corporate affairs ministry notifcation.

While the relaxation is applicable for three years till 2022-23, it comes with the caveat that such R&D activity must be carried out in collaboration with specifed public institutions. This step is expected to enhance manifold the fow of funds towards the COVID-19 vaccine and drug development.

MCA’S COVID-19 RELATED FREQUENTLY ASKED QUESTIONS (FAQS) ON CSR

On 10 April 2020, MCA issued FAQs on CSR related to COVID-19 via its General Circular No. 15/2020 which helped clarify a few concerns regarding the deployment of CSR funds for COVID-19 relief.

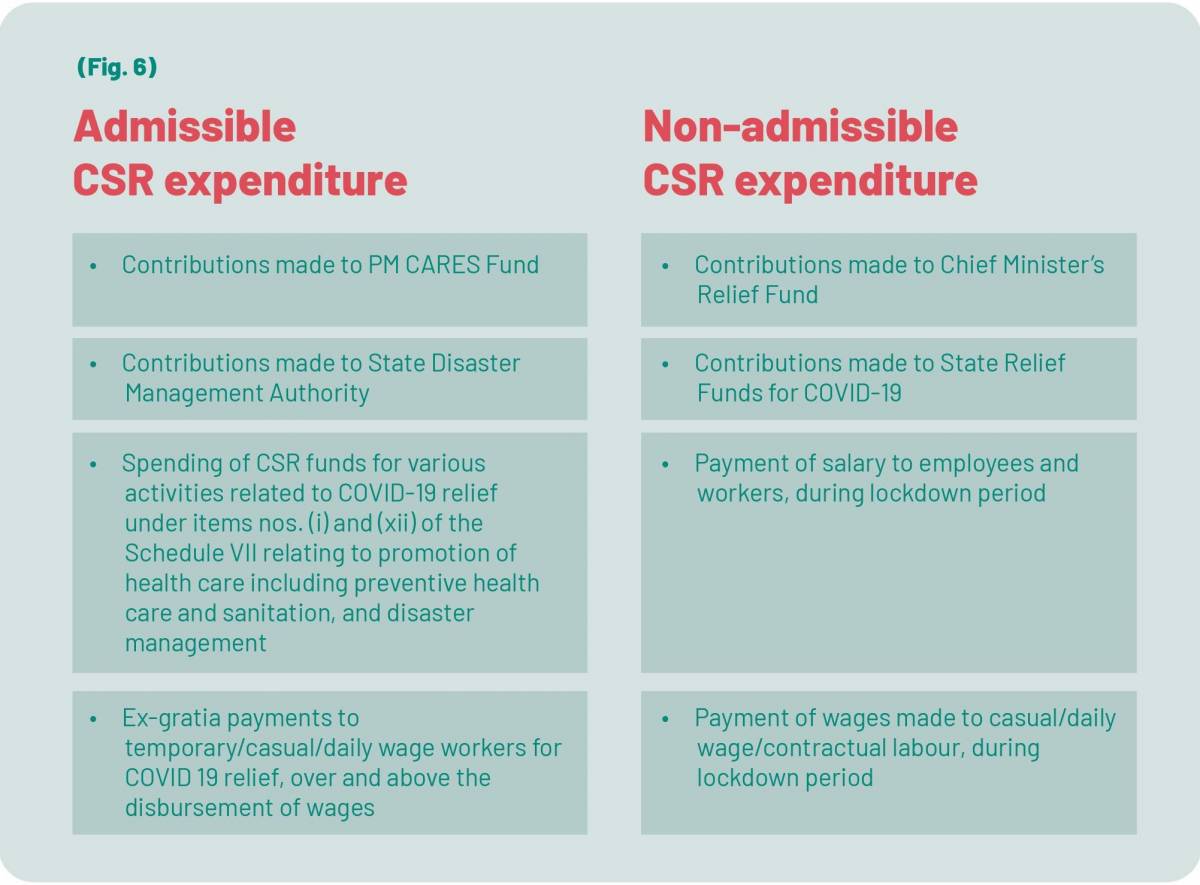

The FAQs state clearly that contributions made towards the PM CARES Fund shall be covered under CSR, while funds given to Chief Minister’s Relief Fund or State Relief Fund for COVID-19 shall not qualify as admissible CSR expenditure. However, the notifcation adds that contributions made to the State Disaster Management Authority to combat COVID-19 shall qualify as CSR expenditure under item no (xii) of Schedule VII.

The notifcation also allows for ex-gratia payments made to temporary/casual/daily wage workers to qualify under CSR as a one-time exception. This is possible, provided there is an explicit declaration to that effect by the board of the company which is duly certifed by the statutory auditors.

Section 4: Key CSR Trends During COVID-19 - Survey by Invest India

The response to this changing CSR landscape has been demonstrated not only by companies of Indian origin but even foreign corporations who have mobilized support and initiated targeted campaigns to mitigate the impact of this unprecedented crisis. While the Government’s PM-CARES Fund has witnessed monumental support from corporates, some companies have also contributed by individual programs and relief efforts. Some have also partnered with local authorities of respective state governments to donate medical/food supplies and scale other initiatives to cater to the needs of local communities.

Invest India conducted a survey of select corporates actively spending CSR funds during the current pandemic to gather insights into their COVID-19 CSR strategy, methodology of identifcation of projects, experience with implementation during the pandemic, and any persistent obstacles to efcient operations of their CSR teams. One signifcant observation was that a majority of companies (75%) foresee a dedicated programme for COVID-19 in some capacity. In fact, the pandemic has led to companies pivoting their CSR priorities to address more pertinent social issues caused by the pandemic. It is hoped that this experience will lead them to expand their CSR footprint to other hitherto, unexplored areas. In terms of identifcation of sectors and projects, currently, companies focus on direct benefciaries for their social welfare projects, and these tend to be done in partnership with NGOs in the geographical proximity of their centres of operations.

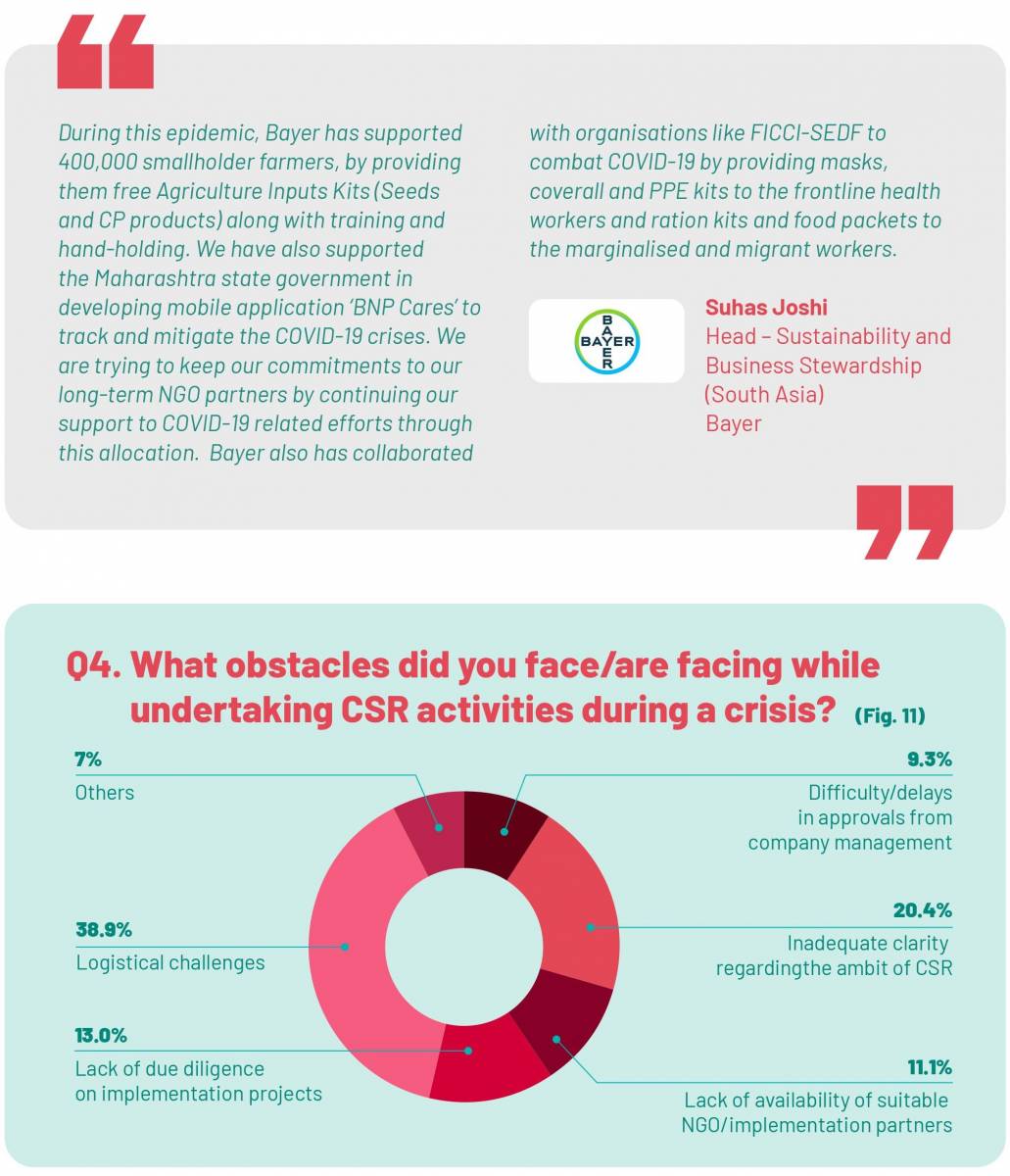

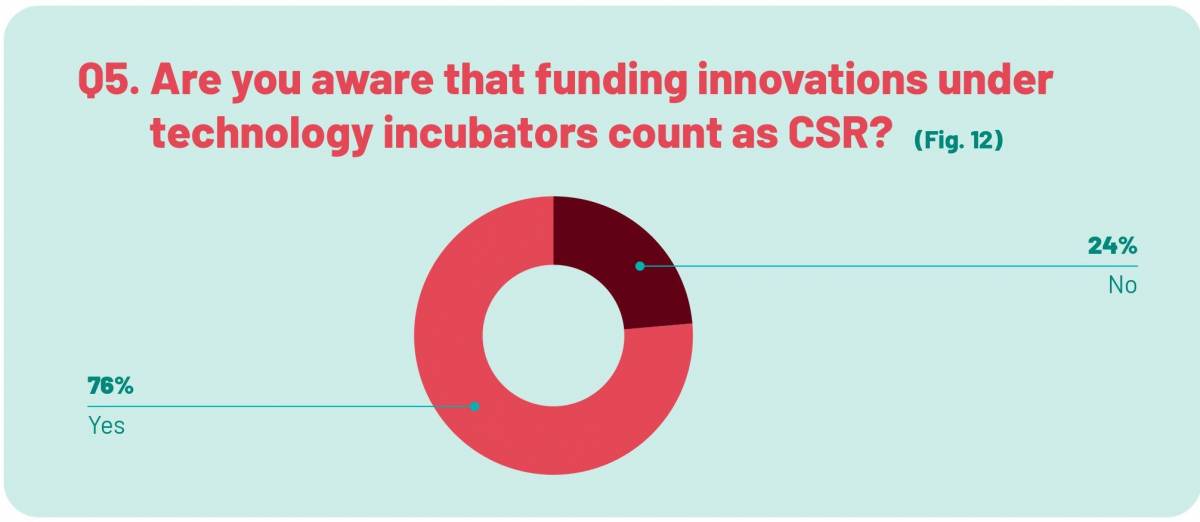

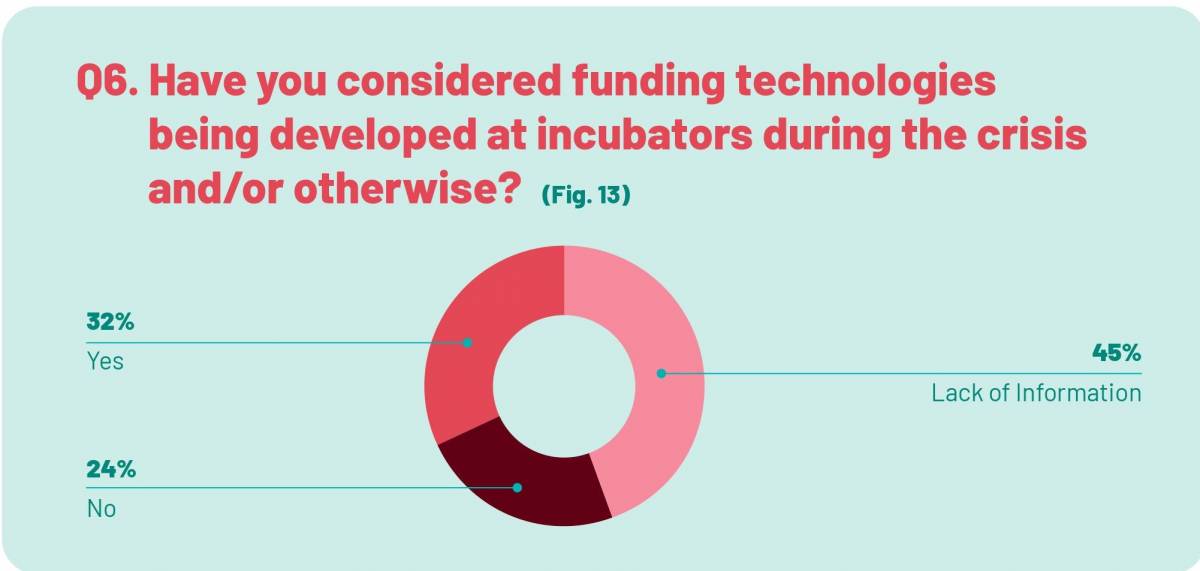

Some of the key obstacles faced by companies include: logistical challenges (39 per cent), inadequate clarity regarding the ambit of CSR (21 per cent), and lack of due diligence on implementation projects (14 per cent). On the funding to technology incubators, the survey found that there was signifcant lack of information in the ecosystem on the modes and processes to be considered for funding technologies being incubated around the country, even while ~75 per cent of the respondents were aware of the fact that this channel of spending CSR funds was available.

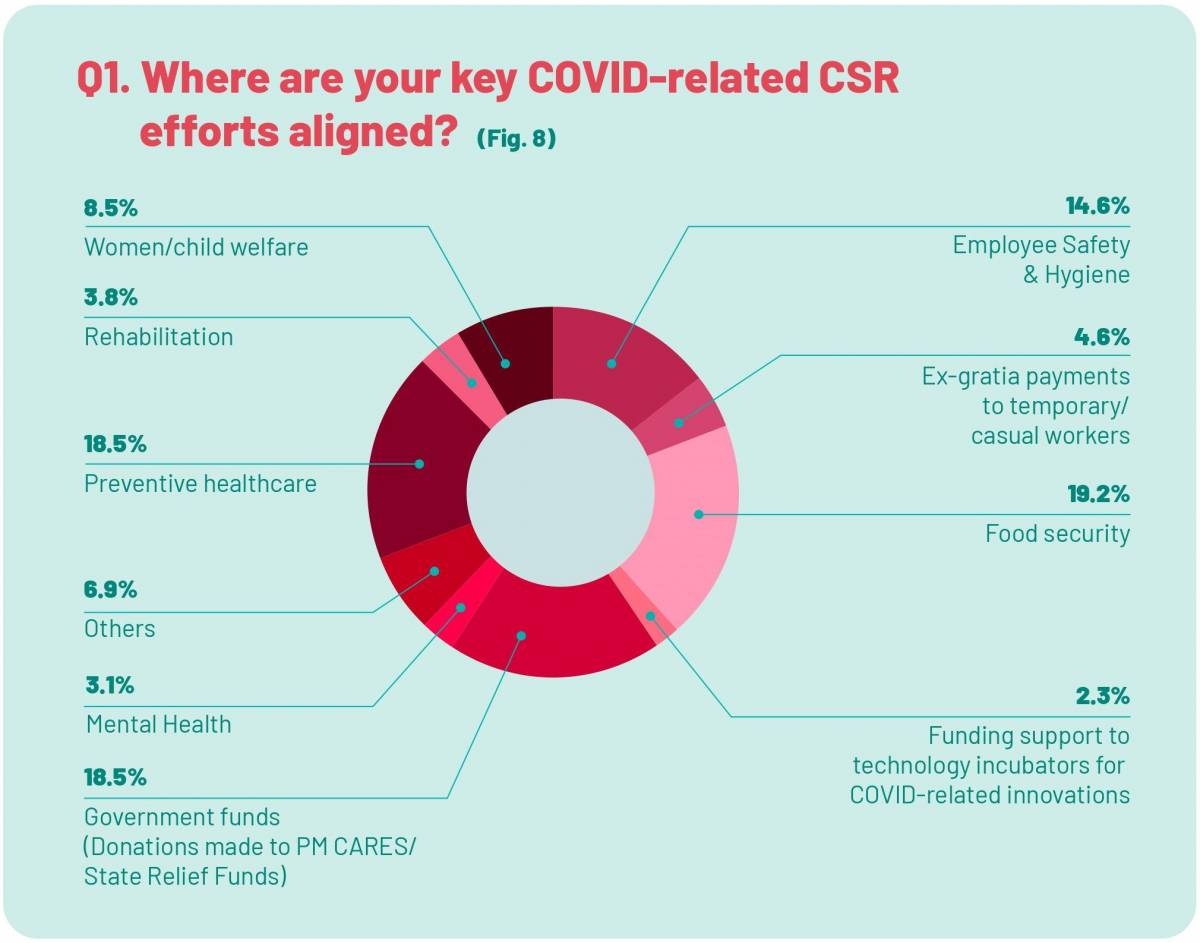

Q1 Key Learnings

- Preventive healthcare, food security and donations to government funds comprised of the top three sectors where companies aligned their CSR funds. Most of the companies aligned their efforts to more than one welfare domain, indicating that they are following a hybrid approach.

- Responding to the COVID-19 pandemic has provided corporates the opportunity to expand their CSR footprint and engage with sectors. It is encouraging to see how corporates have pivoted their CSR models to best address the urgent societal challenges.

- Some corporates have also creatively deployed their funds towards initiatives aligned with unconventional areas of relief such as promoting mental health and harnessing technology to create awareness.

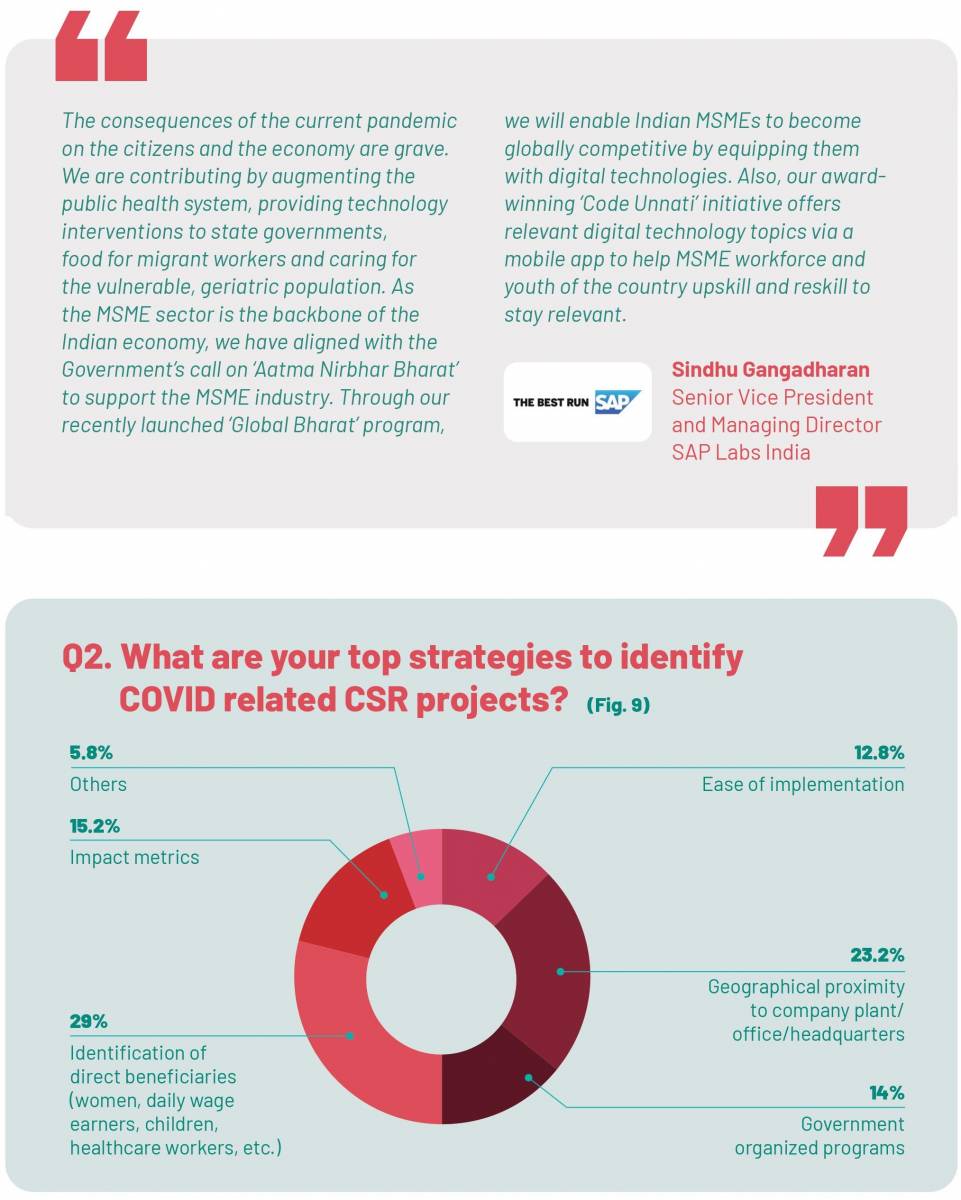

Q2 Key Learnings

- The top strategy for companies for COVID-19 related projects has been to invest in projects and initiatives driven by social welfare through the identifcation of direct benefciaries.

- Geographical proximity is seen as a favourable option as organisations look to rebuild and provide assistance domestically and locally frst.

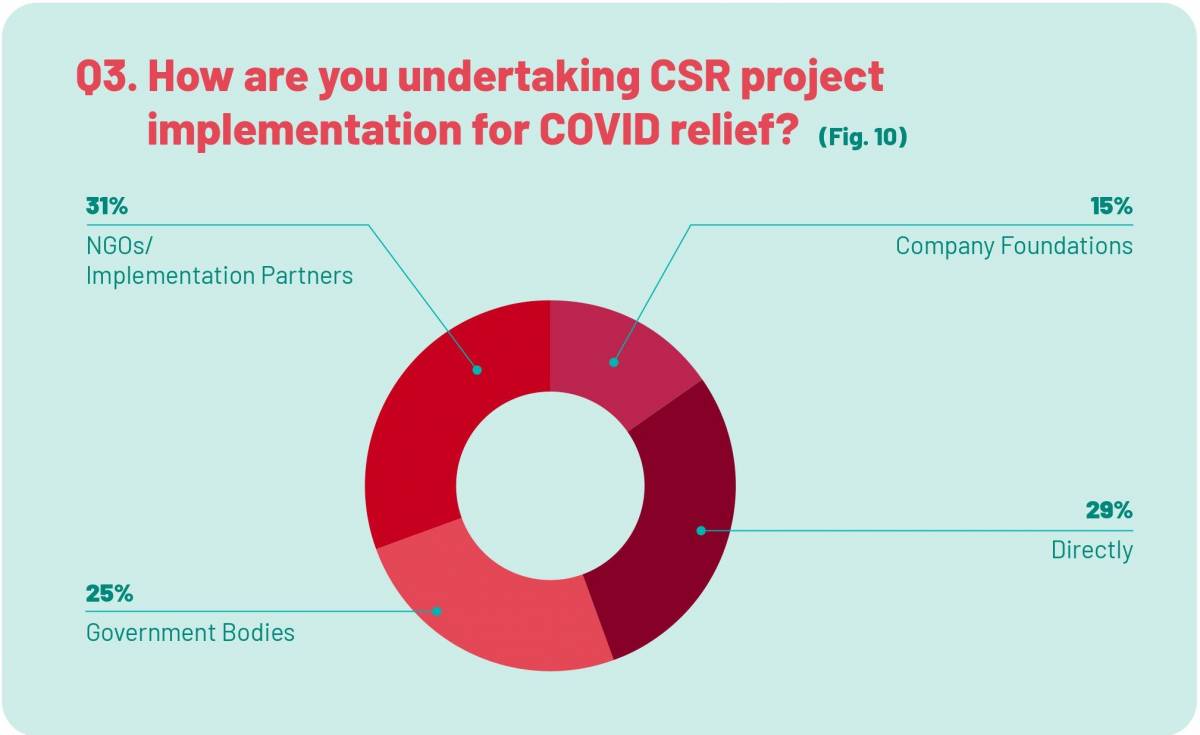

Q3 Key Learnings

- 10 organisations contributed toward CSR initiatives through their company foundations of which 70 per cent or seven were Indian entities while two were from the USA and one was from Germany.

- Companies have been fairly agnostic with respect to the methodology of their contributions as NGO’s, government bodies and direct contributions have a similar weightage.

- Amongst foreign entities - ~40 per cent organisations prefer to route CSR funds through NGO’s/implementation partners. Amongst Indian organisations - all four means of CSR project implementation are fairly equally distributed. Besides, ~60 per cent of the surveyed companies followed a multifaceted approach in utilising their CSR funds.

- In addition to the COVID-19 update to the act, the introduction of the PM-CARES fund and its consideration as CSR expenditure also saw an increase in CSR expenditure through government bodies. The PM-CARES fund reportedly received around Rs.9677.9 crores out of which Rs.4308.3 crores were from Government agencies and around Rs.5369.6 Crores to the fund.

Q4 Key Learnings

- Amongst the issues faced in contributing funds towards CSR initiatives, ‘logistical challenges’ emerged as the most common response among respondents, implying difculties mainly pertaining to the physical aspects on contribution to CSR funds.

- Lack of suitable funds/NGO’s was less than 10 per cent of an issue - implying a wide range of suitable implementation partners/funds for organisations to partner with. Additionally, the diligence of implementation projects/ NGOs too was not fagged as a major concern with only 14 per cent of the respondents citing the same, implying NGO’s/ implementation partners had well-defned projects and actions plans.

- Another key challenge that emerged was ambiguity pertaining to interpreting current CSR laws as formulated by the MCA. Even though the MCA has issued a clarifcation that all funds spent on COVID-19 management would be spent on COVID-19 spent on COVID-19 management would be treated as eligible CSR activity, these guidelines remain broad-based. While the government has also subsequently released notifcations providing further clarity, over 20 per cent of respondents felt that unambiguity clarity regarding the ambit of CSR remains a challenge while undertaking CSR activities during a crisis.

Q5 Key Learnings

- Approx 75 per cent participants were aware that the funding of innovations under technology incubators counts toward CSR too.

Q6 Key Learnings

- Less than 40% of the organizations indicated that they have considered funding technologies that are being developed at incubators during the crisis, while ~50% indicated that they lack the necessary information for these technology initiatives.

- ~50% of the organizations that indicated a lack of information with respect to funding technologies are from the Healthcare/ Medical and Technology sectors. These respondents have indicated an appetite to invest in higher budgets for CSR initiatives in the next fscal year, indicating an opportunity for incubators to pitch their technologies to these organizations.

- Amongst the organizations that indicated a lack of awareness, ~50% are HQ’d in the USA, indicating an opportunity to build awareness among these organizations for future funding of technologies.

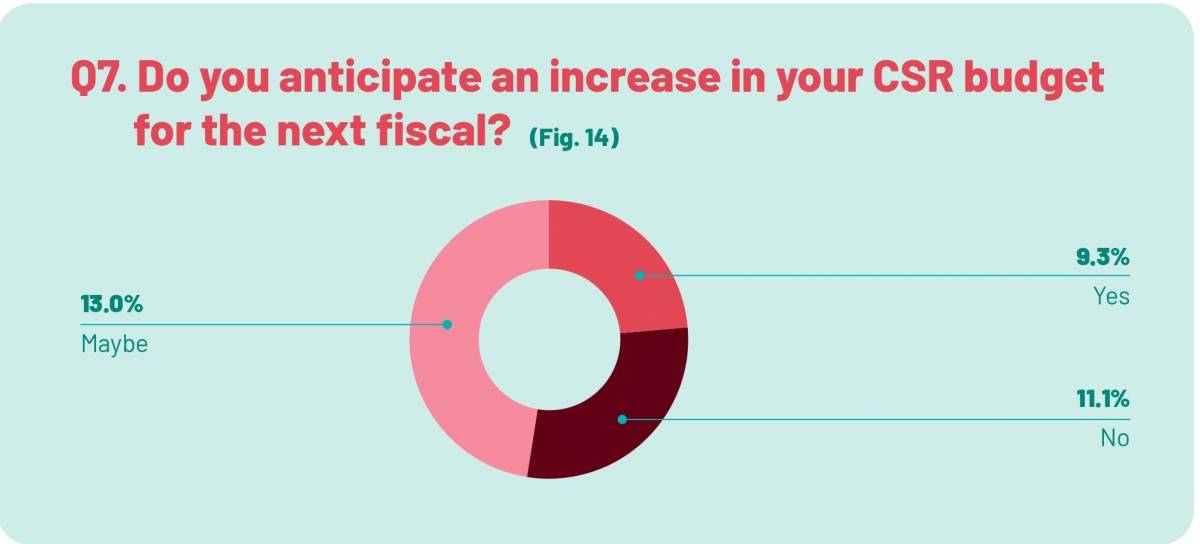

Q7 Key Learnings

- Although the full impact of COVID-19 is yet to be determined, it is likely to negatively impact most companies’ revenue streams. Companies will be faced with the crucial question of whether to reduce, maintain, or even expand their CSR activities.

- While ~50 per cent of the companies indicated that they ‘maybe’ foresee an increase in their CSR budgets, we anticipate that the key challenge for them shall remain using funds in an innovative and impactful way without increasing the corpus size at large. Over 50 per cent of the total organisations that have indicated an increase in CSR budget for the next fscal are foreign companies with Indian subsidiaries.

- Of the companies that have indicated an increase in CSR budget in the next fscal – 17 per cent of the companies are from the Middle East/GCC region and comprise of more than 30 per cent of the total foreign companies that have indicated the increase in budget.

Q8 Key Learnings

- Approximately, 75 per cent of the companies indicated that they ‘maybe’ see a dedicated program for COVID-19 relief in their CSR strategy for the next fscal. Around 25 per cent of the total respondents are certain that these programs will be implemented.

- Amongst the organisations that are certain of launching a dedicated program toward COVID-19 in the next fscal – 75 per cent of them are Indian entities.

- Healthcare/Medical and Technology organizations represent ~50% of the companies that have indicated dedicated programs toward COVID-19 relief in their CSR strategy for the next fiscal.

Section 5: CSR for Technology Incubators

INTRODUCTION

In September 2019, the government expanded the scope of CSR with a view to spur the Research & Development (R&D) and innovation ecosystem in the country. The Schedule VII of the Companies Act now recognises any contribution to incubators funded by Central or State Government or any agency or Public Sector Undertaking of Central or State Government, and, making contributions to public funded Universities, IITs, National Laboratories and Autonomous Bodies (established under the auspices of ICAR, ICMR, CSIR, DAE, DRDO, DST, MeitY) engaged in conducting research in science, technology, engineering and medicine aimed at promoting SDGs) as falling within the ambit of CSR. It is important to appreciate that the amendment focuses on both the pillars of innovation ecosystem – startups, by funding support to incubators and research across science, technology, engineering and medicine. Even though funding to technology incubators, albeit under a narrower defnition, has been allowed for a while, the sector hasn’t seen signifcant funding, less than 0.2% of total CSR spending from 2014-15 to 2017-18. This was due to ambiguity around permitted activities and institutions as well as a lack of information about projects which required funding across the country. To help solve the problem of information asymmetry, the CSR repository on IIG has a dedicated section for projects from technology incubators. Invest India activated the same network of 275+ incubators to gather solutions across diagnostics, preventive, and other support technologies against COVID-19. Some of these solutions from a pool of 150+ are being actively deployed to help mitigate the current pandemic.

In light of the COVID-19 pandemic, the Government of India further expanded the scope of Corporate Social Responsibility (CSR) to include funds spent on COVID-19 related activities as CSR (Circular No 05.01.2019-CSR). The Ministry of Corporate Affairs (MCA), for example, now allows companies to channel their mandatory Corporate Social Responsibility (CSR) spending towards helping fund new innovative technologies that will aid in the fght against the COVID-19 pandemic.

Technology innovation will play a signifcant role in the fght against COVID-19, as well as strengthen the country’s preparedness for combating future such epidemics. World over, science, technology, and innovation has come at the forefront of the battle against COVID-19. The Indian innovation ecosystem has risen to the challenge, with all stakeholders including public and private laboratories, startups, funding agencies and government bodies nimbly pivoting their strategies and operations to meet the COVID-19 threat head-on.

This section of the report will focus on trends pertaining to CSR for technology, the impact of tech during the times of COVID-19, and how companies can channel their CSR funding towards new technologies that are at the forefront of the COVID-19 battle. Our team collected data on 183 innovative start-ups in the COVID-19 space as well as 106 additional projects from government incubators that showcase the tech incubator ecosystem requirements. We collected data by utilising a vast network of technology incubators and Government Agencies and came up with our fndings below.

WHAT QUALIFIES AS CSR FUNDING TO SUPPORT TECHNOLOGIES?

- The scope of the CSR spending includes contributions to public-funded Universities, IITs, National Laboratories and Autonomous Bodies (established under the auspices of ICAR, ICMR, CSIR, DAE, DRDO, DST, MeitY) engaged in conducting research in science, technology, engineering, and medicine.

- As well as incubators funded by Central or State Government or any agency or Public Sector Undertaking of Central or State Government.

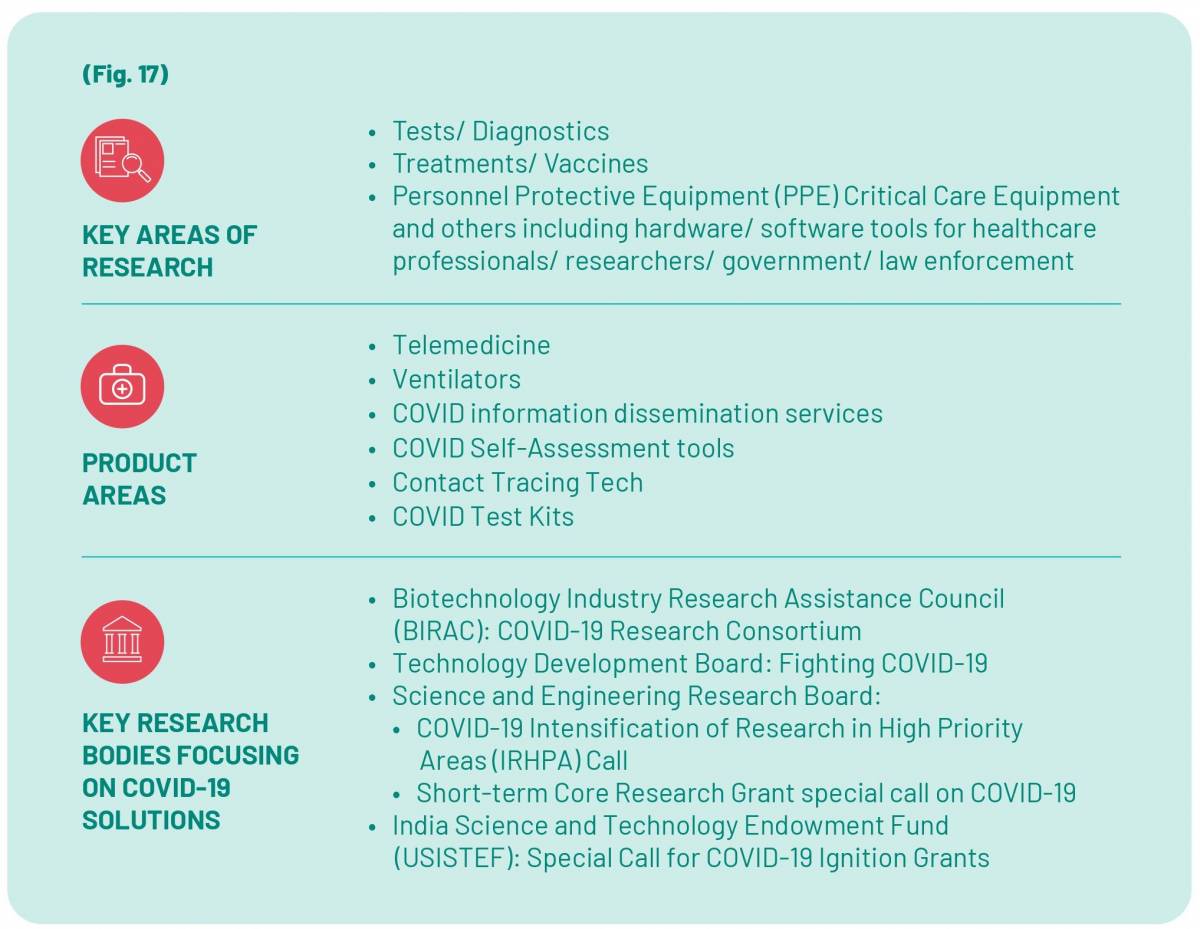

TECHNOLOGY FOR COVID-19: KEY TRENDS

Various research bodies in India are now focusing their attention on solutions that can help combat the COVID-19 pandemic. Technology companies have taken the onus on developing and releasing new products centered around combating the COVID-19 pandemic. The table below highlights the key areas of research, key organizations conducting the research, and product areas in which new COVID-19 solutions are being released:

Technology incubators are a key aspect of the nation’s technological innovations and tech start-up ecosystem. Of the over 250 government incubators in India, there are over 148 government incubators dedicated to technological innovations. The top technology Incubators in the nation are housed in Universities and Government departments:

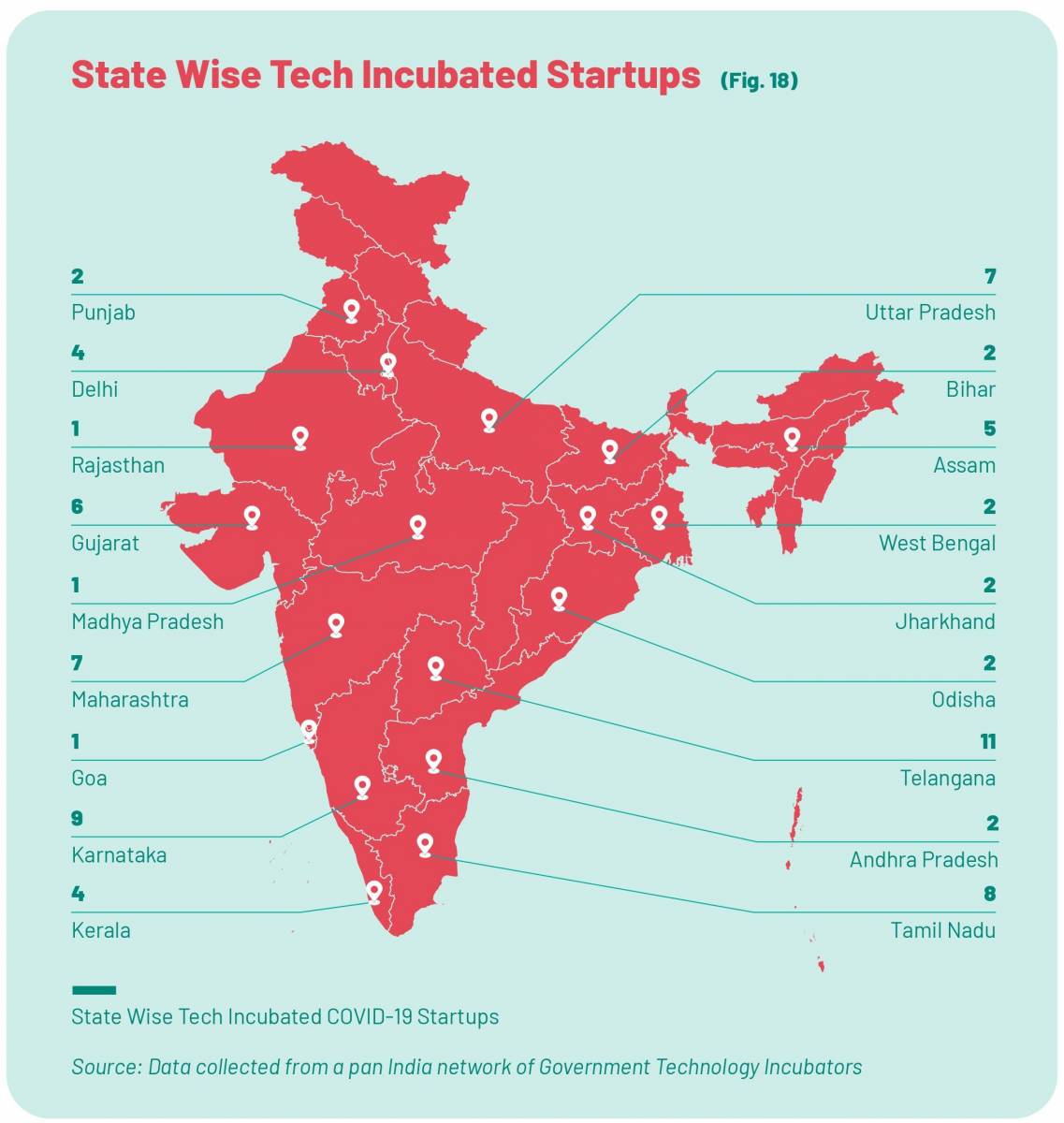

The chart below showcases 76 Government incubators across the nation that are working to fght against the COVID-19 pandemic. Any CSR mandated company can fund the incubators around their locality or can look to fund incubators across the nation, the chart below highlights the potential in each state/ union territory.

Another interesting trend currently taking place is the collectivizing of funding for startups looking to develop products relevant for the COVID-19 crisis. India’s top venture capitalists, which include Sequoia Capital, Accel, Matrix Partners, Kalaari Capital, and others, along with prominent angel investors, and successful startup founders have set up a Rs 100 crore grant fund to support startups developing products and services aimed at helping contain the virus. This is a welcome sign for the startup community severely impacted by the pandemic due to various factors such as disruption of supply chains and lack of funding.

CATEGORIES WITH MAXIMUM INVESTMENT OPPORTUNITIES

New technology development requires many different kinds of assistance; however, the most effective way to help this development along is through the funding of specifc activities undertaken by incubators in India.

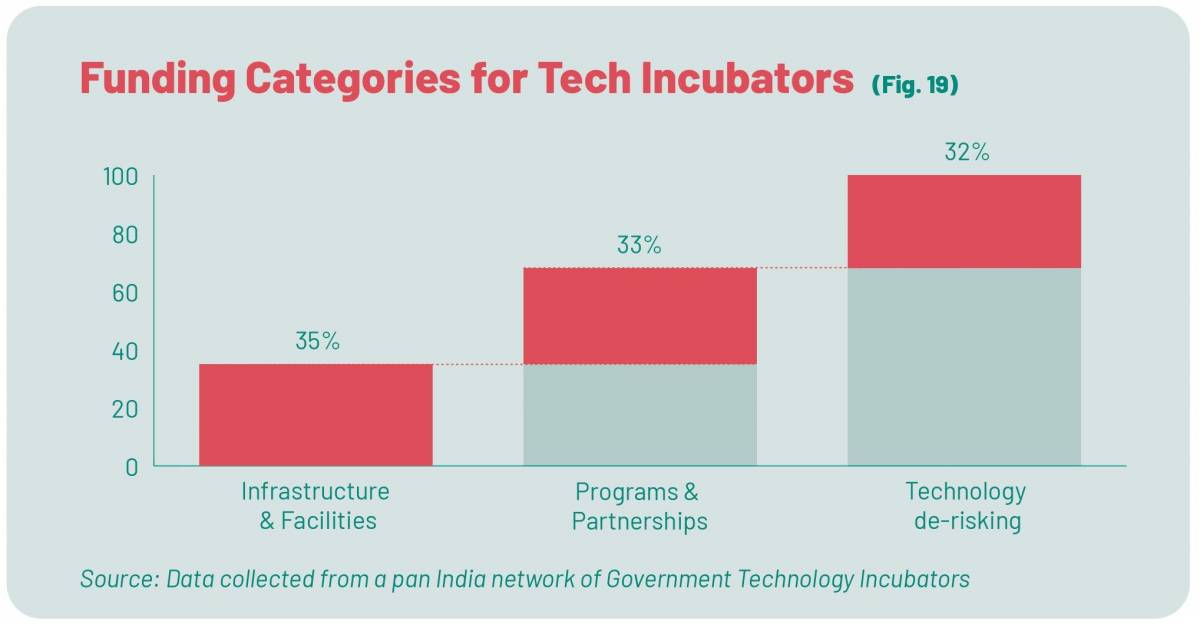

Infrastructure & facilities is the most basic requirement for incubators and R&D labs. Institutions around the nation require funding for labs, equipment, and research facilities. This produces physical and intellectual capital which can beneft many generations of startup founders.

Programs & Partnerships is another important area of funding. This can be through investing in pre-incubation support, funding for organizing accelerator camps, skill development programs, seed funding, etc. These programs can help in enhancing the entrepreneurship ecosystem of the country. Technology Validation is the most important aspect of a startup’s success.

Technology validation or de-risking is needed to address the risks associated with development of new technologies. This is done through creating opportunities for systematic identifcation of potential barriers to commercialization, and addressing them via necessary funding, technical, and regulatory support throughout the development cycle.

After collecting data* (Data collected from a pan India network of Government Technology Incubators) on 106 innovations throughout the nation, the average range of the funding requirement varies from INR 10 lakhs to INR 30 lakhs, all these amounts vary according to the requirements of the organizations. But it is clear that even a small amount of funding to an incubator has a multiplier effect on the impact in the larger innovation ecosystem.

Here is a summary of the various categories in which the projects require funding:

COVID-19 INTERVENTIONS

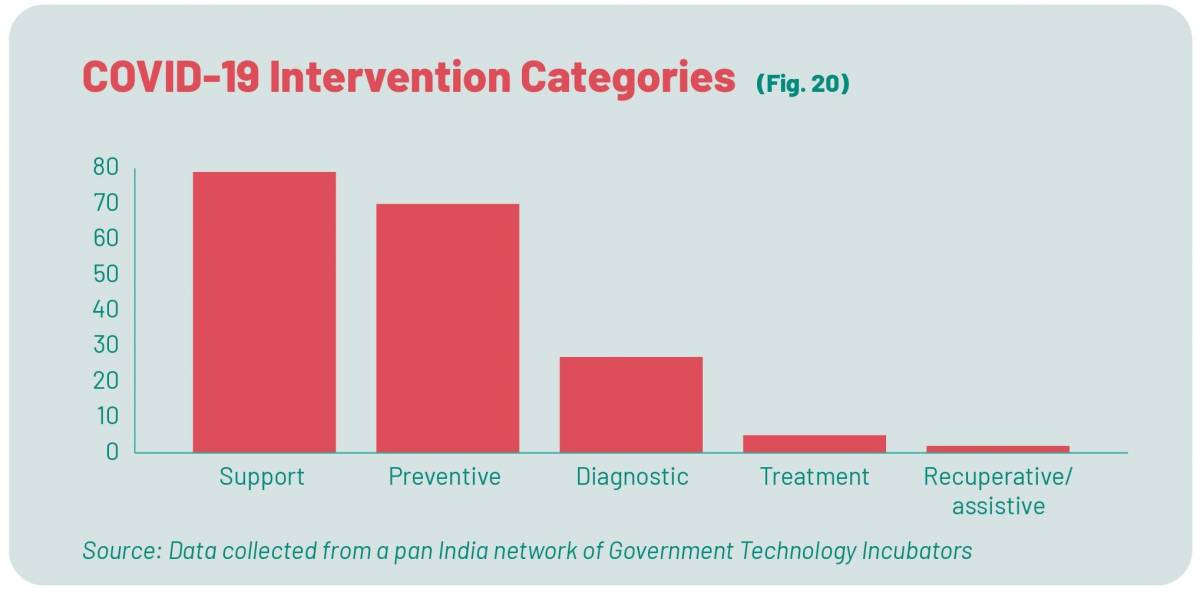

In a special effort to understand the funding requirements of startups working to combat COVID-19, we gathered data from a multitude of government incubated startups. These Government Incubated startups are keen on utilizing CSR funds donated by companies and partnering with companies that provide the donations. We have divided the solutions according to pain point categories. Here are our fndings:

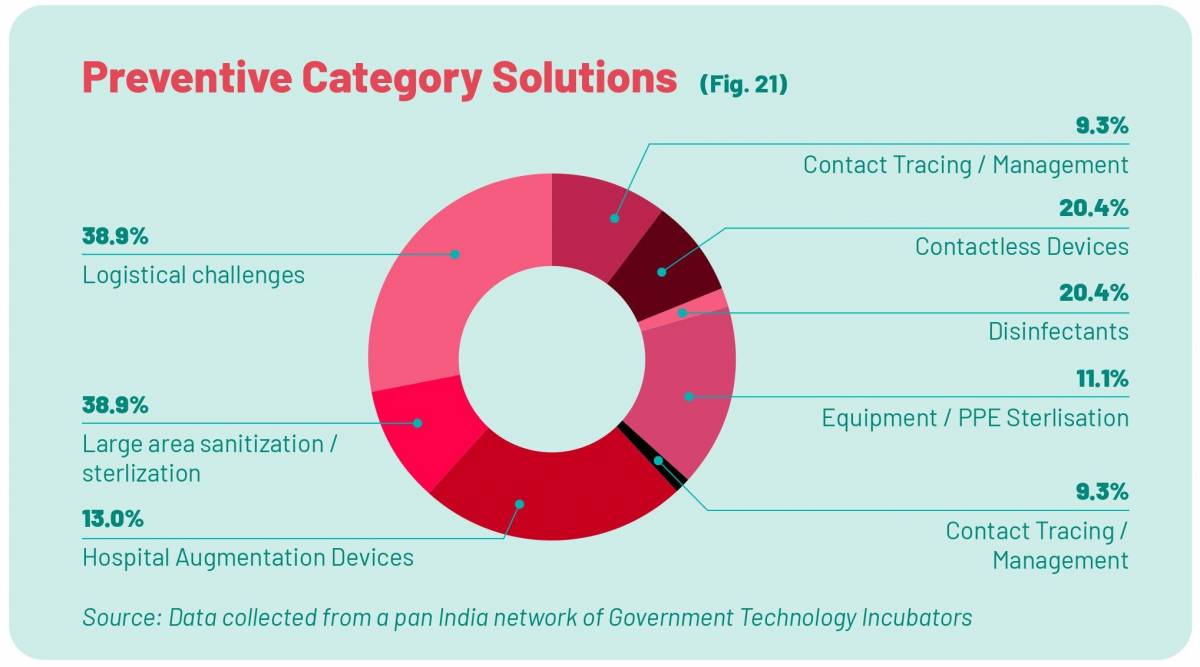

Preventive: The demand for preventive equipment such as masks, sanitizers, and PPEs has been adequately well met by the supply of innovative solutions. These technologies which also include large area sanitization and other contact-less devices have helped to prevent the spread of the pandemic. Moreover, there has been a steady supply of AI/ML solutions to help ensure social distancing and public order.

Diagnostic: The diagnostic technologies included test kits, and secondary testing devices. Testing kits of all varieties such as RT-PCR kits, portable kits, and antibody testing kits were produced by startups and R&D insitutions on a war footing to meet the nation’s requirements. Additionally, various secondary testing devices such as IR thermometers and other contact-less solutions were also created.

Support: Almost half of all innovations are included in this category consisting of a wide spectrum of technologies ranging from respiratory- support devices, hospital augmentation devices, IVR/ IT/ remote health management as well as mental wellness solutions. These technologies particularly highlight the agility of Indian innovators, who pivoted rapidly to meet the particular demands of the COVID-19 pandemic.

Treatment: Some startups and laboratories have also submitted initial ideas for therapeutic solutions. However, these were found to be at quite an early-stage.

KEY EMERGING COVID-19 TECHNOLOGIES FROM GOVT-FUNDED INCUBATORS

HuWel- the Quantiplus COVID-19 detection kit received INR 50 lakhs through ACT Grants initiative. This product has RT-PCR capabilities and has CDSCO and ICMR clearance for manufacturing and commercialisation. They are working with Telegana State Govt. for supplying testing kits and several other States as well

Nocca Robotics- An invasive mechanical ventilator capable of operating in a pressurecontrolled mode- received INR25 Lakhs via ACT Grants. Bharat Dynamics Ltd, a leading defence PSU under the Ministry of Defence, Govt. of India, joined hands with Nocca for the largescale production of the device

Mylab created an RT-PCR kit that is manufactured domestically, has a local supply chain and is approved by ICMR. This kit is cheaper, more accurate and faster than its international peers. Deployed at ICMR approved labs and Hospitals across the nation. Grant provided by ACT Initiative: INR 1 CR

Cargo FL – APEX - Cargo FL’s APEX app helps businesses and Organizations get Covid-19 Compliant. They can push their Covid-19 SOP’s, Guidelines, Circulars to employees and gather metrics as well as get employees to report symptoms, food ration shortages, safety issues, etc all in real-time. It is deployed in 9 companies in Pune with 10K+ employees including Pune Road Transport Corporation. Received funding from Hindustan Petroleum.

BIRAC and DBT announced COVID-19 Research Consortium with a focus on diagnostics, vaccines, novel therapeutics, repurposing of drugs, or any other intervention for the control of COVID-19. Our CSR team in collaboration with BIRAC set up a CSR funding channel to fund innovations that are at the forefront of the battle against COVID-19 and are ready for deployment.

Section 6: Conclusion

It is clear that the CSR obligation is a game changer for ensuring that the gains made by corporations in India can be transferred back to society in a meaningful manner. The government’s efforts to keep the activities permitted under the obligation broad based is commendable. Moreover, linking the CSR activities to the SDGs both explicitly and implicitly will ensure that CSR spending aligns with and augments national priorities. However, there are several shortcomings observed in the implementation of the CSR regulation which need to be resolved proactively for ensuring maximum impact on the ground. Firstly, a shift in mindset from one that focuses on meeting a statutory obligation to one where companies actively identify and create sustained impact projects aligned to their values. Secondly, streamlined information on activities that are permitted under the regulation as well as timely clarifcations. Thirdly, creation of channels for identifcation of projects on a pan-India basis. This will help spread the deployment of CSR funds to areas where maximum impact would be possible. A welcome step in this regard is the proposal for a ‘Social Stock Exchange’ by the Securities & Exchange Board of India. The SSE will allow for more efcient deployment of CSR funding, verifcation of the impact of projects and trading of excess/defcient CSRspends between companies. Finally, there is an urgent need to ensure that CSR-spending has a multiplier effect on social, economic and environmental impact on the ground. This will have to be achieved by measuring outcomes of CSR spending over time, as well as engaging in activities with larger impact potential. Funding research and technology incubators could be one such area where the impact could be highly diversifed.

In conclusion, the COVID-19 pandemic has brought Corporate Social Responsibility to the forefront. Corporates, both large and small, headquartered in India or abroad, have risen to the challenge and augmented the government’s efforts by re-orienting their CSR strategies. It is hoped that the same zeal and mission-mode orientation carries over to activities beyond the pandemic. Invest India, on its part, will endeavour to facilitate corporates looking for impactful CSR opportunities under the larger effort to enhance the ease of doing business in India by strengthening initiatives such as the CSR repository on the IIG, and facilitating knowledge transfer between different stakeholders.

Acknowledgements

Invest India would like to thank all respondents for their time and effort to complete our survey – “CSR Trends During & Post COVID-19”. We would also like to express our sincerest gratitude to the following people for their valuable inputs: