India’s ambitious journey toward self-reliance in the telecom sector has taken a decisive turn with the launch of the Production Linked Incentive (PLI) Scheme in April 2021.

This initiative-a key pillar of Prime Minister Narendra Modi's ‘Atmanirbhar Bharat’ vision—is designed to fuel the ‘Make in India’ revolution by boosting domestic manufacturing and attracting significant investments.

Recognizing the importance of design, the scheme guidelines were amended in April 2022 to promote design-led manufacturing. Two and a half years after its implementation, the PLI Scheme has already reshaped India’s telecom landscape and infrastructure – driving growth, innovation and competitiveness.

This article delves into the progress made so far, the challenges it encountered and the path ahead as India positions itself as a global telecom manufacturing powerhouse.

Background of the scheme

The PLI Scheme was introduced to enhance India’s manufacturing capabilities and establish the country as a global hub for telecom equipment design and production.

By offering incentives ranging from 4% to 7%, it aims to encourage the production of core transmission equipment, 4G/5G RAN and wireless equipment, IoT access devices and enterprise equipment. Special provisions, including an additional 1% incentive for design-led manufacturing and a higher incentive for MSMEs in the first three years, have been designed to ensure widespread participation and success.

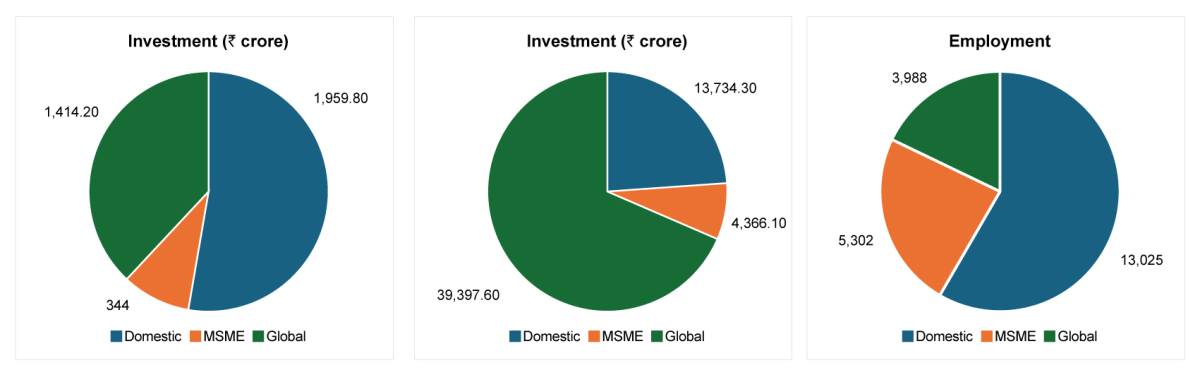

Under the PLI Scheme, 42 beneficiaries, including 28 MSMEs, have committed to invest ₹4,115 crore with projected sales of ₹2.45 lakh crore and giving rise to 44,000 jobs over the scheme period.

Leading domestic and international companies like Tejas Networks, HFCL, VVDN, Nokia and Samsung are at the forefront of this transformation, driving innovation and growth in India’s telecom sector.

Driving investments and job creation

The scheme—with the 42 companies establishing 61 manufacturing units across 14 states and union territories-has made significant strides in the first half of its tenure.

According to the PLI dashboard, as of July 2024, it has nearly achieved its investment target, attracting ₹3,718 crore of the planned ₹4,115 crore.

This has resulted in telecom equipment production worth more than ₹57,000 crore, showcasing the scheme’s success in boosting domestic manufacturing.

Beyond financial metrics, the PLI scheme has also been a catalyst for job creation and skill development in the telecom sector. To date, the initiative has generated over 22,000 direct jobs and many more indirect employment opportunities across the value chain, from manufacturing to research and development.

Propelling India onto the global stage

The PLI Scheme has significantly impacted India’s telecom industry, leading to a substantial reduction in import dependency. With a 60% import substitution rate, India is now nearly self-reliant in the production of critical components such as antennas, Gigabit Passive Optical Network (GPON) and customer premises equipment. This shift toward local production has not only enhanced national security, but also fostered self-reliance in the sector.

The scheme has driven India onto the global stage, with domestic manufacturers now competing internationally in advanced telecom technologies like 5G. Made in India 5G telecom equipment are being exported to markets in North America and Europe, underscoring the global competitiveness of the country's telecom industry.

According to a press release by the Ministry of Communication, the net trade deficit in telecom, including both equipment and mobile devices, has reduced dramatically from ₹68,000 crore to ₹4,000 crore over the last five years. Both exports and imports have grown during this period, reflecting India's deeper integration into the global value chain.

Furthermore, the scheme has facilitated significant technology transfer, with indigenous development of critical telecom infrastructure. For instance, the 4G deployment by BSNL utilizes C-DoT Core and RAN equipment from Tejas Networks, while 5G deployment in India is primarily driven by locally manufactured equipment.

Notably, the number of 5G base transceiver stations (BTS) installed nationwide has crossed the 4,50,000 mark in just 22 months, reflecting the scale and speed of India’s 5G rollout.

With a significant portion of 5G deployment already completed in India, the country is well-positioned to leverage its scale and deliver cost-effective 5G solutions globally.

“The PLI Scheme has led to unprecedented growth in domestic manufacturing and innovation in the telecom sector. This transformation has not only reshaped India’s export basket from traditional commodities to high-value-added products, but also firmly integrated India as a key player in the global supply chain.

“By creating an environment that rewards excellence and fosters technological advancement, India is rapidly emerging as a preferred destination for global investments in telecom,” says Sidharth Narayanan, Senior Vice President & Chief Strategy Officer at Invest India.

Challenges and shortcomings

Despite its successes, the scheme has faced several challenges. Only 17 of the 42 approved companies could claim incentives for FY 2022-23. Among the remaining 25 companies, 14 failed to meet investment targets, while 20 could not achieve the required incremental sales targets.

These shortfalls highlight the challenges companies face in fully leveraging the benefits of the scheme, often due to implementation issues, policy bottlenecks or broader economic factors.

In consultation with the industry, some limitations in the scheme’s design and execution have been identified. While due diligence is necessary, concerns have been raised about the stringent conditions attached to the incentives, which some companies find challenging to meet, especially in a fluctuating economic environment.

“Another challenge has been the limited availability of advanced semiconductor components for telecom equipment manufacturing. Despite India’s growing manufacturing capabilities, there is still a heavy reliance on imports for critical components like semiconductors, which are essential for 5G, IoT and other advanced telecom technologies.

“Without a robust domestic semiconductor ecosystem, India’s telecom manufacturing industry may face bottlenecks in scaling up production, which could limit the overall effectiveness of the PLI scheme in achieving its long-term goals,” adds Narayanan.

Outlook

As the PLI scheme enters its second half, there is scope for strategic adjustments to ensure it meets its ambitious goals. The Department of Telecommunications (DoT) is already considering amendments to the scheme’s guidelines.

These include quarterly disbursements, additional incentives for overachieving companies, increasing incentives for the design and the inclusion of new products – particularly in the satellite communication field.

The future impact of the PLI scheme will also be closely tied to the adoption and expansion of 5G and other emerging technologies. By aligning the scheme with these technological advancements, India can further strengthen its position in the global telecom industry and attract more investments.

“Through initiatives like the India Semiconductor Mission and partnerships with global chip manufacturers, we are actively building a self-reliant supply chain. With ATMP (Assemble, Test, Mark and Package) units from Micron, Tata Electronics, CG Power and Kaynes Technology, alongside fabrication plants by Tata Electronics, India is actively developing its semiconductor ecosystem. The PLI Scheme, in conjunction with these efforts, will further strengthen India’s telecom manufacturing ecosystem,” adds Narayanan.

The PLI Scheme for telecom has undeniably made a significant impact on India’s manufacturing landscape, driving growth, job creation and self-reliance in a critical sector.

However, to fully realize its potential, there is a need to address the challenges that have surfaced during its implementation. Through strategic refinements to the scheme and alignment with emerging technologies, India can continue its journey toward becoming a global telecom manufacturing hub, ultimately benefiting the industry and the economy.

“By fostering innovation and scaling up domestic capabilities, India is poised to not only achieve self-reliance, but also to lead the global telecom revolution,” concludes Narayanan.